Why NNN Investors Prefer Louisiana State: Higher Growth & Competitive Cap Rates Explained

Future Holding for NNN Property Investments in Louisiana

Triple Net Lease (NNN) properties continue to gain traction in Louisiana, offering investors a low-maintenance, income-generating asset class with long-term potential. The state’s economic development, regional growth, and investor-friendly policies make Louisiana an attractive location for NNN property investments. Here are the key factors shaping the outlook:

1. Economic Growth and Infrastructure Development

Louisiana is experiencing steady economic progress fueled by investments in infrastructure, logistics, and energy sectors. Key cities like Baton Rouge, Lafayette, and Shreveport are seeing revitalization efforts and commercial expansion, which in turn supports the growth of retail, industrial, and medical NNN properties.

2. Reliable Income Stream and Inflation Hedge

NNN leases offer investors predictable cash flow since tenants cover taxes, insurance, and maintenance. Many lease agreements include annual rent escalations, providing a natural hedge against inflation. This reliability is especially attractive to passive investors and those planning for long-term income stability.

3. Attractive Cap Rates and Investor Demand

Cap rates in Louisiana for NNN assets tend to be higher compared to national averages, providing an appealing risk-adjusted return. As interest in net lease properties grows among institutional and private investors, Louisiana continues to stand out for its favorable pricing and value opportunities in second-tier and tertiary markets.

4. Financial Requirements and Entry Considerations

Investors entering the NNN market should be prepared for down payments typically ranging between 30% and 40%, with common qualification thresholds including a net worth of $1 million or annual income above $200,000. Louisiana’s diverse range of NNN opportunities allows both seasoned and new investors to find suitable entry points.

5. Emerging Investment Opportunities Across the State

Net lease investments in Louisiana are expanding across retail (e.g., dollar stores, pharmacies), industrial, and service-based sectors. Locations along major interstate corridors and near port cities like New Orleans and Lake Charles are especially promising. Additionally, NNN properties with long-term leases and built-in escalators are ideal for those executing a 1031 exchange or seeking tax-efficient investment strategies.

Triple-net (NNN) investors are increasingly turning to Louisiana as a strategic market for net lease properties. With competitive cap rates, a growing economy, and expanding infrastructure, Louisiana offers compelling opportunities for both institutional and private NNN investors. Here’s why the Pelican State is gaining traction:

1. Competitive Cap Rates with High Return Potential

Louisiana offers attractive cap rates, typically ranging from 6% to 7.5%, making it a strong contender against saturated coastal markets. These higher yields allow investors to enjoy better cash flow while maintaining the security of long-term lease agreements with national tenants.

2. Affordable Entry Points for Investors

Compared to more expensive real estate markets, Louisiana provides cost-effective property acquisition opportunities. This lower cost of entry enables NNN investors to purchase well-located assets leased to creditworthy tenants, improving overall ROI and scalability for growing portfolios.

3. Economic Growth & Urban Revitalization

Key cities like New Orleans, Baton Rouge, Lafayette, and Shreveport are seeing significant economic development. Investments in healthcare, petrochemicals, logistics, and tourism have created jobs and increased demand for commercial properties. This sustained growth makes the state ideal for long-term NNN investments.

4. Demand for Essential Retail and Service Tenants

Louisiana’s commercial real estate market is fueled by essential retail and service-based businesses, including pharmacies, dollar stores, and quick-service restaurants (QSRs) such as CVS, Family Dollar, Wendy’s, and Popeyes. These tenant types offer strong lease terms and reliable income, even in shifting economic cycles.

5. Tax Advantages and 1031 Exchange Potential

Louisiana provides tax incentives and favorable depreciation structures that can benefit net lease investors. Those utilizing a 1031 exchange can defer capital gains taxes while upgrading into higher-performing NNN assets—making the state an attractive destination for strategic reinvestment.

6. Industrial & Logistics Expansion

Major ports like the Port of New Orleans and Port of South Louisiana, along with access to interstates and railways, have positioned the state as a logistics and industrial hub. This has driven up demand for net-leased industrial and distribution properties, expanding the NNN asset class beyond just retail.

