Why NNN Investors Prefer Illinois State: Higher Growth & Competitive Cap Rates Explained

Future Holding for NNN Property Investments in Illinois

Triple Net Lease (NNN) properties, where tenants are responsible for taxes, insurance, and maintenance, continue to appeal to investors seeking predictable cash flow and passive income. In Illinois, NNN property investments are positioned for long-term viability, supported by several important market dynamics:

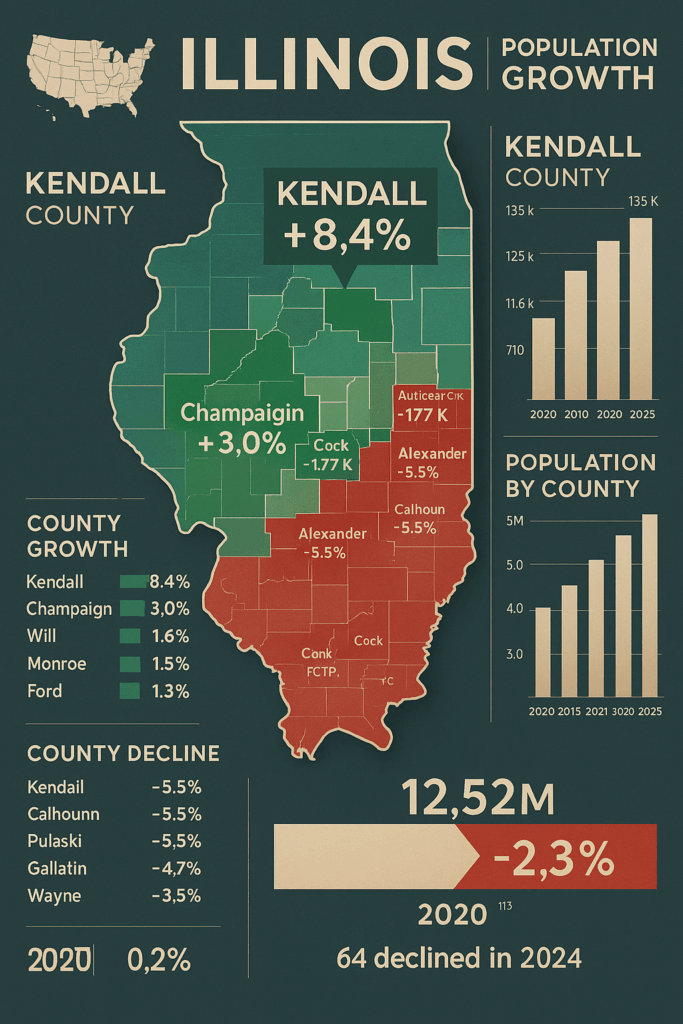

1. Economic and Population Growth

While Illinois overall has experienced a modest population decline, select counties such as Kendall and Champaign are seeing measurable growth. These areas have become attractive for retail and industrial development, contributing to a sustained demand for commercial real estate and offering strategic opportunities for NNN investors seeking high-growth pockets.

2. Resilient Demand for NNN Assets

NNN properties in Illinois, especially in metro areas like Chicago, Naperville, and Rockford, continue to see solid tenant demand. Essential retail tenants, logistics providers, and healthcare-related businesses are increasingly utilizing NNN structures, making these investments particularly resilient even amid market fluctuations. Investors benefit from long-term leases and reduced management responsibilities.

3. Cap Rate Trends and Market Activity

Cap rates for NNN properties in Illinois are relatively attractive compared to national averages, typically ranging between 5.5% to 6.5% depending on tenant strength and location. Suburban markets around Chicago and emerging corridors like those in central and southern Illinois are seeing increased NNN listing activity, offering investors diverse entry points and risk profiles.

4. Financial Requirements and Investment Profile

NNN investments in Illinois usually require investors to have a minimum net worth of $1 million or annual income over $200,000. Down payments range from 30% to 40%, depending on asset class and lender criteria. These investments are particularly suitable for accredited investors aiming to balance income generation with capital preservation.

5. Local Market Opportunities

Illinois offers a strong pipeline of single-tenant NNN assets across retail, industrial, and medical sectors. For instance, properties in suburbs such as Aurora, Elgin, and Peoria are attracting investor interest, particularly those with national tenants under long-term leases. Additionally, NNN investors using 1031 exchanges are targeting Illinois markets to defer capital gains while reinvesting in stable, income-producing properties.

