Why NNN Investors Prefer Hawaii State: Higher Growth & Competitive Cap Rates Explained

Future holding for NNN property investments in Hawaii

Triple Net Lease (NNN) properties, where tenants are responsible for property taxes, insurance, and maintenance, offer investors a stable and low-maintenance income stream. In Hawaii, the outlook for NNN property investments remains strong, supported by several compelling factors:

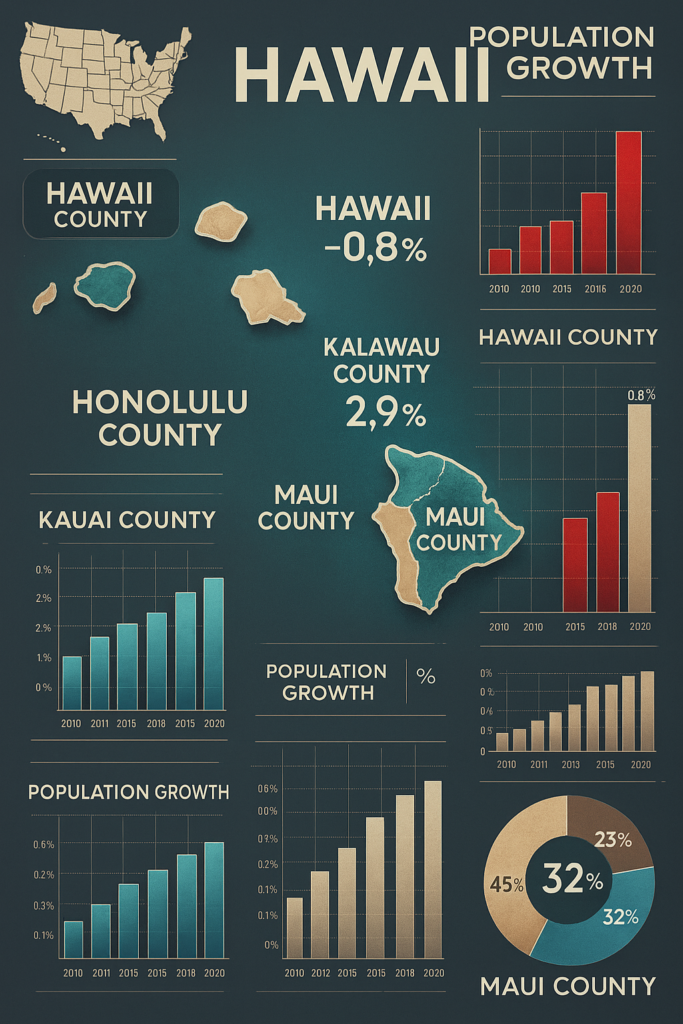

1. Economic and Population Growth

Hawaii continues to experience steady economic recovery and selective population growth, particularly in counties like Maui and Hawaii (Big Island). While overall population shifts have been modest, the growing demand for essential retail and service-based commercial real estate makes NNN properties a resilient choice for investors seeking income and long-term value appreciation.

2. Stability and Demand for NNN Properties

The island economy relies heavily on consistent sectors such as tourism, government, and healthcare, all of which create demand for commercial properties. NNN leases offer long-term, passive income backed by national or regional tenants in sectors like convenience retail, quick-service restaurants, and medical offices—critical needs in Hawaii’s geographically contained markets.

3. Market Trends and Cap Rates

Cap rates for NNN properties in Hawaii remain competitive due to the limited land supply and high construction costs, which support property values. While cap rates are typically lower than mainland averages, the trade-off is long-term stability and tenant retention. Investors targeting NNN assets in Hawaii often prioritize secure leases over high-yield volatility, especially in urban hubs like Honolulu and Kahului.

4. Financing Considerations for NNN Investors

NNN investments in Hawaii require financial readiness, with a typical minimum net worth of $1 million or annual income over $200,000. Given the state’s higher-than-average property values, down payments often range from 35% to 50%. Access to financing may be more limited compared to the mainland, so investors should be prepared with strong financials or consider 1031 exchange opportunities.