Income Taxes

Louisiana’s Tax Advantages for NNN Investors: A Profitable Environment for Net Lease Properties

Louisiana offers a range of income tax benefits that make it an appealing market for investors in triple-net (NNN) lease properties. With moderate tax rates, pro-investor policies, and incentives for both individuals and businesses, the state supports long-term investment growth and profitability. Here’s why NNN investors should consider Louisiana as a strategic location:

1. Favorable Treatment of Passive Rental Income

Rental income earned through an LLC or partnership structure is generally treated as pass-through income in Louisiana. While it is subject to personal income tax, Louisiana’s moderate tax rates and deductions can help minimize the overall tax burden for investors earning passive income from NNN leases.

2. Reasonable Corporate Income Tax Structure

Louisiana’s corporate income tax ranges from 3.5% to 7.5%, depending on taxable income levels. Recent reforms have lowered the top corporate tax rate and eliminated the federal income tax deduction, simplifying compliance and offering a more competitive environment for corporations investing in real estate.

3. Graduated Personal Income Tax Rates

Louisiana features three personal income tax brackets:

1.85% on income up to $12,500

3.5% on income between $12,501 and $50,000

4.25% on income over $50,000

These rates are below the national average, allowing NNN investors operating as individuals or through pass-through entities to keep more of their earnings.

4. No Estate or Inheritance Tax

Louisiana does not levy an estate or inheritance tax, making it easier for investors to pass NNN property holdings to heirs without state-level transfer costs. This creates a more efficient generational wealth transfer strategy for long-term real estate investors.

5. Competitive Property Tax Rates

With an average effective property tax rate of around 0.55%, Louisiana offers low holding costs for real estate owners. Lower annual property taxes improve net operating income (NOI) and make Louisiana an attractive destination for investors seeking cash-flow-positive NNN assets.

6. Capital Gains Taxed as Regular Income

Louisiana does not impose a separate capital gains tax. Capital gains from the sale of real estate are taxed as ordinary income under the personal or corporate income tax structure. This straightforward treatment benefits investors looking to exit or reinvest through mechanisms like a 1031 exchange.