Triple-net (NNN) investors are increasingly eyeing Illinois as a stronghold for net lease property investments. Despite some statewide population challenges, Illinois remains a lucrative market due to its economic diversity, robust urban infrastructure, and continued demand for essential retail and industrial space. Here’s why NNN brokers and investors see Illinois as a smart choice:

1. Competitive Cap Rates in Key Markets

Illinois offers competitive cap rates typically ranging from 5.5% to 6.5%, with even higher returns possible in secondary or tertiary markets. These rates are especially appealing in suburban areas surrounding Chicago, such as Aurora, Elgin, and Joliet, where investor competition is lower and tenant demand remains stable. These yields offer investors solid returns while maintaining the benefits of long-term, low-maintenance leases.

2. Accessibly Priced Commercial Assets

While urban cores like Chicago carry premium prices, investors can find affordable NNN properties throughout Illinois in high-traffic suburban and rural corridors. Markets like Peoria, Rockford, and Decatur offer attractive entry points, with single-tenant retail and industrial properties at prices significantly below coastal states, while still featuring nationally recognized tenants.

3. Economic Anchors & Development Zones

Illinois is home to a diverse economic base, including logistics, manufacturing, agriculture, and healthcare. The Chicago metro area serves as one of the nation’s largest transportation hubs, while downstate cities benefit from targeted economic development incentives and enterprise zones. These conditions drive sustained demand for retail, warehouse, and service-sector net lease properties.

4. Strong Tenant Demand in Key Sectors

NNN investors in Illinois benefit from high demand across essential retail (e.g., Walgreens, CVS, Dollar Tree), QSRs (e.g., Chick-fil-A, Wendy’s, Taco Bell), and healthcare operators. These tenants prioritize visibility and high-traffic locations, making Illinois’s arterial road networks and walkable communities ideal for long-term occupancy and lease stability.

5. Favorable 1031 Exchange Options

Illinois offers an abundance of 1031 exchange-eligible net lease properties, giving investors flexibility to reposition their portfolios without triggering capital gains taxes. With a wide range of price points, property types, and credit-grade tenants, Illinois is well-suited for investors seeking to defer taxes while securing reliable income-producing assets.

6. Industrial and Logistics Growth Corridors

Illinois continues to see strong industrial growth, especially in areas like Will County, Joliet, and the I-55/I-80 corridor, due to their strategic proximity to intermodal facilities, rail lines, and highways. The rise in e-commerce and supply chain infrastructure has driven significant demand for single-tenant NNN industrial and distribution centers, giving investors access to long-term leases with logistics operators.

Income Taxes

Illinois Tax Overview for NNN Investors: What to Know Before Investing in Net Lease Properties

Illinois presents a mixed tax landscape for NNN (triple-net) investors. While it does not offer the same tax advantages as some low-tax states, investors can still strategically benefit from the state’s transparent tax structure, straightforward treatment of LLC income, and available tools like 1031 exchanges. Here’s what NNN investors and brokers should know about Illinois’ income tax and how it impacts net lease investments:

1. State Income Tax on LLC and Rental Income

Illinois does tax rental income earned through LLCs or individuals at a flat rate of 4.95%, which applies uniformly to all taxable income. However, unlike states with tiered income taxes, Illinois’ flat rate simplifies tax planning, making it easier for NNN investors to project returns. Income earned through pass-through entities like LLCs is taxed at the individual level.

2. Corporate Income Tax

Illinois has a corporate income tax rate of 7%, in addition to a 2.5% personal property replacement tax, bringing the effective corporate tax rate to 9.5%. Investors operating NNN portfolios through corporations or REITs should account for this higher combined rate. Strategic use of depreciation, reinvestment, and capital structuring can help offset the tax burden for larger investment portfolios.

3. Flat Personal Income Tax Rate

Illinois levies a flat personal income tax of 4.95%, regardless of income level. While this rate is higher than some low-tax states, it is lower than top rates in progressive-tax states and provides consistency in tax forecasting. NNN investors filing as individuals or sole proprietors will pay this flat rate on income from net lease properties.

