Why NNN Investors Prefer lowa State: Higher Growth & Competitive Cap Rates Explained

Future Holding for NNN Property Investments in Iowa

Triple Net Lease (NNN) properties, where tenants are responsible for property taxes, insurance, and maintenance, continue to be a reliable investment option. In Iowa, the future of NNN property investments looks promising, backed by several favorable trends and market fundamentals:

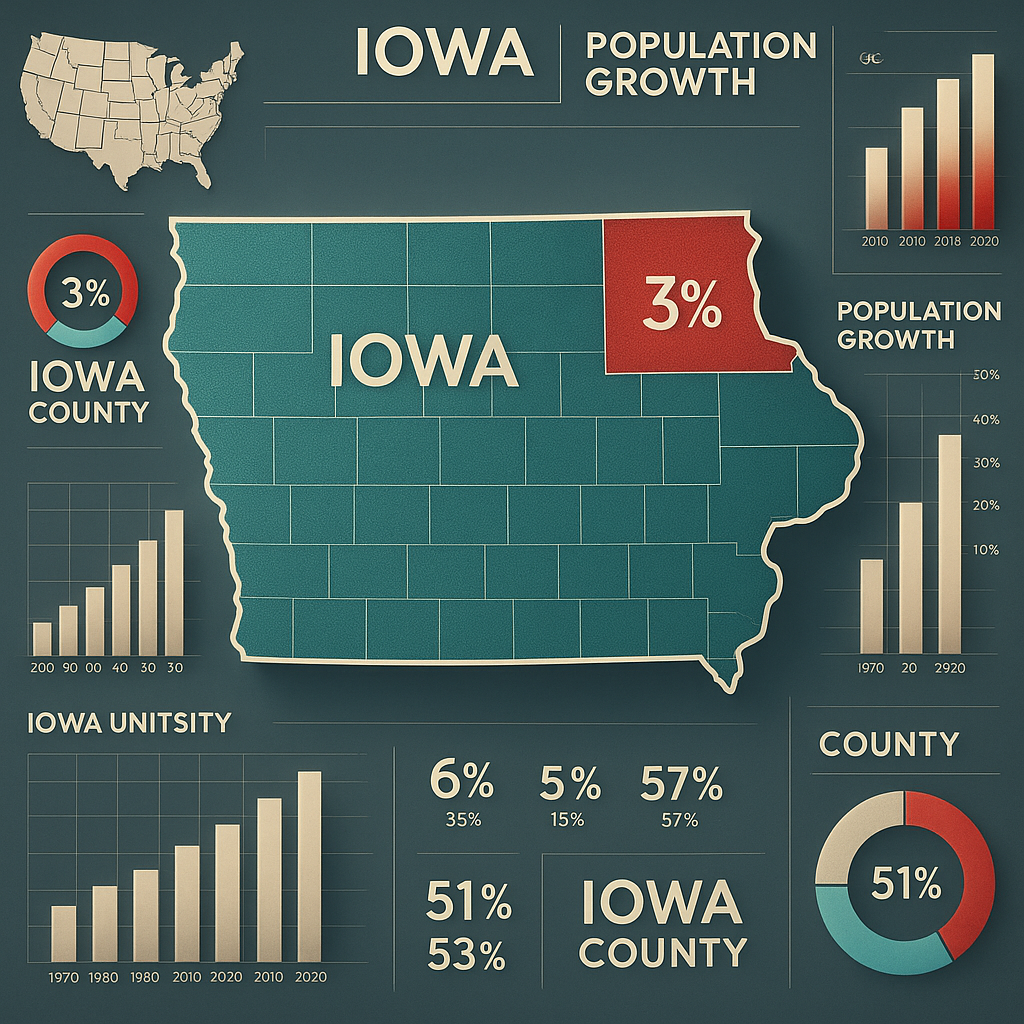

1. Economic and Population Growth

While Iowa’s overall population growth is modest, cities like Des Moines, Cedar Rapids, and Iowa City have emerged as strong economic hubs. Des Moines, in particular, is a growing center for finance, insurance, and healthcare, fueling demand for commercial spaces and making it an ideal location for stable NNN investments.

