Why NNN Investors Prefer Georgia State: Higher Growth & Competitive Cap Rates Explained

Future holding for NNN property investments in Georgia

Triple Net Lease (NNN) properties, where tenants are responsible for taxes, insurance, and maintenance, remain a popular investment class for those seeking passive income with low management burden. In Georgia, the outlook for NNN property investments continues to strengthen due to several key factors:

1. Economic and Population Growth

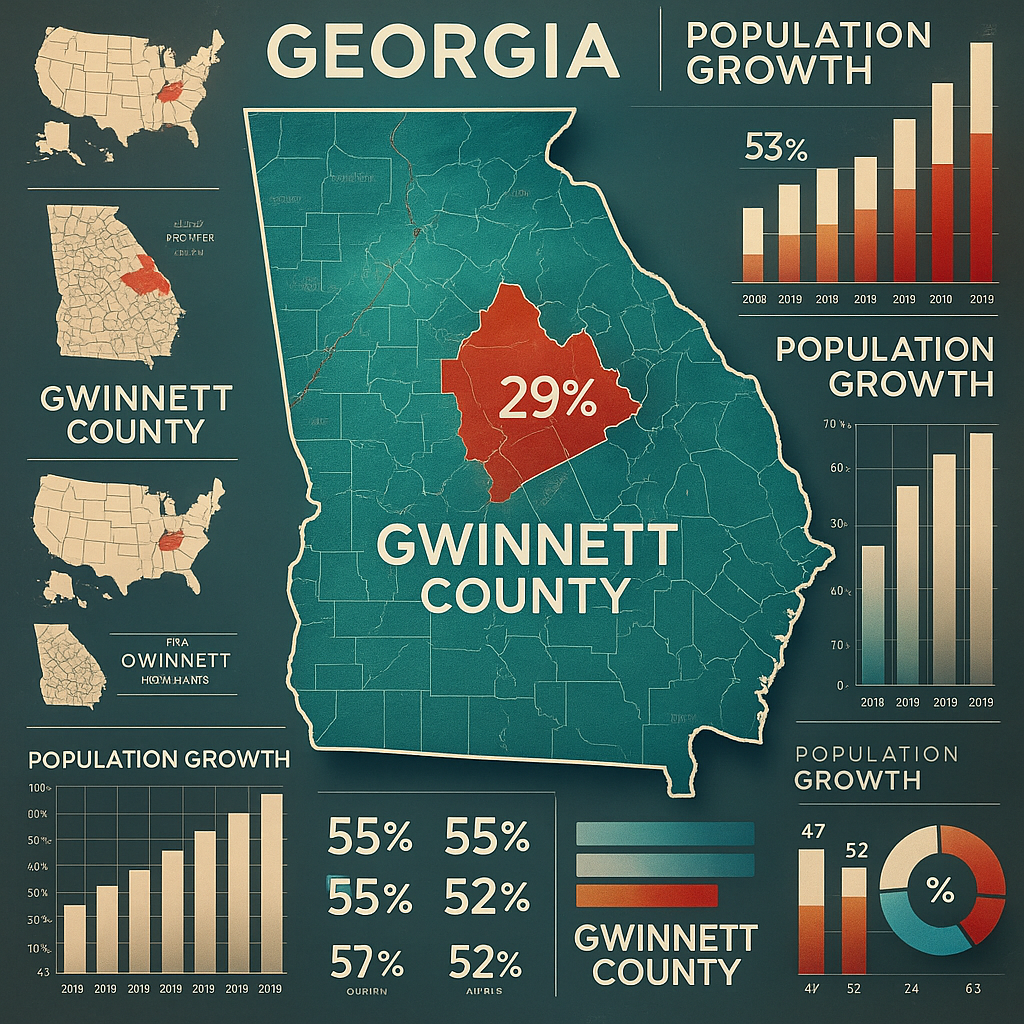

Georgia’s population continues to grow, particularly in metropolitan areas such as Atlanta, Gwinnett County, and Savannah. According to recent census data, Gwinnett County has seen a 29% population increase, contributing to increased demand for retail, industrial, and healthcare real estate. This growth fuels investor interest in NNN assets, as expanding communities require more commercial infrastructure.