4. No State-Level Capital Gains Tax Surcharge

Illinois does not impose a separate capital gains tax. Capital gains are treated as ordinary income and taxed at the same 4.95% flat rate. For NNN investors planning an exit, this offers a modest, predictable tax liability compared to states with steep capital gains surcharges. This also simplifies 1031 exchange planning, which can be used to defer those gains entirely.

5. No Estate or Inheritance Tax

Illinois does have an estate tax, but only on estates exceeding $4 million in value. The state does not impose an inheritance tax on heirs. Investors with significant net lease holdings should consider estate planning tools such as trusts or LLC succession structures to mitigate estate tax exposure and ensure smooth asset transition to future generations.

6. High Property Tax Rates

Illinois has some of the highest property taxes in the U.S., with an average effective property tax rate around 2.1%. This is particularly true in counties such as Cook, Lake, and DuPage. NNN investors must factor these higher property taxes into their pro forma calculations, especially when acquiring properties with modest NOI margins. However, these costs are typically passed on to tenants under true triple-net lease structures.

Triple‑net lease (NNN) investments in Illinois present strategic opportunities in counties experiencing modest population gains, stable economies, and solid tenant demand. Tenants handle taxes, insurance, and maintenance, offering investors passive income with minimal oversight. Below are key Illinois regions to consider:

1. Kendall County (Yorkville/Oswego):

Population Growth: Ranked as the fastest-growing county in Illinois in 2023–24, among the top five statewide.

Economic Development: Rapid suburban expansion and strong retail and industrial demand near Chicago’s southwest corridor.

Investment Potential: Ideal for single-tenant retail and light industrial NNN properties serving growing commuter populations and regional distribution needs.

2. Champaign County (Champaign‑Urbana):

Population Growth: One of the fastest-growing counties statewide in 2023–24

Economic Development: Anchored by the University of Illinois, steady inflow of students, faculty, and staff. New tech and research spin-offs expand commercial demand.

Investment Potential: Opportunities in large-format retail, quick-serve restaurants (QSRs), and medical/office properties under stable, long-term NNN leases.

3. Will County (Joliet & suburbs):

Population Growth: Estimated 700 k in 2023, up from 696 k in 2020

Economic Development: Located in a major logistics and manufacturing corridor with growth supported by intermodal and highway infrastructure.

Investment Potential: Excellent for industrial and warehouse NNN assets, plus retail and service properties supporting suburban growth.

4. McHenry County (Crystal Lake area):

Population Growth: Estimated 312.8 k in 2023, up from 310.2 k in 2020

Economic Development: Suburban and exurban growth with blend of residential and commercial development near Chicago’s northwest corridor.

Investment Potential: Retail, medical, and service-oriented NNN properties catering to established suburban communities.

5. Kane County (Aurora region):

Population Growth: Estimated 515 k in 2023, stable since 2020 (~516 k)

Economic Development: One of Chicago’s collar counties with a diversified mix of manufacturing, logistics, healthcare, and professional services in Aurora and Geneva.

Investment Potential: Classic NNN opportunities in national retailers, QSRs, and medical facilities serving steady suburban demand.

6. Lake County (North Shore suburbs):

Population Growth: Slight decline (714 k in 2020 to 708 k in 2023), but remains a high-income, high-demand region.

Economic Development: Wealthy population, proximity to Chicago, strong office and medical tenant base, ongoing commercial redevelopment.

Investment Potential: Premium NNN opportunities in single-tenant medical centers, high-end retail, and value-stable long-term leases.

Pros:

1️⃣ Higher Cap Rates Compared to Coastal States

Illinois offers relatively attractive cap rates (typically 5.5%–6.5%) compared to low-yield coastal states like California or New York (often <5%). Investors can earn stronger passive income returns, particularly in secondary and suburban markets like Rockford, Peoria, and Springfield.

2️⃣ Central U.S. Location with Strong Logistics Infrastructure

Illinois is a major transportation and logistics hub due to its central location, dense highway network, and the presence of O’Hare International Airport. This boosts demand for industrial and distribution-focused NNN properties, especially in the Chicago metro and Joliet regions.

3️⃣ Large and Stable Consumer Base

With nearly 12.5 million residents, Illinois offers a deep tenant pool and consumer base. Metro Chicago, the third-largest city in the U.S., provides steady demand for retail, medical, QSR, and service-based NNN tenants.