2. Stability and Demand for NNN Properties

NNN lease properties in Iowa offer dependable long-term income due to tenant responsibility for operating costs. In cities like Davenport and West Des Moines, there’s consistent demand from national tenants such as Walgreens, Dollar General, and Quick Service Restaurants (QSRs), providing strong cash flow for investors seeking low-risk, passive income.

3. Market Trends and Cap Rates

Cap rates in Iowa remain competitive, typically higher than coastal and urban markets, offering better yield potential. As inflation and interest rates stabilize, NNN investors are finding attractive cap rate spreads in Iowa, particularly in suburban and secondary markets. An increased supply of net lease opportunities in both retail and industrial sectors is giving investors more choices and better negotiating power.

4. Financing Considerations for NNN Investors

Like other markets, entering Iowa’s NNN space requires sound financial backing. A typical investor should have a net worth of at least $1 million or an annual income exceeding $200,000. Down payments are often 30–40% of property value. However, Iowa’s relatively affordable pricing allows new and middle-market investors easier entry into the net lease market compared to pricier states.

5. Local Market Opportunities

Iowa offers solid opportunities for net lease investments in sectors like healthcare, logistics, and retail. For example, a single-tenant medical property in the Cedar Rapids metro area—leased to a national healthcare provider on a long-term NNN basis—is currently drawing investor interest. Investors using a 1031 exchange can reinvest capital gains into Iowa’s growing markets while benefiting from tax deferral and portfolio diversification.

Triple-net (NNN) investors are increasingly turning to Iowa as a smart destination for net lease properties, driven by its resilient economy, stable returns, and favorable investment climate. Here’s why NNN brokers and investors view Iowa as a promising and strategic market:

1. Competitive Cap Rates for Higher Returns

Iowa offers competitive cap rates typically ranging between 5.75% to 7.5%, depending on asset type and tenant quality. These rates are attractive for investors looking to balance risk and return in a stable Midwestern market. With less price compression than major coastal states, Iowa provides better yield opportunities in the NNN space.

2. Affordable Entry Points for Investors

Compared to larger urban markets, Iowa’s commercial real estate remains affordably priced, allowing investors to acquire NNN properties—often with national or regional tenants—at lower cost per square foot. This affordability enhances ROI while lowering the barriers to entry for both seasoned and new net lease investors.

3. Steady Population and Economic Base

While Iowa’s population growth is steady rather than explosive, cities like Des Moines, Cedar Rapids, and Iowa City boast a diverse economy, robust employment, and strong housing markets. These economic drivers create consistent demand for retail, healthcare, and service-based net lease tenants, ideal for long-term NNN investment strategies.

4. High Demand for National Brands and QSRs

Iowa maintains strong tenant demand for NNN properties leased to brands like Dollar Tree, Casey’s, Walgreens, Arby’s, and Hardee’s. Essential retail and QSRs remain recession-resistant staples in many communities across the state, offering dependable income streams for net lease investors.

5. Business-Friendly and Tax-Stable Environment

Iowa offers a business-friendly regulatory environment, with competitive property taxes and incentive programs supporting commercial development. While Iowa does have a state income tax, the predictability of its tax laws and cost structure makes it easier for investors to plan long-term net lease investments or 1031 exchange strategies with confidence.

6. Growth in Industrial and Distribution Hubs

Iowa’s central location and investment in logistics and warehousing infrastructure have made it an emerging hub for light industrial and last-mile distribution. NNN properties in logistics, medical services, and flex spaces are gaining investor attention, especially in key corridors like I-80 and I-35, which intersect near Des Moines.

