Why NNN Investors Prefer Idaho State: Higher Growth & Competitive Cap Rates Explained

Future holding for NNN property investments in Idaho

Triple Net Lease (NNN) properties, where tenants are responsible for property taxes, insurance, and maintenance costs, continue to offer a compelling investment opportunity for those seeking stable, low-maintenance income. In Idaho, the future of NNN property investments looks strong, supported by several key factors:

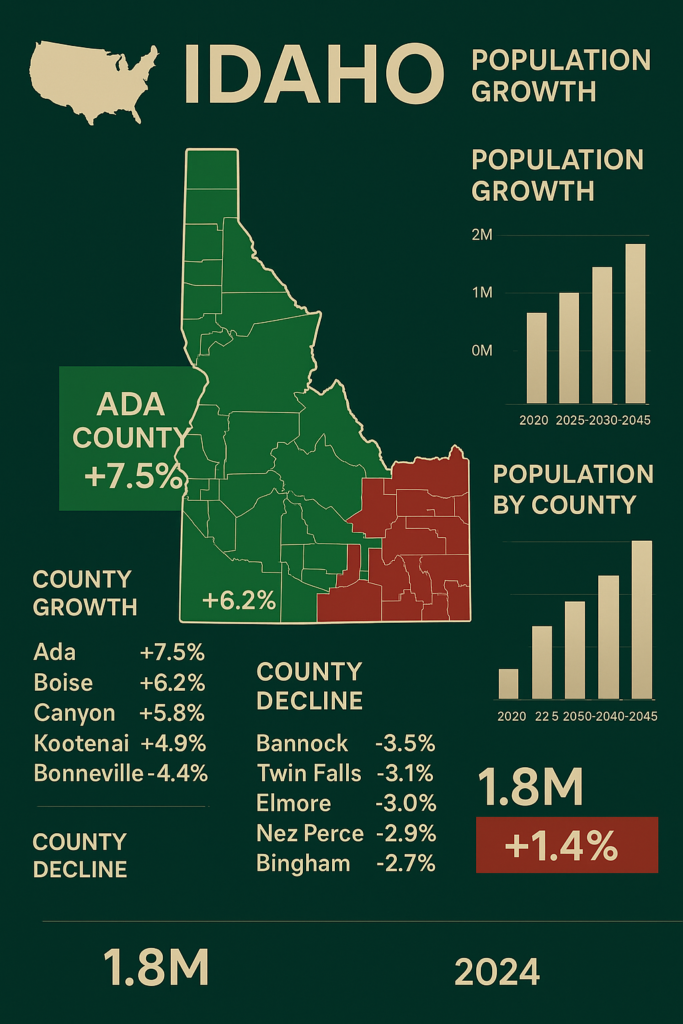

1. Economic and Population Growth

Idaho has emerged as one of the fastest-growing states in the U.S., with cities like Boise and Meridian experiencing a population and economic boom. This growth drives up demand for commercial real estate, making NNN properties an appealing option for investors focused on long-term stability and value appreciation.

2. Stability and Demand for NNN Properties

NNN lease investments offer predictable, long-term cash flow, with tenants assuming responsibility for most operating expenses. This structure is particularly attractive in a state like Idaho, where expanding business sectors and an influx of residents contribute to high tenant reliability and increasing demand for NNN opportunities.

3. Market Trends and Cap Rates

Cap rates for NNN investments in Idaho remain competitive, offering strong returns in both urban and secondary markets. As demand continues to grow, the volume of net lease property listings has increased, providing investors with a broader range of opportunities to secure well-leased, income-generating assets.

4. Financing Considerations for NNN Investors

To invest in NNN properties, investors typically need a net worth exceeding $1 million or an annual income above $200,000. Down payments usually range from 30% to 40% of the purchase price. Understanding these thresholds is critical for those entering the Idaho NNN market or looking to expand their portfolio.