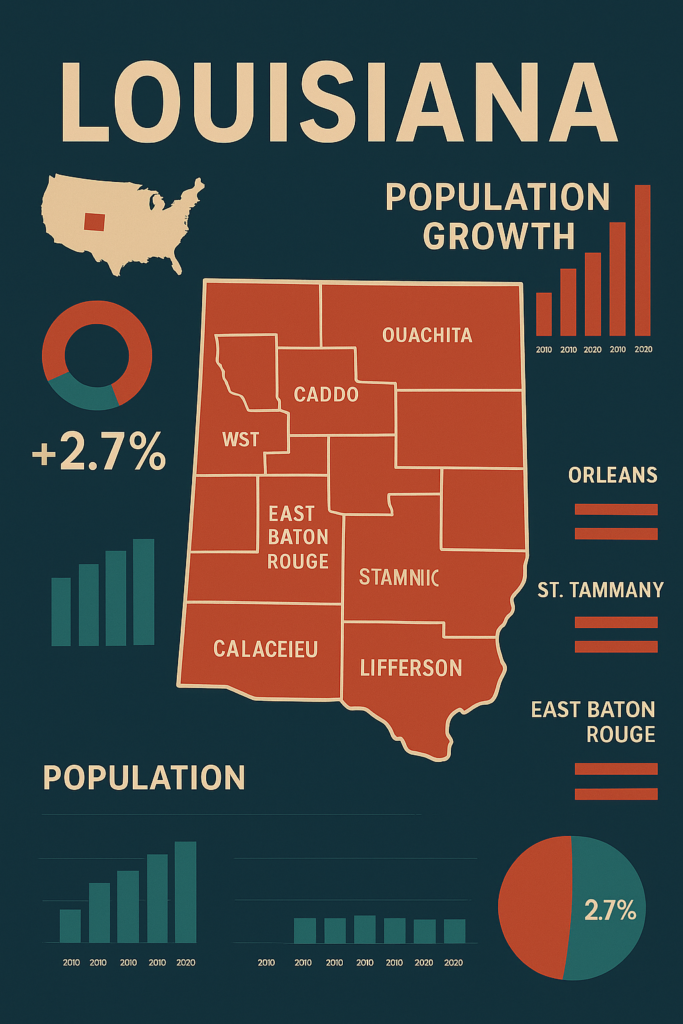

Investing in triple net lease (NNN) properties in Louisiana offers investors a reliable and passive income stream, with tenants typically responsible for property taxes, insurance, and maintenance. As population growth and economic development continue across the state, certain regions stand out for their strong potential in the net lease market. Below are some of Louisiana’s top parishes and cities to consider:

1. East Baton Rouge Parish (Baton Rouge):

Population Growth: Baton Rouge remains the second-largest city in Louisiana, with ongoing residential and commercial development driving modest but steady growth.

Economic Development: The city is a center for government, healthcare, petrochemical, and higher education. Anchored by Louisiana State University (LSU), it benefits from a stable and diverse economy.

Investment Potential: NNN opportunities include medical office spaces, QSRs (quick-service restaurants), and essential retail centers catering to the student and professional population.

2. Lafayette Parish (Lafayette):

Population Growth: Lafayette has been experiencing steady growth, bolstered by its regional status as a cultural and economic hub in southwestern Louisiana.

Economic Development: The economy is supported by energy services, healthcare, education, and retail. Major employers and infrastructure upgrades are contributing to rising demand for commercial properties.

Investment Potential: Ideal for NNN investments in retail plazas, pharmacies, and service-based tenants, particularly in suburban corridors.

3. St. Tammany Parish (Covington, Mandeville, Slidell):

Population Growth: One of the fastest-growing parishes in Louisiana, St. Tammany has seen a consistent influx of new residents seeking suburban living near New Orleans.

Economic Development: Growth is driven by healthcare, education, and a rising number of small businesses and professional services.

Investment Potential: Strong demand for NNN-leased properties in neighborhood shopping centers, medical offices, and QSRs.

4. Ascension Parish (Gonzales, Prairieville):

Population Growth: Ascension Parish continues to show notable growth, especially in family-oriented communities like Prairieville and Gonzales.

Economic Development: The parish benefits from its proximity to Baton Rouge and strong industrial and logistics sectors.

Investment Potential: NNN assets in grocery-anchored retail, daycare centers, and essential services are highly sought after in this area.

5. Bossier Parish (Bossier City):

Population Growth: Bossier City is part of the Shreveport-Bossier metro area and has seen stable growth fueled by a mix of military, tech, and retail jobs.

Economic Development: Home to Barksdale Air Force Base and various federal employers, the region offers economic stability.

Investment Potential: Reliable NNN property types include fast food, auto service centers, and healthcare facilities.

6. Calcasieu Parish (Lake Charles):

Population Growth: While recovery continues after recent hurricanes, Lake Charles and surrounding areas are rebuilding with strategic investments.

Economic Development: Major investments in liquefied natural gas (LNG), petrochemicals, and port facilities are revitalizing the local economy.

Investment Potential: NNN investors may find opportunities in industrial support services, gas stations, and national retail tenants.

Pros:

1️⃣ Attractive Cap Rates

Louisiana offers competitive cap rates, often ranging from 6% to 7.5%, depending on location and tenant strength. These higher yields present strong cash flow opportunities compared to more saturated or expensive markets.

2️⃣ Moderate Property Taxes

With an average effective property tax rate of approximately 0.55%, Louisiana ranks among the lower property tax states, reducing holding costs and enhancing long-term investment returns.

3️⃣ Affordable Market Entry

Commercial real estate in Louisiana is generally more affordable than in larger metro markets. This allows NNN investors to acquire well-located properties with national tenants at a more reasonable cost, improving ROI potential.