2. Stability and Demand for NNN Properties

The appeal of NNN lease properties lies in their reliable income stream and minimal landlord involvement. In Georgia, a robust tenant base—including national retailers, medical services, and QSR (quick service restaurant) chains—supports long-term lease agreements. Investors are increasingly targeting medical office buildings and drugstore tenants like CVS and Walgreens for their recession-resilient characteristics.

3. Market Trends and Cap Rates

Georgia’s NNN cap rates have stabilized in the 5.25% to 6.75% range for retail and medical tenants, with industrial NNN properties commanding slightly lower cap rates due to strong demand. Nationally, cap rates are trending higher in 2025 due to interest rate pressures, improving return prospects for new acquisitions. Georgia’s inventory of NNN properties is expanding, especially around growth corridors like I-85 in metro Atlanta and the Port of Savannah.

4. Financing Considerations for NNN Investors

Entry into Georgia’s NNN market typically requires a 30%–40% down payment, with lenders favoring borrowers with a net worth exceeding $1 million or annual income above $200,000, consistent with broader national standards. Stronger lease terms (10+ years, credit tenants, rent escalations) often yield more favorable financing rates and lower risk profiles.

5. Local Market Opportunities

Georgia offers prime opportunities in single-tenant industrial, QSR, and convenience store sectors. Recent listings include:

A Dollar General in a suburban Atlanta market with a 15-year NNN lease.

A FedEx-distribution facility in the Augusta area on a long-term lease with annual rent bumps.

Starbucks and Chick-fil-A net lease properties in expanding suburbs like Alpharetta and McDonough.

For investors leveraging a 1031 exchange, Georgia’s active NNN market allows for tax deferral while upgrading to higher-performing or newer assets.

Triple-Net (NNN) Investors are Increasingly Turning to Georgia as a Prime Location for Net Lease Properties thanks to its booming economy, pro-business environment, and population growth, Georgia continues to stand out as a top market for net lease investments. Here’s why NNN brokers and investors view Georgia as a high-potential destination for stable, long-term returns:

1. Competitive Cap Rates with Strong Growth Potential

While Georgia’s cap rates are slightly lower than those in tertiary markets like Alabama, they remain competitive—typically in the 5.25% to 6.75% range for retail and essential services tenants. For investors balancing risk and return, Georgia offers stable yields with strong upside, especially in emerging metro areas beyond Atlanta, such as Macon, Augusta, and Savannah.

2. Accessible Property Prices in Growing Submarkets

Though Atlanta’s core remains expensive, many suburban and secondary markets across Georgia still offer affordable acquisition opportunities. Areas like Warner Robins, Rome, and Gainesville are drawing investor attention for their lower price points and expanding commercial footprints, making Georgia attractive to those looking to enter the NNN space or diversify geographically.

3. Explosive Population and Economic Expansion

Georgia ranks among the top Southeastern states for population growth, with metro Atlanta, Gwinnett County, and Savannah leading the charge. The state’s population now exceeds 11 million (as of 2025 estimates), driven by tech sector growth, port-related logistics, and affordable cost of living. This growth fuels consistent demand for commercial properties under NNN leases.

4. Essential Retail & QSR Tenants Thrive

Investors are actively acquiring NNN-leased properties to national tenants like Dollar Tree, CVS, Chick-fil-A, Starbucks, and Tractor Supply Co., which are expanding in Georgia’s growth corridors. These essential retail and QSR tenants maintain strong sales performance, ensuring rent reliability and long-term tenancy—a key factor in the durability of NNN cash flows.

5. Tax Advantages for NNN Investors

Georgia offers competitive state-level tax policies and supports 1031 exchange investors with no special limitations. While the state does tax LLC income, it offers deductions and pass-through entity elections that can optimize after-tax returns. Moreover, local municipalities often provide property tax abatements or incentives for developments that attract jobs and retail activity.

6. Logistics and Industrial Backbone

Georgia is home to the Port of Savannah, one of the busiest in the U.S., and a rapidly expanding distribution and logistics network along the I-75 and I-85 corridors. Major industrial players like Amazon, Home Depot, and UPS continue to build fulfillment centers across the state. This surge in industrial activity fuels investor interest in NNN-leased warehouses, last-mile delivery facilities, and service-oriented retail.