5. Local Market Opportunities

Idaho offers diverse opportunities across sectors like retail, healthcare, and industrial single-tenant properties. For instance, properties with long-term NNN leases in Boise’s growing suburbs or logistics facilities near I-84 offer strong potential. Investors using 1031 exchanges can take advantage of Idaho’s expanding market to defer capital gains while upgrading to higher-performing assets.

Triple-net (NNN) investors are increasingly turning to Idaho as a prime location for net lease properties, thanks to its steady cap rates, explosive population growth, and investor-friendly climate. Here’s why NNN brokers and investors see Idaho as a lucrative market:

1. Competitive Cap Rates with Steady Income

Idaho offers attractive cap rates, typically ranging from 5.5% to 7%, making it a strong contender in the NNN investment market. While these cap rates remain competitive, they also reflect the state’s stability and growth potential, allowing investors to enjoy reliable cash flow from long-term tenants.

2. Moderate Property Prices with High Upside

Idaho’s commercial real estate remains more affordable than coastal states, enabling investors to enter the market at moderate price points. With growing demand and increasing rents in high-growth areas like Boise, Meridian, and Nampa, investors benefit from both cash flow and appreciation.

3. Rapid Population Growth & Economic Expansion

Idaho has consistently ranked among the fastest-growing states in the U.S., driven by migration from high-cost urban centers. Booming metro areas such as Boise and Coeur d’Alene are attracting talent and businesses, stimulating demand for retail, industrial, and service-based NNN lease properties.

4. High Demand for Essential Retail & QSR Tenants

NNN investors are increasingly targeting essential retail and QSR (Quick-Service Restaurant) tenants like Starbucks, Dutch Bros, Chick-fil-A, Walgreens, and Tractor Supply Co. These tenants thrive in Idaho’s growing suburban and rural markets, providing long-term stability and lease security for investors.

5. Tax-Friendly Environment for Passive Investors

Idaho offers a favorable tax environment for passive real estate investors. While it does have a state income tax, it allows various deductions and offers attractive conditions for LLC structures. Investors using 1031 exchanges can effectively defer capital gains and reinvest in Idaho’s appreciating markets.

6. Logistics, Tech, and Industrial Development

With its strategic location and growing infrastructure, Idaho has become a regional hub for logistics, agriculture, and light manufacturing. The expansion of tech and warehousing operations, especially around Boise, is creating increased demand for single-tenant industrial and flex-use NNN properties.

Income Taxes

Idaho’s Tax Advantages for NNN Investors: A Strategic Market for Net Lease Properties

Idaho presents a tax environment that, while not entirely tax-free, offers several financial advantages for NNN investors seeking consistent returns and manageable tax obligations. With reasonable tax rates, pro-business policies, and growth-friendly conditions, Idaho is becoming an increasingly attractive state for net lease property investments. Here’s why investors and NNN brokers are paying attention:

1. Favorable Tax Treatment for LLC Rental Income

NNN investors who own properties through an LLC in Idaho benefit from pass-through taxation, meaning the rental income is taxed at the individual level, not the entity level. This avoids double taxation and allows investors to use deductions such as depreciation, mortgage interest, and operational expenses to lower their overall taxable income.

2. Competitive Corporate Income Tax Rate

Idaho’s corporate income tax rate is 5.8%, which is lower than the national average. For NNN investors operating through corporations, this rate allows for greater retained earnings, supporting reinvestment strategies into additional properties or value-added improvements.

3. Moderate Personal Income Tax Rates

As of recent tax reforms, Idaho’s flat personal income tax rate is 5.8%, which simplifies tax calculations and reduces the burden on higher earners. This rate is especially beneficial for NNN investors with significant passive income from rental properties, providing predictable and manageable tax liabilities.

4. No State-Level Estate or Inheritance Tax

Idaho does not impose an estate or inheritance tax, making it easier for investors to pass down net lease assets to heirs without additional state-level tax consequences. This supports long-term wealth preservation and estate planning strategies for multi-generational investors.

