Why NNN Investors Prefer Kentucky State: Higher Growth & Competitive Cap Rates Explained

Future Holding for NNN Property Investments in Kentucky

Triple Net Lease (NNN) properties, where tenants are responsible for property taxes, insurance, and maintenance, continue to be an attractive investment for those seeking passive income with low operational involvement. In Kentucky, the future of NNN property investments is supported by a combination of economic trends, favorable lease structures, and growing investor interest.

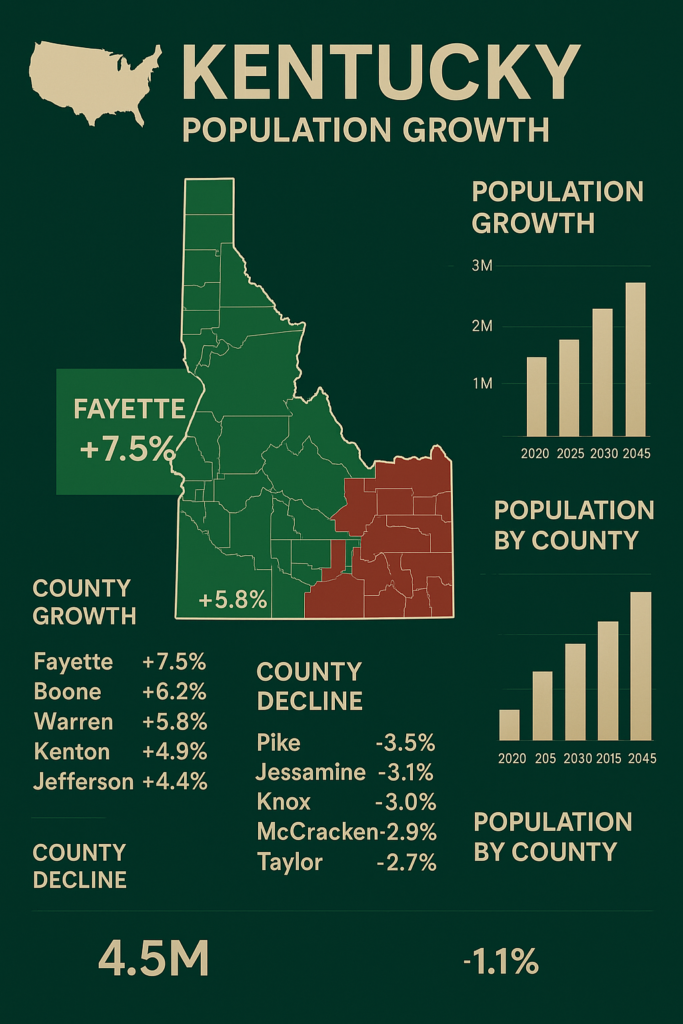

1. Economic and Population Growth

Kentucky has experienced steady population and economic growth, especially in metropolitan areas like Louisville, Lexington, and Northern Kentucky. With the expansion of logistics hubs, manufacturing centers, and healthcare facilities, demand for commercial real estate is increasing. This makes Kentucky an appealing market for NNN investors looking for dependable returns and long-term appreciation.

2. Stability and Demand for NNN Properties

NNN leases offer predictable, long-term cash flow because tenants are contractually obligated to cover key property expenses. In Kentucky’s stable commercial real estate environment, this model is particularly effective. Investors and brokers alike are capitalizing on the sustained interest from national brands and essential service providers seeking long-term leases in strategic locations.

3. Market Trends and Cap Rates

Cap rates for NNN properties in Kentucky are competitive and often higher than those in more saturated real estate markets. As interest rates fluctuate, many investors are drawn to the relative yield stability that NNN assets provide. The increase in available listings across retail, industrial, and medical sectors also offers investors a broader selection of profitable deals.

4. Financing Considerations for NNN Investors

Entering Kentucky’s NNN market typically requires a strong financial position—investors often need a net worth exceeding $1 million or an annual income above $200,000. Down payments usually fall between 30% and 40% of the purchase price. Prospective investors should be prepared to meet these financial thresholds to take full advantage of the state’s growing net lease opportunities.