Income Taxes

Georgia’s Tax Landscape for NNN Investors: Balanced and Strategic for Long-Term Growth

While Georgia may not offer tax-free passive income like Alabama, it remains a strong choice for NNN investors thanks to its reasonable tax rates, business-friendly policies, and pro-growth incentives. Here’s how Georgia’s income tax structure supports net lease property investors seeking consistent returns and sustainable portfolio growth:

1. Passive LLC Income Is Taxable — But Manageable

In Georgia, passive rental income earned through an LLC is subject to state income tax, unlike in some states with exemptions. However, Georgia allows deductions for operating expenses, depreciation, and pass-through entity (PTE) tax elections, which can help reduce overall liability. Investors can also use strategic structuring to optimize after-tax returns through tax planning and cost segregation.

2. Flat Individual Income Tax Rate

As of 2024, Georgia implemented a flat individual income tax rate of 5.49%, with a planned reduction to 4.99% by 2029, pending revenue targets. This flat rate simplifies tax planning for individual NNN investors and is lower than the top marginal rates in many states, such as California (13.3%) or New York (10.9%).

3. Competitive Corporate Income Tax Rate

Georgia maintains a corporate income tax rate of 5.75%, which is below the national average and significantly more attractive than high-tax states. This makes it favorable for NNN investors who hold properties through a corporation or REIT structure.

4. No State-Level Estate or Inheritance Tax

Georgia does not levy a state estate or inheritance tax, ensuring that NNN investors can transfer wealth or real estate holdings without state-level death taxes. This aligns with Georgia’s pro-business and pro-investor stance, supporting long-term portfolio planning and generational wealth preservation.

5. Moderate Property Taxes

Georgia’s average effective property tax rate is about 0.87%, which is slightly above Alabama’s but still well below the national average (1.1%). Property tax rates vary by county but remain affordable in secondary and tertiary markets such as Macon, Albany, and Valdosta, helping to reduce holding costs.

6. No Separate State Capital Gains Tax

Georgia does not impose a separate capital gains tax. Instead, capital gains are taxed at the standard income tax rate (5.49% in 2025). This structure is relatively investor-friendly compared to states like California or Oregon, making Georgia a viable state for 1031 exchange strategies and profitable exits.

Investing in triple net lease (NNN) properties in Georgia can be a strategic move, particularly in areas experiencing significant population growth and economic development. NNN properties require tenants to handle property taxes, insurance, and maintenance, offering investors a more hands-off approach. Based on recent data, here are some of the top cities and counties in Georgia to consider for NNN property investments:

1. Dawson County:

Population Growth: Dawson County experienced a 5.8% growth in population between 2021 and 2022, making it one of the fastest-growing counties in the nation.

Economic Development: The county’s proximity to the Atlanta metropolitan area and its scenic appeal contribute to its rapid growth.

Investment Potential: The rapid population increase suggests a growing demand for retail and service-oriented NNN properties.

2. Jackson County:

Population Growth: Jackson County has been among the top destinations for domestic migration within the United States between July 1, 2023, and June 30, 2024.

Economic Development: The county benefits from its strategic location near major transportation routes and its growing industrial base.

Investment Potential: The influx of residents and businesses presents opportunities for NNN investments in commercial and industrial properties.

3. Bryan County:

Population Growth: Bryan County is experiencing significant growth due to major developments like Hyundai’s upcoming electric vehicle factory.

Economic Development: The Hyundai plant is expected to create thousands of jobs, attracting more residents to the area.

Investment Potential: The economic boom presents opportunities for NNN investments in retail and housing sectors to serve the growing population.

4. Forsyth County:

Population Growth: Forsyth County continues to be one of the fastest-growing counties in Georgia, with a steady influx of new residents.

Economic Development: The county’s excellent school systems and quality of life attract families and professionals.

Investment Potential: The growing population supports demand for NNN properties in retail and service sectors.

5. Columbia County:

Population Growth: Columbia County has seen consistent population growth, driven by its proximity to Augusta and a strong local economy.

Economic Development: The county benefits from a diverse economy, including healthcare, education, and manufacturing.

Investment Potential: The economic diversity and growth make it suitable for NNN investments in various sectors.

Pros:

1️⃣ Higher Cap Rates Than Coastal States

Georgia typically offers cap rates between 5.5% and 7.5%, higher than coastal states like California and New York (4%-5%). Investors can achieve stronger cash flow with lower entry prices.

