Why NNN Investors Prefer Maryland State: Higher Growth & Competitive Cap Rates Explained

Future holding for NNN property investments in Maryland

Triple Net Lease (NNN) properties, where tenants are responsible for property taxes, insurance, and maintenance, offer investors stable income with low management effort. In Maryland, the future for NNN property investments looks promising, supported by strong economic fundamentals, strategic location, and growing investor interest.

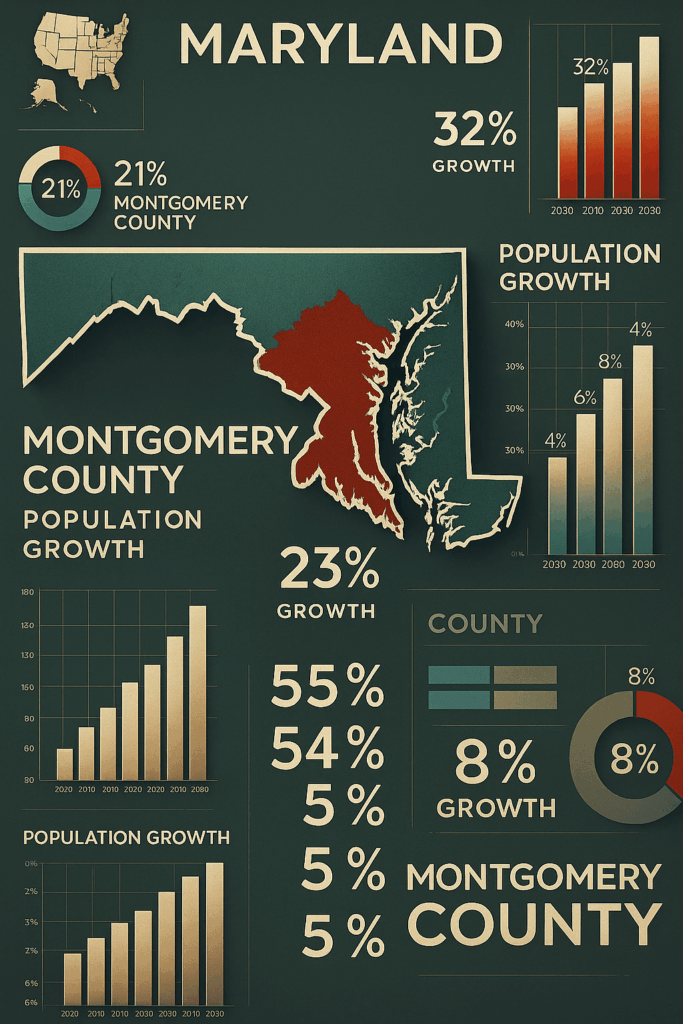

1. Economic and Population Growth

Maryland boasts a robust and diversified economy, driven by industries such as biotechnology, healthcare, defense, and cybersecurity. Major employment hubs like Baltimore, Columbia, and the Washington, D.C. suburbs continue to attract businesses and residents. This population and job growth drives demand for commercial real estate, making NNN lease investments an attractive choice for long-term stability.

2. Stability and Demand for NNN Properties

Maryland’s dense population centers and proximity to major East Coast markets enhance the reliability of NNN leases. Investors benefit from long-term leases with national or regional tenants in essential service sectors like healthcare, retail, and logistics. This lease structure continues to attract NNN investors seeking predictable cash flow and minimal operational involvement.

3. Market Trends and Cap Rates

Cap rates for NNN properties in Maryland have remained competitive, particularly in suburban and secondary markets outside Washington, D.C. and Baltimore. While primary locations often see lower cap rates due to higher demand, tertiary markets in Maryland are offering improved yields and increased availability of listings, creating opportunities for investors to achieve favorable returns.

4. Financing Considerations for NNN Investors

Investing in NNN properties typically requires strong financial qualifications, including a high net worth or substantial income. Investors should anticipate a down payment of 30% to 40% of the property value. Maryland’s competitive financing landscape and access to local lenders with NNN expertise help streamline the acquisition process and support portfolio growth.

5. Local Market Opportunities

Maryland offers diverse opportunities for NNN property investments, particularly in fast-growing counties such as Montgomery, Howard, and Anne Arundel. Retail centers anchored by national brands, medical office buildings, and single-tenant logistics hubs are in high demand. A growing number of Maryland-based NNN properties qualify for 1031 exchanges, allowing investors to defer capital gains taxes while repositioning or expanding their holdings.

Triple-net (NNN) investors are increasingly turning to Maryland as a prime location for net lease properties, thanks to its strategic location, economic diversity, and strong tenant demand. Here’s why NNN brokers and investors see Maryland as a lucrative market:

1. Competitive Cap Rates in Key Submarkets

Maryland offers competitive cap rates, especially in secondary and suburban markets such as Frederick, Hagerstown, and parts of Prince George’s County. Cap rates generally range from 5% to 6.5%, offering solid returns compared to coastal metro markets with compressed yields. These stable returns attract NNN investors looking for a balance between income and long-term growth.

2. Accessible Property Pricing with High Tenant Quality

While Maryland is part of the Mid-Atlantic corridor, it offers more favorable acquisition costs than neighboring states like Virginia or the District of Columbia. NNN investors can secure properties occupied by nationally recognized tenants—such as CVS, Starbucks, and AutoZone—at reasonable price points, enhancing cash flow potential.

3. Population Growth & Economic Resilience

Maryland boasts steady population growth in counties like Montgomery, Howard, and Anne Arundel, fueled by proximity to Washington, D.C., and a highly educated workforce. The state’s economy is bolstered by sectors like healthcare, biotech, government contracting, and cybersecurity, driving commercial demand and supporting long-term net lease investment viability.