5. Local Market Opportunities

Hawaii offers niche but lucrative opportunities for NNN investors, particularly in high-traffic retail corridors, standalone drugstores, and essential service tenants. Properties in Honolulu, Hilo, and Wailuku with long-term national tenants under NNN agreements are highly sought after. Investors can benefit from 1031 exchanges by reinvesting capital into Hawaii’s resilient commercial property market while deferring capital gains taxes.

Triple-net (NNN) investors are increasingly exploring Hawaii as a valuable market for net lease properties due to its unique economic stability, limited land supply, and strong demand for essential services. Here’s why Hawaii presents a compelling opportunity for NNN brokers and investors:

1. Strong Tenant Demand Despite Lower Cap Rates

While cap rates in Hawaii typically range between 4.5% to 6%, slightly lower than mainland averages, investors benefit from exceptionally stable tenant occupancy and long-term lease security. The high barrier to entry, coupled with strong tourism and local consumer demand, makes Hawaii’s NNN investments a stable, lower-risk option for consistent income.

2. High-Value Real Estate Market

Hawaii’s commercial property values are elevated due to limited developable land and strict zoning laws. For NNN investors, this creates an opportunity to hold appreciating assets with minimal landlord responsibilities. Prime retail and service-based net lease properties, particularly on Oʻahu and Maui, continue to draw investor interest despite higher initial acquisition costs.

3. Steady Population and Tourism-Driven Economy

While overall population growth is modest, counties like Maui and Hawaii (Big Island) are experiencing positive trends. More importantly, Hawaii’s economy is heavily supported by consistent tourism activity, which fuels demand for national retailers, pharmacies, and quick-service restaurants operating under long-term NNN leases.

4. Prime Locations for Essential Retail & Medical Tenants

NNN investors in Hawaii focus on essential service tenants such as 7-Eleven, CVS, Walgreens, Starbucks, and urgent care centers. Properties located in high-foot-traffic areas like Honolulu, Kahului, and Hilo are especially desirable. These tenants offer stable, recession-resistant cash flow ideal for long-term, passive investing.

5. Tax Deferral Opportunities via 1031 Exchange

Hawaii is a favorable market for 1031 exchange investors looking to reinvest in appreciating markets while deferring capital gains taxes. Given the state’s limited inventory and consistently high rental demand, NNN properties in Hawaii offer investors a strong combination of preservation, income, and long-term growth potential.

6. Limited Inventory Drives Long-Term Value

Due to Hawaii’s geography and regulatory environment, the supply of commercial real estate is limited. This scarcity enhances the value of existing net lease assets and reduces vacancy risks. Investors holding NNN properties in Hawaii often benefit from longer lease renewals, higher tenant retention, and minimal landlord interference.

Income Taxes

Hawaii’s Tax Considerations for NNN Investors: What to Know Before You Invest

Hawaii offers a unique tax environment that NNN investors should carefully consider when evaluating potential net lease property opportunities. While Hawaii does not provide the lowest tax rates in the country, understanding its structure can help investors optimize returns and navigate potential costs effectively. Here’s what NNN brokers and investors need to know about Hawaii’s income and property tax implications:

1. State Income Tax on Rental Income

Hawaii taxes rental income, including that earned through LLCs or corporations, as part of state income. Passive rental income is subject to Hawaii’s personal or corporate income tax, depending on how the investment is structured. This means NNN investors must account for state-level taxes on net lease income, though proper planning can help mitigate the overall tax burden.

2. Corporate Income Tax Rates

Hawaii imposes a progressive corporate income tax with the following brackets:

4.4% on the first $25,000 of income

5.4% on income between $25,001 and $100,000

6.4% on income over $100,000

For investors operating through a corporate entity, these rates are moderate compared to national averages and can be managed with appropriate tax strategies.