5. Reasonably Low Property Tax Rates

Idaho’s average effective property tax rate is approximately 0.63%, below the national average. This provides NNN investors with lower holding costs over the long term, boosting overall returns on investment and improving property cash flow performance.

6. No Separate State Capital Gains Tax

Capital gains in Idaho are taxed as ordinary income under the state’s flat 5.8% income tax rate. Idaho does not levy a separate capital gains tax, allowing NNN investors engaging in 1031 exchanges or strategic property sales to benefit from simpler tax treatment and cost-effective exit planning.

Triple net lease (NNN) properties in Idaho offer strong investment potential, especially in high-growth areas where population influx and economic expansion are creating heightened demand for retail, industrial, and service-oriented real estate. With tenants covering property taxes, insurance, and maintenance, these properties provide a hands-off investment model. Based on recent population and economic trends, here are some of the top cities and counties in Idaho to consider for NNN property investments:

1. Ada County (Boise):

Population Growth: Ada County added approximately 6,950 residents between 2023 and 2024, driven by domestic migration into Boise and Meridian.

Economic Development: Boise is Idaho’s capital and largest city, known for its growing tech sector, healthcare facilities, and dynamic startup ecosystem.

Investment Potential: The population boom and economic diversity make Ada County ideal for NNN properties in retail, medical office, and service-related sectors.

2. Canyon County (Nampa and Caldwell):

Population Growth: Canyon County experienced a population increase of around 4,000 between 2023 and 2024.

Economic Development: As a key part of the Boise metro area, the county benefits from affordable housing, logistics hubs, and agricultural processing industries.

Investment Potential: Growth in residential developments is fueling demand for QSRs, convenience retail, and essential service providers—ideal for NNN leasing.

3. Kootenai County (Coeur d’Alene):

Population Growth: The county grew by approximately 3,200 residents from 2023 to 2024.

Economic Development: Coeur d’Alene has a diversified economy driven by healthcare, tourism, and professional services.

Investment Potential: With a high quality of life and increasing year-round population, the area is well-suited for NNN investments in retail, restaurants, and medical services.

4. Bonneville County (Idaho Falls):

Population Growth: Bonneville County added about 2,300 new residents between 2023 and 2024.

Economic Development: Idaho Falls is a regional economic center with strengths in nuclear research, healthcare, and retail.

Investment Potential: Strong employment growth and demand for consumer services present opportunities for NNN investments in shopping centers and freestanding tenant buildings.

5. Twin Falls County (Twin Falls):

Population Growth: Twin Falls County saw a population gain of around 1,800 in the past year.

Economic Development: Anchored by food processing, agriculture, and retail trade, Twin Falls is one of southern Idaho’s fastest-developing cities.

Investment Potential: The expanding economy supports NNN investments in retail, warehouse-distribution facilities, and restaurant chains.

6. Bannock County (Pocatello):

Population Growth: Bannock County grew by about 1,400 residents from 2023 to 2024.

Economic Development: Pocatello, home to Idaho State University, maintains a stable economy centered on education, healthcare, and logistics.

Investment Potential: A steady influx of students and professionals creates demand for QSRs, pharmacies, and other NNN-leased service providers.

Pros:

1️⃣ Higher Cap Rates

Idaho offers competitive cap rates for NNN properties, typically ranging from 5.5% to 7%, which are attractive compared to more saturated real estate markets. This allows investors to enjoy stronger cash flow and return on investment.

2️⃣ Predictable Tax Environment for LLCs

Idaho does not impose a separate tax on LLCs; instead, rental income flows through to the owner and is taxed at a flat 5.8% personal income rate. This provides transparency and simplicity in managing NNN rental income.

3️⃣ Reasonable Property Taxes

With an average effective property tax rate of ~0.63%, Idaho ranks favorably for holding costs. This helps investors retain more cash flow over the long term, especially on higher-value properties.