Income Taxes

Iowa’s Tax Environment for NNN Investors: Balancing Returns with Stability

While not a tax haven, Iowa offers a balanced and predictable tax environment that can still benefit NNN investors looking for consistency, manageable rates, and a transparent structure. Here’s what brokers and investors should know when considering net lease properties in Iowa:

1. Passive Income Is Taxable, but With Structured Deductions

In Iowa, passive rental income from LLCs is subject to state income tax, but investors can benefit from deductions such as mortgage interest, depreciation, maintenance costs, and property management expenses. This allows NNN investors to offset a significant portion of their taxable income and reduce overall liability with proper tax planning.

2. Moderate Corporate Income Tax Structure

Iowa recently restructured its corporate income tax system. As of 2024, the corporate income tax rate is a flat 7.1% on taxable income. While not the lowest in the U.S., the simplified structure improves predictability and helps real estate investors plan more confidently for their long-term net lease strategy.

3. Graduated Personal Income Tax

Iowa is in the process of shifting to a flat personal income tax system. As of now, the state has graduated rates up to 6.0%, but by 2026, it aims to implement a flat 3.9% personal income tax. This transition will benefit individual NNN investors by creating a more favorable and competitive tax environment for passive income and capital gains.

4. No State-Level Estate or Inheritance Tax

Iowa no longer imposes an inheritance tax as of January 1, 2025. This is good news for NNN investors focused on legacy and wealth transfer. Properties can now be passed to heirs without the burden of additional state-level estate taxes, aligning with multigenerational investment strategies.

5. Competitive Property Tax Rates

Iowa’s average effective property tax rate is approximately 1.5%, which is slightly above the national average. However, many counties offer valuation caps and credits for commercial properties that can ease tax burdens. Net lease investors can optimize returns by targeting markets with favorable local tax structures.

6. Capital Gains Taxed as Regular Income

In Iowa, capital gains are taxed as part of regular income, subject to the standard personal or corporate tax rate. While there’s no separate capital gains tax, the shift toward lower flat income taxes by 2026 will benefit NNN investors who plan to sell or reposition assets. Investors using a 1031 exchange can also defer capital gains taxes altogether under federal rules.

Investing in triple-net lease (NNN) properties in Iowa can be a strategic choice, especially in areas experiencing population growth and economic vitality. Here are some top cities and counties in Iowa that NNN investors should consider:

1. Polk County (Des Moines metro):

Population Growth: Iowa’s capital region grew by about 23,000 residents (+0.7%) from mid‑2023 to mid‑2024

Economic Development: Polk County received over $17 million in IEDA development funding in FY 2024, fueling growth and infrastructure.

Investment Potential: As the state’s major logistics, financial services, and government hub, it supports strong demand for essential retail, QSRs, and industrial net lease properties.

2. Linn County (Cedar Rapids)

Population Growth: Among the top four Iowa counties awarded IEDA funds (~$17.9 million in FY 2024).

Economic Development: Cedar Rapids boasts a diverse industrial base—manufacturing, biosciences, and tech—with ongoing revitalization of its urban core.

Investment Potential: Affordable commercial real estate and rising demand in light industrial, office, and retail NNN assets.

3. Johnson County (Iowa City area):

Population Growth: Received ~$5.3 million in 2024, reflecting strong regional investment.

Economic Development: Received ~$5.3 million in 2024, reflecting strong regional investment.

Investment Potential: NNN opportunities in medical, retail, and service-sector properties supporting the university community.

4. Jasper County (Newton/Des Moines corridor):

Population Growth: Median home price ~$129,100; low unemployment (~2.6%) and lower cost of living .

Economic Development: I‑80 corridor access and strong transport links to Des Moines.

Investment Potential: Single-tenant industrial, flex, and retail NNN properties serving workforce populations.

5. Dallas County (West Des Moines submarket):

Population Growth: Fastest-growing median household incomes in Central Iowa; modern housing stock .

Economic Development: Benefiting from suburban expansion and Des Moines metro spillover.

Investment Potential: Demand for retail centers, professional offices, and suburban QSRs on NNN leases.

6. Marshall County (Marshalltown micropolitan):

Population Growth: One of the few micropolitan areas to experience domestic net inflow in 2023 .

Economic Development: Attracting renewed investment from both domestic and international migration.