3. Personal Income Tax Rates

Hawaii’s personal income tax rates range from 1.4% to 11%, applied across 12 brackets. The top marginal rate of 11% applies to higher income levels, including substantial net rental income. While higher earners may experience a larger tax impact, proper use of deductions, depreciation, and expense tracking can help offset taxable income.

4. No State-Level Capital Gains Tax

Hawaii does not have a separate capital gains tax rate. Instead, capital gains are taxed as regular income at the applicable personal or corporate income tax rate. For NNN investors planning an exit strategy or using a 1031 exchange, this means gains are subject to the standard income tax rules, but deferral through 1031 is allowed if IRS criteria are met.

5. No Inheritance or Estate Tax

Hawaii does not impose a state inheritance tax, but it does have an estate tax with progressive rates up to 20% for large estates. NNN investors planning generational transfers of real estate should work with estate planning professionals to minimize or defer estate tax obligations when passing down property.

6. Moderate Property Tax Rates

Hawaii has relatively low property tax rates, with an average effective rate of around 0.28%, one of the lowest in the U.S. However, actual tax amounts can be high due to elevated property values, especially in counties like Honolulu and Maui. For NNN investors, the benefit is a lower tax rate on high-value properties, keeping holding costs predictable.

Investing in triple-net lease (NNN) properties in Hawaii offers unique opportunities—fueled by modest population gains, tourism-driven economies, and essential-retail demand. Below are the most attractive counties and metro areas based on recent data (July 2023–July 2024):

1. Honolulu County (Oʻahu):

Population Growth: Saw net increase of +4,171 residents (majority of statewide growth). Took the lead in reversing previous multi-year decline .

Economic Development: Hawaii’s largest employment hub, anchored by tourism, healthcare (Queen’s Health Systems), government, and expanding transit (Skyline rail project) .

Investment Potential: Strong demand for NNN-leased convenience retail, QSR, pharmacies, and medical offices near transit nodes and dense urban neighborhoods—backed by stable national tenants.

2. Hawaii County (Big Island):

Population Growth: Increased from ~208,043 to ~209,790 (+1,747 people, 0.8%). Over the past four years, averaged +2,264 net migrants annually — the only county to show sustained positive net migration

Economic Development: Tourism-centric economy in Kona and Hilo, alongside diversified agriculture (coffee, macadamia, aquaculture), and growing sustainable-tourism initiatives. County-backed regeneration of island‑grown businesses and enhanced community broadband and infrastructure.

Investment Potential: Rising population via migration and broad economic base support NNN properties in retail, hospitality, essential services, and agri-business sectors.

3. Maui County – Kahului, Wailuku, Lahaina:

Population Growth: Declined slightly from ~164,835 to ~163,769 (approx. –1,066, –0.6%). Devastating effects from recent wildfires may have compressed estimates, but future redevelopment expected.

Economic Development: Tourism-centered but currently rebuilding—hospitality took a hit post-wildfires. Mayor proposing to phase out some vacation rentals to shift towards long-term housing, signaling market transformation.

Investment Potential: Rebuilding phase and policy changes create NNN opportunities in hospitality, residential conversions, retail serving local demand, and office space.

4. Kauai County – (Lihue, Kapaa):

Population Growth: Slight decline (~–0.1%), having lagged Hawaii County and Oahu

Economic Development: Smaller tourism market with slower job and payroll growth. Some positive migration via international visitors and returning residents

Investment Potential: Opportunities in retail, hospitality, and essential services remain viable but should be approached with caution due to slower growth.

Pros:

1️⃣ Stable Cap Rates

Hawaii offers stable cap rates for NNN properties, generally ranging between 4% and 6%. While slightly lower than some mainland states, these cap rates reflect the state’s unique market stability and long-term investment potential.

2️⃣ Exceptionally Low Property Taxes

Hawaii has one of the lowest property tax rates in the U.S., averaging around 0.30%. This helps reduce overall holding costs, making it attractive for long-term investors focused on cash flow and asset preservation.