5. Local Market Opportunities

Kentucky offers a variety of NNN investment opportunities, including single-tenant retail properties, distribution centers, and healthcare facilities. For instance, industrial corridors near Louisville are attracting national tenants with long-term NNN leases, complete with annual rent escalations. These properties are especially attractive for 1031 exchange investors seeking to defer capital gains while growing their portfolios in a business-friendly environment.

Triple-net (NNN) investors are increasingly turning to Kentucky as a prime location for net lease properties, thanks to its favorable cap rates, diversified economy, and expanding infrastructure. Here’s why NNN brokers and investors see Kentucky as a lucrative and stable market:

1. Competitive Cap Rates and Attractive Returns

NNN investors are drawn to Kentucky for its strong cap rates, often ranging between 5.5% to 7%, offering better yields than many coastal states. These competitive rates allow investors to achieve strong cash flow from long-term, creditworthy tenants in essential service industries.

2. Reasonably Priced Commercial Real Estate

Kentucky offers more affordable entry points compared to high-cost metro markets. NNN investors can acquire well-located net lease properties at favorable pricing, improving ROI and lowering the barriers to entry for both seasoned and first-time investors.

3. Steady Population Growth & Economic Expansion

Cities such as Louisville, Lexington, and Bowling Green have seen consistent population growth, fueled by expanding job markets, educational institutions, and a lower cost of living. Kentucky’s economy is growing across sectors, including healthcare, logistics, and advanced manufacturing—creating increased demand for retail, industrial, and medical net lease spaces.

4. Demand for Essential Retail & QSR Tenants

Kentucky’s retail and service sectors are anchored by high-performing national brands like Dollar General, Walgreens, Starbucks, and Chick-fil-A. NNN brokers and investors find strong demand for essential retail and QSRs across both urban and suburban markets, ensuring dependable occupancy and long-term lease stability.

5. Favorable Tax Environment for Real Estate Investors

Kentucky offers a relatively investor-friendly tax climate, including lower property taxes than the national average and various incentives for real estate development. Investors using 1031 exchanges can defer capital gains while acquiring income-generating NNN properties throughout the state.

6. Logistics, Healthcare, and Industrial Growth

Kentucky is home to major logistics and distribution hubs, including UPS Worldport in Louisville—one of the largest package-handling facilities in the world. The state also benefits from robust manufacturing and healthcare sectors, all of which drive demand for NNN properties in industrial, retail, and medical categories.

Income Taxes

Kentucky’s Tax Advantages for NNN Investors: A Strategic Market for Net Lease Properties

Kentucky provides a balanced and investor-friendly tax environment that makes it an appealing location for triple-net (NNN) property investments. With competitive income tax rates, business incentives, and no estate tax, NNN investors can benefit from greater profitability and long-term financial planning advantages. Here’s why NNN brokers and investors view Kentucky as a strong market from a tax perspective:

1. Favorable Taxation of Rental Income Through LLCs

In Kentucky, rental income earned through an LLC is taxed as pass-through income, meaning it flows through to the individual member(s) and is taxed at the personal income rate. While not entirely exempt, this structure avoids double taxation and allows NNN investors to take advantage of individual deductions and credits, ultimately improving after-tax cash flow.

2. Competitive Corporate Income Tax Rate

Kentucky has adopted a flat corporate income tax rate of 5%, which is lower than the national average. Investors operating under a corporate structure can benefit from this streamlined, predictable rate, which helps maximize retained earnings and reinvestment potential for net lease property portfolios.

3. Flat Personal Income Tax Rate

Kentucky levies a flat personal income tax rate of 4.5%, regardless of income level. This straightforward tax structure benefits NNN investors by eliminating higher tax brackets and allowing consistent planning across income tiers. Investors can keep more of their rental profits and long-term gains under this simplified system.

4. No State-Level Estate or Inheritance Tax

Kentucky does not impose a state estate or inheritance tax, making it easier for investors to transfer net lease properties to heirs or successors without facing significant tax liabilities. This is a key benefit for long-term estate planning and wealth preservation through real estate.