4️⃣ Diverse Economy Across Sectors

Illinois boasts a diversified economy—spanning finance, healthcare, education, manufacturing, and agriculture. This reduces risk exposure to a single industry and promotes tenant stability across various sectors for NNN investors.

5️⃣ Affordable Entry in Downstate & Suburban Markets

Outside of downtown Chicago, Illinois offers relatively affordable commercial property prices, especially in cities like Champaign, Rockford, and Bloomington. This enables investors to enter the market with lower capital outlays while still benefiting from quality tenants and growing submarkets.

6️⃣ Institutional Tenant Presence

Illinois hosts a broad range of national and regional tenants—Walgreens (headquartered in Deerfield), McDonald’s, CVS, AutoZone, Dollar Tree, and more—ensuring a deep inventory of net lease assets with strong corporate guarantees.

7️⃣ 1031 Exchange Opportunities with Strong Market Depth

Illinois has a robust inventory of single-tenant and multi-tenant NNN properties, enabling investors to complete 1031 exchanges more efficiently and reinvest gains into stable, income-generating real estate.

Cons:

1️⃣ Higher Property Tax Burden

Illinois has one of the highest property tax rates in the U.S., with an average effective rate of ~2.1%. This increases holding costs and may slightly offset higher cap rate advantages.

2️⃣ State Budget Challenges and Pension Obligations

Illinois has a well-documented history of fiscal instability, including unfunded pension liabilities. This can lead to increased taxes or reduced services over time, potentially impacting business operations and investor sentiment.

3️⃣ Slower Population Growth

Unlike many Sunbelt states, Illinois has seen stagnant or negative population growth in recent years. While metro Chicago remains strong, downstate and rural counties may experience population declines, impacting tenant demand in those areas.

4️⃣ Regulatory Complexity and Permitting Delays

Illinois’ real estate permitting and zoning processes—especially in Chicago and Cook County—can be more time-consuming and bureaucratic than in other states. This may create hurdles for redevelopment or re-tenanting projects.

5️⃣ Seasonal Weather Risks and Maintenance Costs

Illinois experiences harsh winters and temperature extremes that can lead to increased property maintenance costs for HVAC, roofing, and exterior repairs—even on NNN leases where the tenant pays, higher costs can affect lease renewal or tenant negotiations.

Illinois NNN Properties for 1031 Exchange

Invest in Free Standing Single Tenant Triple Net (NNN) Properties in Illinois

Are you looking for a reliable 1031 exchange replacement property?

At Triple Net Investment Group, we specialize in the sale of single tenant NNN properties and triple net shopping centers across the United States. Our team is dedicated to helping investors find high-quality (Tenant Triple Net) NNN properties in Illinois and nationwide that align with their financial goals and 1031 exchange requirements.

With our in-depth market knowledge and personalized service, we provide tailored investment strategies for both buyers and sellers of commercial real estate. Whether you’re looking to defer capital gains through a 1031 tax-deferred exchange or want to diversify your portfolio with income-generating assets, our team offers a wide selection of vetted NNN investment properties.

Corporate Tenant Credit Ratings

Find out more about the credit rating of the tenant before purchasing.

How safe are the triple net investment grade free standing single tenant properties?

Market Analysis

What three things should I know before investing?

Call or e-mail us and we will get back to you within 24 hours. We know of properties for sale that aren’t listed or advertised.

Email: [email protected] Tel: 202-361-3050

We strive hard to provide clients with quality costumer service

We provide our clients with all of the information they need upfront to make an informed decision, even before a Letter of Intent is issued such as: tenant credit information, store sales, lease terms, options, renewal rates, rent escalations, location analysis, site analysis, market analysis, demographic data, cash on cash returns on investment, internal rate of returns after taxes, risks, likes, dislikes and so on. We will then strategies how to proceed on making a best offer. It is our goal to build a solid relationship with our clients and keep them updated on net lease investments, even though they may not have a need for years to come.(NNN Properties in Illinois)

We markets our listings locally, nationally and internationally

Triple Net Investment Group difference is a concept that is revolutionary in the commercial real estate brokerage business. In addition to marketing our deals to potential investors, we market our listings to the entire brokerage community. We put our listings directly in front of thousands of commercial real estate agents in each state, region, and locality where the property is located.