4️⃣ Rapid Population Growth

Cities like Boise, Meridian, Nampa, and Coeur d’Alene are experiencing significant population and housing growth. This surge supports steady demand for essential services, boosting the value and stability of NNN-leased properties.

5️⃣ Expanding Economic Base

Idaho’s economy is diversifying beyond agriculture, with growth in technology, healthcare, manufacturing, and logistics. This broad-based development creates demand for NNN tenants such as QSRs, pharmacies, medical clinics, and service centers.

6️⃣ Business-Friendly Climate

Idaho is ranked highly for regulatory efficiency, low operating costs, and access to workforce incentives. These factors make it attractive to national brands and franchise operators that typically sign long-term NNN leases.

7️⃣ Strong Tenant Opportunities in Growing Suburbs

Suburban areas surrounding Boise and Coeur d’Alene offer strong potential for tenants like Dollar Tree, Tractor Supply Co., Starbucks, and urgent care centers, which thrive in mid-density markets with rising populations.

Cons:

1️⃣ Moderate Property Appreciation

Idaho’s property values appreciate more slowly than explosive-growth markets like Arizona or Texas. Investors focused purely on capital growth may see more gradual returns.

2️⃣ Tenant Demand May Be Uneven

While urban and suburban centers are growing, rural regions may have limited tenant interest or slower lease-up times. Due diligence is critical when evaluating locations outside key metros.

3️⃣ Harsh Winters in Some Regions

Northern and eastern Idaho experience harsh winters and snowfall, which can lead to increased maintenance costs and utility expenses, depending on lease structure.

4️⃣ Smaller Urban Footprint

Idaho doesn’t have large urban sprawl. While Boise is growing rapidly, urban core opportunities are fewer, and high-end retail tenants may prefer larger markets.

5️⃣ Economic Reliance on Certain Sectors

Some regions of Idaho still rely heavily on agriculture, mining, and timber. These industries are susceptible to economic fluctuations and may limit tenant diversification in certain markets.

Idaho NNN Properties for 1031 Exchange

Invest in Free Standing Single Tenant Triple Net (NNN) Properties in Idaho

Are you looking for a reliable 1031 exchange replacement property?

At Triple Net Investment Group, we specialize in the sale of single tenant NNN properties and triple net shopping centers across the United States. Our team is dedicated to helping investors find high-quality (Tenant Triple Net) NNN properties in Idaho and nationwide that align with their financial goals and 1031 exchange requirements.

With our in-depth market knowledge and personalized service, we provide tailored investment strategies for both buyers and sellers of commercial real estate. Whether you’re looking to defer capital gains through a 1031 tax-deferred exchange or want to diversify your portfolio with income-generating assets, our team offers a wide selection of vetted NNN investment properties.

Corporate Tenant Credit Ratings

Find out more about the credit rating of the tenant before purchasing.

How safe are the triple net investment grade free standing single tenant properties?

Market Analysis

What three things should I know before investing?

Call or e-mail us and we will get back to you within 24 hours. We know of properties for sale that aren’t listed or advertised.

Email: [email protected] Tel: 202-361-3050

We strive hard to provide clients with quality costumer service

We provide our clients with all of the information they need upfront to make an informed decision, even before a Letter of Intent is issued such as: tenant credit information, store sales, lease terms, options, renewal rates, rent escalations, location analysis, site analysis, market analysis, demographic data, cash on cash returns on investment, internal rate of returns after taxes, risks, likes, dislikes and so on. We will then strategies how to proceed on making a best offer. It is our goal to build a solid relationship with our clients and keep them updated on net lease investments, even though they may not have a need for years to come.(NNN Properties in Idaho)

We markets our listings locally, nationally and internationally

Triple Net Investment Group difference is a concept that is revolutionary in the commercial real estate brokerage business. In addition to marketing our deals to potential investors, We markets our listings to the entire brokerage community. We put our listings directly in front of thousands of commercial real estate agents in each state, region and local where the property is located.