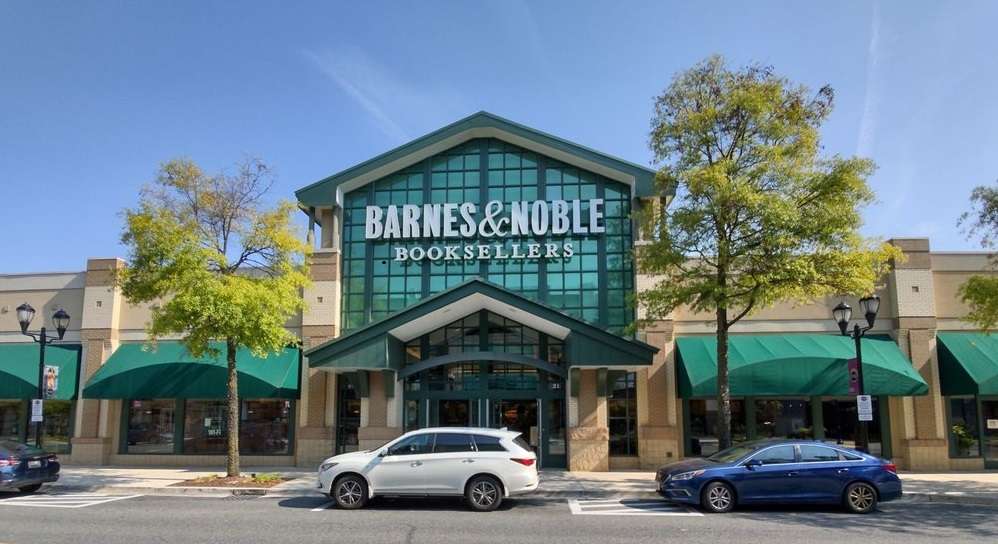

Barnes & Noble NNN Properties for Sale

Are you looking to buy or sell a Barnes & Noble Ground Lease Property, or NNN Lease Barnes&Noble Property for passive investment? If you would like to buy or sell Net Lease Barnes & Noble NNN Properties, please feel free to send us an email to info@nnndeals.com and we will get back to you quickly.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

| Type | Private |

|---|---|

| ISIN | US0677741094 |

| Industry | bookselling |

| Predecessor | Arthur Hinds & Company |

| Founded | 1886; 137 years ago (1886) (as Arthur Hinds & Company) in New York City, U.S. |

| Founders |

|

| Headquarters | 33 E. 17th Street,

New York City

,

U.S. |

|

Number of locations |

614 (As of July 2020[update][3]) |

|

Key people |

|

| Products | Books, maps, CDs, DVDs, toys, games, stationery, calendars, gift packs, magazines, board games, encyclopedias |

| Brands |

|

| Revenue | |

| Total assets | |

| Total equity | |

| Owner | Elliott Management Corporation |

|

Number of employees |

24,000 (2019) |

| Website |

|

Barnes & Noble – The Most Famous Retail Bookseller Chain across the United States![]()

Barnes & Noble is one of the most famous Fortune 500 Company operating a wide range of retail bookstores across the United States. It is also a prominent retailer of digital media, educational and content products within the country. Owning over 640 retail stores spreading across 50 cities of the country, the company provides you utmost convenience and ease of access to newspapers, books, and magazines.

It is continuously transforming the concept of store-based model of business operation to multi-channel model focusing majorly on its digital commerce, internet and retail stores. Going through numerous leaps and bound over the years, the company today stands firm as the only bookseller chain in the country nationally.

Its market position![]()

Today, the company enjoys a reputed position in the market. Being 427th in the list of Fortune 500 Companies, Barnes and Noble holds a total market of $923 million as on 31st march 2016. Its total assets account for $3,230 million. Furthermore, as per the financial analysis of the Wall Street Journal, the company shows a net growth of -62.40% in its income that amounts for $13.48 million.

Being a public sector company traded under the New York Stock Exchange (NYSE) with the ticker name of BKS, the company also shows a minute change in its revenue of -4.9 % accounting to $6,070 million as per the reports of Fortune 500 companies. It further displays its overall profit for the year 2016 of $37 million making it an ideal company for the sake of investment and doing business.

The foundation story

The existence of Barnes and Nobles today as a renowned retail bookseller traces a long and rich history dating back to the year 1873 with the opening of book-printing business by Charles Barnes at Wheaton, Illinois. Barnes and Nobles initiated its first bookstore in the year 1886 with the name of Arthur Hind & Company in New York City. However, with the fall of year 1886, Gilbert Clifford Noble was hired the clerk of the company who later became the partner in the year 1894.

This resulted in the change of name to Hind & Noble. Furthermore, in the year 1901, the company shifted to 31-35 W. 15th Street. The year 1917 marks the entrance of William Barnes into partnership with Noble that changed the company name to Barnes and Noble.

During the Great Depression of 1932 in US, the company moved to 18th Street and 5th Avenue Manhattan. A big turnover for the company came in the year 1971 when Leonard Riggio purchased the company in $1.2 million. As told earlier, the company today holds an overall market value of $923 million due to the endless efforts of its vast team of over 37,000 employees.

How it functions?

Ever since their inception in the 1980s, the company is continuously experimenting with its store formats as well as sizes, in search of developing suburban superstores. It is rigorously looking for ideal locations to expand its reach across the globe by opening either corporate owned stores or franchises. If you have sufficient area of land available, you can lease it with Barnes & Noble.

According to its lease agreement, the initial term of lease is 15 to 20 years and it can extend with options as per terms of the lease to 20 to 40 years, at the discretion of the tenant. It also ensures an increment of 10% on rent at the end of every five years. The minimum price range that you can invest to join hands with the company is $3M to $6M.