5. Moderate Property Tax Rates

Kentucky features moderate property tax rates, with an average effective rate of approximately 0.83%. This rate is below the national average and helps reduce the overall cost of holding commercial properties. Lower annual tax obligations mean improved net returns for NNN investors maintaining properties across multiple years.

6. Capital Gains Tax Treated as Regular Income

Kentucky does not impose a separate capital gains tax. Instead, capital gains are taxed as ordinary income at the flat 4.5% personal income tax rate. This provides predictability for investors planning a sale or executing a 1031 exchange and ensures capital appreciation is not penalized with an extra state-level tax.

Investing in triple net lease (NNN) properties in Kentucky can be a smart strategy for investors seeking stable, long-term income with minimal management responsibilities. In NNN leases, tenants cover property taxes, insurance, and maintenance costs—making it a more passive investment model for property owners. Kentucky’s steady economic growth, low cost of living, and business-friendly climate create attractive opportunities for NNN investments. Based on current market trends and regional development, here are some of the top cities and counties in Kentucky to consider for NNN property investments:

1. Warren County (Bowling Green):

Population Growth: Added ~7,200 people from 2020–2023—a 5.3% increase, the largest numeric gain in the state

Economic Development: Anchored by the automotive and manufacturing sectors (notably the Nissan assembly plant), and growth in education (Western Kentucky University).

Investment Potential: Strong population and job growth support NNN investments in retail, industrial, and QSR properties—ideal for long-term lease opportunities.

2. Boone County (Northern Kentucky – Cincinnati MSA):

Population Growth: Added ~4,028 residents since 2020

Economic Development: Part of the Cincinnati metro; significant corporate activity in logistics and site-readiness projects (e.g., NKY Port investment funds)

Investment Potential: Prime for NNN properties serving industrial, logistics, and essential services, backed by cross-state growth and strong corporate expansion.

3. Madison County (Richmond–Lexington MSA):

Population Growth: Increased by ~3,742 from 2020–2023

Economic Development: Influenced by proximity to Lexington, rising educational and healthcare sectors, and infrastructure growth.

Investment Potential: NNN prospects in retail, office, and medical spaces catering to the expanding residential and institutional base.

4. Scott County (Lexington Suburbs):

Population Growth: Added ~2,637 residents since 2020

Economic Development: Rapid suburban development from Lexington, improved infrastructure, and rising commuter economy.

Investment Potential: NNN opportunities in neighborhood retail centers—anchored by grocery, pharmacy, and service tenants.

5. Bullitt County (South Louisville Suburbs):

Population Growth: Grew by ~2,497 residents since 2020 .

Economic Development: Benefits from proximity to Louisville, growth in logistics, light manufacturing, and family-oriented housing.

Investment Potential: Strong demand for NNN net lease retail, medical, and QSR properties serving suburban neighborhoods.

6. Robertson / Allen / Lyon Counties (Rural Growth Hotspots):

Population Growth: Among fastest-growing counties by percentage (≈5.9% growth), though smaller populations

Economic Development: Kentucky saw sustained rural growth—with 134,000 new rural residents between 2023–2024

Investment Potential: Emerging opportunity for NNN in local essential retail and community services (gas stations, Dollar General–type concepts) in underserved rural areas.

Pros:

1️⃣ Higher Cap Rates

Kentucky offers relatively high cap rates (typically between 5.5%–7.5%), making it attractive compared to coastal or high-cost states where returns are often below 5%. This allows NNN investors to achieve stronger cash flow from stable, long-term tenants.

2️⃣ No State Tax on Passive LLC Income

Kentucky generally does not tax passive income derived from rental real estate held in a properly structured LLC. This allows investors to retain more of their rental income, especially when using a pass-through entity.

3️⃣ Low Property Taxes

With an average effective property tax rate of around 0.83%, Kentucky ranks below the national average. Lower property taxes reduce holding costs, boosting long-term returns for NNN investors.