4️⃣ Growing Suburban Markets

Areas such as St. Tammany, Ascension, and Lafayette Parishes are experiencing population growth and suburban expansion. These areas offer excellent potential for essential retail, QSRs, and medical office NNN tenants.

5️⃣ Strategic Location & Infrastructure

Louisiana’s access to major ports (New Orleans, South Louisiana), highways, and rail networks makes it a logistics and distribution hub. This supports demand for industrial and service-oriented NNN properties.

6️⃣ Business Incentives & Tax Programs

The state provides several economic development incentives, such as tax credits for businesses, which can enhance tenant stability and make Louisiana attractive for long-term lease agreements.

7️⃣ Resilient Demand for Essential Services

There’s consistent demand for essential service tenants—pharmacies, gas stations, grocery stores, and QSRs—especially in growing suburban and secondary markets, ensuring reliable occupancy.

Cons:

1️⃣ Hurricane Risk

Louisiana, particularly southern regions near the Gulf, is vulnerable to hurricanes and flooding, which can increase insurance costs and tenant risk. Investors should factor in storm preparedness and premiums.

2️⃣ Slower Urban Expansion

Outside of Baton Rouge and New Orleans, urban development can be slower-paced. Investors seeking high-density retail or luxury tenants may find fewer opportunities in Louisiana’s mid-sized cities.

3️⃣ Economic Reliance on Specific Sectors

The state’s economy is heavily tied to oil, gas, and petrochemicals. While this provides strength in some areas, downturns in these industries can affect employment and local commercial demand.

4️⃣ Mixed Demographics Across Regions

While some parishes are growing quickly, rural areas may experience stagnation or population decline, impacting tenant demand and long-term viability for certain NNN asset types.

5️⃣ Limited Presence of Premium National Retail Brands

While essential and value-focused brands (like Dollar General, Family Dollar, and Circle K) are widespread, high-end or boutique tenants are less prevalent, limiting asset diversity in some regions.

Louisiana NNN Properties for 1031 Exchange

Invest in Free Standing Single Tenant Triple Net (NNN) Properties in Louisiana

Are you looking for a reliable 1031 exchange replacement property?

At Triple Net Investment Group, we specialize in the sale of single tenant NNN properties and triple net shopping centers across the United States. Our team is dedicated to helping investors find high-quality (Tenant Triple Net) NNN properties in Louisiana and nationwide that align with their financial goals and 1031 exchange requirements.

With our in-depth market knowledge and personalized service, we provide tailored investment strategies for both buyers and sellers of commercial real estate. Whether you’re looking to defer capital gains through a 1031 tax-deferred exchange or want to diversify your portfolio with income-generating assets, our team offers a wide selection of vetted NNN investment properties.

Corporate Tenant Credit Ratings

Find out more about the credit rating of the tenant before purchasing.

How safe are the triple net investment grade free standing single tenant properties?

Market Analysis

What three things should I know before investing?

Call or e-mail us and we will get back to you within 24 hours. We know of properties for sale that aren’t listed or advertised.

Email: [email protected] Tel: 202-361-3050

We strive hard to provide clients with quality costumer service

We provide our clients with all of the information they need upfront to make an informed decision, even before a Letter of Intent is issued such as: tenant credit information, store sales, lease terms, options, renewal rates, rent escalations, location analysis, site analysis, market analysis, demographic data, cash on cash returns on investment, internal rate of returns after taxes, risks, likes, dislikes and so on. We will then strategies how to proceed on making a best offer. It is our goal to build a solid relationship with our clients and keep them updated on net lease investments, even though they may not have a need for years to come.(NNN Properties in Louisiana)

We markets our listings locally, nationally and internationally

Triple Net Investment Group difference is a concept that is revolutionary in the commercial real estate brokerage business. In addition to marketing our deals to potential investors, We markets our listings to the entire brokerage community. We put our listings directly in front of thousands of commercial real estate agents in each state, region and local where the property is located.