Investment Potential: Neighborhood retail, banking, medical, and service-sector NNN assets in smaller urban/rural markets.

Pros:

1️⃣ Competitive Cap Rates

Iowa offers attractive cap rates ranging from 6% to 7.5%, making it a favorable market for NNN investors seeking better returns than in coastal or oversaturated markets.

2️⃣ Predictable and Improving Tax Structure

Iowa is transitioning to a flat 3.9% personal income tax by 2026, creating a more investor-friendly climate.

3️⃣ Affordable Commercial Property Prices

Compared to states with inflated property markets, Iowa offers lower acquisition costs and strong income-to-price ratios.

4️⃣ Diverse and Stable Economy

Iowa’s economy is bolstered by manufacturing, logistics, education, agriculture, and healthcare.

5️⃣ Low Vacancy Rates in Key Sectors

Retail and industrial sectors in Iowa maintain healthy occupancy levels, especially in cities like Des Moines, Iowa City, and Ankeny.

6️⃣1031 Exchange-Friendly Environment

Iowa supports federal 1031 exchange rules, allowing investors to defer capital gains and reinvest in-state or nationwide.

7️⃣ Strong Demand for Essential Retail

Tenants such as Dollar Tree, Casey’s, Fareway, McDonald’s, and CVS are expanding across Iowa towns.

Cons:

1️⃣Slower Population Growth

Compared to sunbelt states, Iowa experiences moderate to flat population growth in many counties.

2️⃣ Harsh Winter Weather

Severe winters can impact foot traffic, logistics, and maintenance costs, especially in retail and QSR sectors.

3️⃣ Limited Urban Density

Iowa lacks large urban cores, with few cities exceeding 200,000 population.

4️⃣ Market Liquidity Challenges

NNN properties in smaller Iowa towns may take longer to lease or sell, affecting investor exit strategies.

5️⃣ Agricultural & Manufacturing Exposure

Many regions are dependent on agriculture or light manufacturing, which can be vulnerable to economic cycles and global demand shifts.

Lowa NNN Properties for 1031 Exchange

Invest in Free Standing Single Tenant Triple Net (NNN) Properties in Lowa

Are you looking for a reliable 1031 exchange replacement property?

At Triple Net Investment Group, we specialize in the sale of single tenant NNN properties and triple net shopping centers across the United States. Our team is dedicated to helping investors find high-quality (Tenant Triple Net) NNN properties in Lowa and nationwide that align with their financial goals and 1031 exchange requirements.

With our in-depth market knowledge and personalized service, we provide tailored investment strategies for both buyers and sellers of commercial real estate. Whether you’re looking to defer capital gains through a 1031 tax-deferred exchange or want to diversify your portfolio with income-generating assets, our team offers a wide selection of vetted NNN investment properties.

Corporate Tenant Credit Ratings

Find out more about the credit rating of the tenant before purchasing.

How safe are the triple net investment grade free standing single tenant properties?

Market Analysis

What three things should I know before investing?

Call or e-mail us and we will get back to you within 24 hours. We know of properties for sale that aren’t listed or advertised.

Email: [email protected] Tel: 202-361-3050

We strive hard to provide clients with quality costumer service

We provide our clients with all of the information they need upfront to make an informed decision, even before a Letter of Intent is issued such as: tenant credit information, store sales, lease terms, options, renewal rates, rent escalations, location analysis, site analysis, market analysis, demographic data, cash on cash returns on investment, internal rate of returns after taxes, risks, likes, dislikes and so on. We will then strategies how to proceed on making a best offer. It is our goal to build a solid relationship with our clients and keep them updated on net lease investments, even though they may not have a need for years to come.(NNN Properties in Lowa)

We markets our listings locally, nationally and internationally

Triple Net Investment Group difference is a concept that is revolutionary in the commercial real estate brokerage business. In addition to marketing our deals to potential investors, We markets our listings to the entire brokerage community. We put our listings directly in front of thousands of commercial real estate agents in each state, region and local where the property is located.