4️⃣ Affordable Property Prices

Commercial real estate in Kentucky remains competitively priced, especially in secondary and tertiary markets. This makes it easier for investors to enter the market with a lower initial capital outlay.

5️⃣ Economic & Population Growth in Key Markets

Cities like Bowling Green, Lexington, and Northern Kentucky (Boone County/Covington) are experiencing growth due to expansion in manufacturing, logistics, healthcare, and education sectors. This supports demand for essential retail and service-based tenants.

6️⃣ Strategic Location for Logistics & Manufacturing

Kentucky’s central location, access to major highways (I-65, I-75, I-64), and presence of UPS Worldport in Louisville make it a logistics and distribution hub. This strengthens demand for industrial and warehouse NNN assets.

7️⃣ Diverse and Essential Tenant Base

Kentucky supports a variety of national tenants including QSRs, pharmacies, auto parts stores, and convenience retailers. Businesses like Dollar General, CVS, Taco Bell, and O’Reilly Auto Parts are expanding across the state, creating strong tenant demand.

Cons:

1️⃣ Slower Urban Appreciation

While cap rates are favorable, property appreciation in Kentucky tends to be moderate compared to high-growth states like Florida or Texas. Investors seeking rapid equity gains may find appreciation slower in Kentucky.

2️⃣ Tenant Demand Can Be Market-Specific

Smaller towns and rural counties may face limited tenant demand and slower leasing velocity. Investors must assess local demographics and competition carefully before investing outside major metros.

3️⃣ Weather Risks (Tornadoes & Flooding)

Certain regions in Kentucky are susceptible to tornadoes and localized flooding, which may lead to higher insurance costs and pose occasional risks to property and tenant stability.

4️⃣ Limited High-End Retail & Urban Development

Kentucky’s commercial real estate is largely focused on essential services and suburban growth. Investors seeking exposure to luxury retail or dense urban redevelopment may have fewer opportunities here.

5️⃣ Economic Dependence on Manufacturing & Logistics

While these sectors support job growth, heavy reliance on manufacturing and distribution means that economic shifts or automation trends could impact regional employment and tenant demand over time.

Kentucky NNN Properties for 1031 Exchange

Invest in Free Standing Single Tenant Triple Net (NNN) Properties in Kentucky

Are you looking for a reliable 1031 exchange replacement property?

At Triple Net Investment Group, we specialize in the sale of single tenant NNN properties and triple net shopping centers across the United States. Our team is dedicated to helping investors find high-quality (Tenant Triple Net) NNN properties in Kentucky and nationwide that align with their financial goals and 1031 exchange requirements.

With our in-depth market knowledge and personalized service, we provide tailored investment strategies for both buyers and sellers of commercial real estate. Whether you’re looking to defer capital gains through a 1031 tax-deferred exchange or want to diversify your portfolio with income-generating assets, our team offers a wide selection of vetted NNN investment properties.

Corporate Tenant Credit Ratings

Find out more about the credit rating of the tenant before purchasing.

How safe are the triple net investment grade free standing single tenant properties?

Market Analysis

What three things should I know before investing?

Call or e-mail us and we will get back to you within 24 hours. We know of properties for sale that aren’t listed or advertised.

Email: [email protected] Tel: 202-361-3050

We strive hard to provide clients with quality costumer service

We provide our clients with all of the information they need upfront to make an informed decision, even before a Letter of Intent is issued such as: tenant credit information, store sales, lease terms, options, renewal rates, rent escalations, location analysis, site analysis, market analysis, demographic data, cash on cash returns on investment, internal rate of returns after taxes, risks, likes, dislikes and so on. We will then strategies how to proceed on making a best offer. It is our goal to build a solid relationship with our clients and keep them updated on net lease investments, even though they may not have a need for years to come. (NNN Properties in Kentucky)

We markets our listings locally, nationally and internationally

Triple Net Investment Group difference is a concept that is revolutionary in the commercial real estate brokerage business. In addition to marketing our deals to potential investors, We markets our listings to the entire brokerage community. We put our listings directly in front of thousands of commercial real estate agents in each state, region and local where the property is located.