2️⃣ Business-Friendly Tax Environment

Georgia does not tax passive income separately and offers various tax incentives for LLCs and corporations. Corporate income tax is flat at 5.75%, lower than many other states.

3️⃣ Lower Property Prices than National Average

Georgia commercial real estate, particularly outside Atlanta, is more affordable than national urban markets. Lower acquisition costs allow for stronger yield on investment.

4️⃣ Population Growth in Key Counties

Fast-growing counties like Forsyth, Jackson, Dawson, and Bryan are driving demand for retail, QSRs, and essential services. Metro Atlanta continues to expand, bringing retail and logistics demand with it.

5️⃣ Strong Transportation & Logistics Infrastructure

Georgia is home to Hartsfield-Jackson Atlanta International Airport, Port of Savannah (4th busiest in the U.S.), and multiple major highways. These factors boost industrial and retail demand, benefiting NNN property owners.

6️⃣ Diverse & Stable Economy

Georgia has a well-rounded economy: tech (Atlanta), logistics, manufacturing, healthcare, and film production. This diversification supports long-term tenant demand across sectors.

7️⃣ Growing Essential Retail & QSR Market

Major NNN tenants such as Dollar General, CVS, Chick-fil-A, Taco Bell, and Starbucks are rapidly expanding throughout Georgia. Strong demand for suburban and highway-adjacent retail locations.

Cons:

1️⃣ Property Tax Rates Higher

Georgia’s effective property tax rate is around 0.87%, higher than Alabama’s (~0.40%), though still lower than the national average. Holding costs may be moderately higher, especially in urban counties.

2️⃣ Cap Rate Compression in Metro Atlanta

Prime locations (Atlanta, Savannah, Augusta) may experience compressed cap rates due to high investor competition. Investors seeking higher yield may need to look at secondary or tertiary markets.

3️⃣ Regional Disparities in Growth

Some rural counties in Georgia experience slow growth or population decline, affecting tenant quality and absorption rates. Research is essential before investing outside high-growth corridors.

4️⃣ Weather-Related Risks

While not as hurricane-prone as coastal Alabama, southern Georgia is still at risk for tropical storms. Severe thunderstorms and occasional tornadoes can affect insurance and tenant risk in parts of the state.

5️⃣ Slower Urban Retail Development in Some Areas

Outside Atlanta, urban core developments are limited. Investors focused on high-end retail or mixed-use urban centers may find fewer options outside the metro region.

Georgia NNN Properties for 1031 Exchange

Invest in Free Standing Single Tenant Triple Net (NNN) Properties in Georgia

Are you looking for a reliable 1031 exchange replacement property?

At Triple Net Investment Group, we specialize in the sale of single tenant NNN properties and triple net shopping centers across the United States. Our team is dedicated to helping investors find high-quality (Tenant Triple Net) NNN properties in Georgia and nationwide that align with their financial goals and 1031 exchange requirements.

With our in-depth market knowledge and personalized service, we provide tailored investment strategies for both buyers and sellers of commercial real estate. Whether you’re looking to defer capital gains through a 1031 tax-deferred exchange or want to diversify your portfolio with income-generating assets, our team offers a wide selection of vetted NNN investment properties.

Corporate Tenant Credit Ratings

Find out more about the credit rating of the tenant before purchasing.

How safe are the triple net investment grade free standing single tenant properties?

Market Analysis

What three things should I know before investing?

Call or e-mail us and we will get back to you within 24 hours. We know of properties for sale that aren’t listed or advertised.

Email: [email protected] Tel: 202-361-3050

We strive hard to provide clients with quality customer service

We provide our clients with all of the information they need upfront to make an informed decision, even before a letter of intent is issued, such as tenant credit information, store sales, lease terms, options, renewal rates, rent escalations, location analysis, site analysis, market analysis, demographic data, cash-on-cash returns on investment, internal rates of return after taxes, risks, likes, dislikes, and so on. We will then strategize how to proceed on making a best offer. It is our goal to build a solid relationship with our clients and keep them updated on net lease investments, even though they may not have a need for years to come. (NNN Properties in Georgia)

We markets our listings locally, nationally and internationally

Triple Net Investment Group difference is a concept that is revolutionary in the commercial real estate brokerage business. In addition to marketing our deals to potential investors, We markets our listings to the entire brokerage community. We put our listings directly in front of thousands of commercial real estate agents in each state, region and local where the property is located.