3️⃣ Consistent Demand from Tourism and Local Population

Hawaii’s strong tourism sector and stable residential population support steady demand for essential services and retail businesses. This provides consistent rental income for NNN investors targeting tenants like pharmacies, QSRs, and convenience retailers.

4️⃣ Limited Supply of Commercial Real Estate

Due to Hawaii’s geographic constraints and zoning regulations, commercial real estate is limited. This scarcity enhances tenant retention and leads to lower vacancy risks in NNN properties.

5️⃣ Strong 1031 Exchange Opportunities

Hawaii has a variety of NNN properties with national tenants such as McDonald’s, CVS, and other QSRs. These assets are ideal for 1031 exchange investors seeking to defer capital gains and reinvest in stable, income-generating real estate.

Cons:

1️⃣ Lower Cash Flow from Cap Rates

While cap rates are stable, they are lower than high-yield mainland markets. This may limit immediate cash flow for investors seeking aggressive short-term returns.

2️⃣ High Acquisition Costs

Real estate in Hawaii comes at a premium due to limited land and high demand. This results in higher purchase prices, potentially raising entry barriers for smaller investors.

3️⃣ Higher State Income and Estate Taxes

Hawaii has one of the highest state income tax rates in the U.S., which can affect investor returns. Additionally, estate taxes may impact long-term estate planning for property owners.

4️⃣ General Excise Tax (GET)

Hawaii imposes a General Excise Tax on gross rental income. While often passed on to tenants, this tax requires additional compliance and accounting, especially for out-of-state investors.

5️⃣ Environmental and Climate Risks

Properties may face exposure to natural risks such as hurricanes, coastal erosion, and volcanic activity. These risks can increase insurance premiums and maintenance responsibilities.

6️⃣ Limited Urban Expansion

Most high-demand activity is centered in Honolulu and select urban zones. Rural or outer island areas may offer fewer high-end tenants or urban development opportunities, requiring careful market selection.

Hawaii NNN Properties for 1031 Exchange

Invest in Free Standing Single Tenant Triple Net (NNN) Properties in Hawaii

Are you looking for a reliable 1031 exchange replacement property?

At Triple Net Investment Group, we specialize in the sale of single tenant NNN properties and triple net shopping centers across the United States. Our team is dedicated to helping investors find high-quality (Tenant Triple Net) NNN properties in Hawaii and nationwide that align with their financial goals and 1031 exchange requirements.

With our in-depth market knowledge and personalized service, we provide tailored investment strategies for both buyers and sellers of commercial real estate. Whether you’re looking to defer capital gains through a 1031 tax-deferred exchange or want to diversify your portfolio with income-generating assets, our team offers a wide selection of vetted NNN investment properties.

Corporate Tenant Credit Ratings

Find out more about the credit rating of the tenant before purchasing.

How safe are the triple net investment grade free standing single tenant properties?

Market Analysis

What three things should I know before investing?

Call or e-mail us and we will get back to you within 24 hours. We know of properties for sale that aren’t listed or advertised.

Email: [email protected] Tel: 202-361-3050

We strive hard to provide clients with quality costumer service

We provide our clients with all of the information they need upfront to make an informed decision, even before a Letter of Intent is issued such as: tenant credit information, store sales, lease terms, options, renewal rates, rent escalations, location analysis, site analysis, market analysis, demographic data, cash on cash returns on investment, internal rate of returns after taxes, risks, likes, dislikes and so on. We will then strategies how to proceed on making a best offer. It is our goal to build a solid relationship with our clients and keep them updated on net lease investments, even though they may not have a need for years to come.(NNN Properties in Hawaii)

We markets our listings locally, nationally and internationally

Triple Net Investment Group difference is a concept that is revolutionary in the commercial real estate brokerage business. In addition to marketing our deals to potential investors, We markets our listings to the entire brokerage community. We put our listings directly in front of thousands of commercial real estate agents in each state, region and local where the property is located.