4. Strong Demand for Essential Retail & QSRs

Essential service tenants—including pharmacies, dollar stores, and quick-service restaurants (QSRs)—are thriving across Maryland. National brands like Chick-fil-A, Walgreens, Dollar General, and Dunkin’ maintain strong footholds in both urban and rural areas, offering NNN investors reliable rental income with minimal operational risks.

5. Favorable Tax Incentives & 1031 Exchange Benefits

Maryland offers a range of tax credits and incentives for property investors, including enterprise zone tax credits, job creation tax credits, and more. NNN investors utilizing 1031 exchanges can benefit from reinvesting capital gains into Maryland’s expanding net lease market, making it a strategic destination for portfolio growth and tax deferral.

6. Infrastructure Expansion & Urban Development

Infrastructure improvements, such as upgrades to the Purple Line transit system and port expansions in Baltimore, are spurring commercial development across the state. Maryland’s ongoing investments in transportation, logistics, and mixed-use projects are boosting demand for retail, industrial, and service-based NNN properties.

Income Taxes

Maryland’s Tax Considerations for NNN Investors: What You Need to Know

Maryland presents a balanced tax environment for NNN (Triple-Net) investors, combining moderate income tax rates with strong economic fundamentals and property investment opportunities. While it may not offer the same tax advantages as no-income-tax states, Maryland remains a viable market for those seeking to invest in net lease properties with consistent returns. Here’s what investors and NNN brokers should understand about Maryland’s tax policies:

1. Taxation of Passive LLC Income

In Maryland, rental income earned through an LLC is generally treated as pass-through income and taxed at the individual investor’s personal income tax rate. While passive income is taxable, Maryland provides a clear framework and predictable treatment for real estate investment income, which is advantageous for long-term planning and portfolio growth.

2. Corporate Income Tax Rate

For investors operating through a corporate entity, Maryland levies a flat corporate income tax rate of 8.25%. While higher than some neighboring states, this rate is offset by a wide range of business tax credits and deductions available to companies investing in job creation, enterprise zones, and redevelopment initiatives.

3. Personal Income Tax Structure

Maryland’s personal income tax rates are progressive, ranging from 2% to 5.75% based on income levels. In addition, local counties impose piggyback income taxes, which range between 2.25% and 3.20% depending on the jurisdiction. NNN investors should factor in both state and local taxes when evaluating net income potential but can also benefit from Maryland’s itemized deductions and retirement income exemptions.

4. Estate and Inheritance Tax Policies

Maryland is one of the few states that imposes both an estate tax and an inheritance tax. The estate tax exemption is aligned with federal limits (currently $5 million, indexed annually), and inheritance tax typically applies to transfers outside the immediate family. Investors planning to pass down NNN assets should engage in estate planning to minimize long-term tax exposure and preserve intergenerational wealth.

5. Property Tax Overview

Maryland’s effective property tax rate averages around 1.06%, which is near the national average. Rates vary by county and municipality, with higher rates in urban centers like Baltimore City and lower rates in suburban and rural counties. Investors should assess local tax rates when evaluating holding costs for net lease properties.

6. Capital Gains Tax Treatment

Maryland does not have a separate capital gains tax. Instead, capital gains are taxed as ordinary income at the applicable personal or corporate income tax rates. For NNN investors executing 1031 exchanges, Maryland recognizes federal like-kind exchange rules, allowing deferral of capital gains taxes when reinvesting in qualifying properties.

Investing in triple net lease (NNN) properties in Maryland can be a strategic move for investors seeking long-term value, especially in regions experiencing strong population growth and economic development. With tenants covering property taxes, insurance, and maintenance, NNN leases offer a stable, low-maintenance investment model. Based on recent data, here are some of the top cities and counties in Maryland to consider for NNN property investments:

1. Montgomery County (Bethesda–Rockville–Silver Spring):

Population Growth: From 2023 to 2024, Montgomery County added over 9,000 new residents, driven by domestic migration and international arrivals.

Economic Development: A hub for biotechnology, healthcare, and federal contractors, Montgomery County continues to attract highly skilled professionals.

Investment Potential: The economic diversity and demand for retail, medical office, and service-based tenants make it ideal for NNN investments in urban and suburban corridors.

2. Howard County (Columbia–Ellicott City):

Population Growth: Howard County recorded an estimated increase of 4,300 residents between 2023 and 2024.

Economic Development: Known for its top-rated schools and proximity to Baltimore and Washington, D.C., the county supports a well-educated workforce and thriving commercial scene.

Investment Potential: Mixed-use developments, essential retail, and healthcare tenants are in high demand, making NNN properties a smart investment choice.

3. Anne Arundel County (Annapolis–Glen Burnie):

Population Growth: The county grew by approximately 3,800 residents in the past year, driven by migration from urban centers.

Economic Development: As the home of the state capital and the U.S. Naval Academy, Anne Arundel benefits from stable government, military, and tourism-driven sectors.

Investment Potential: With high traffic in both residential and commercial districts, investors can find value in NNN retail spaces and national tenant leases.

4. Frederick County (Frederick):

Population Growth: Frederick County experienced an increase of 4,600 residents between 2023 and 2024.

Economic Development: A growing life sciences sector and proximity to I-270’s tech corridor have positioned the county for rapid expansion.

Investment Potential: Commercial developments catering to new residential growth create opportunities for NNN properties in healthcare, grocery, and service-based retail.

5. Charles County (Waldorf–La Plata):

Population Growth: The county added approximately 2,900 residents, driven by its appeal to families seeking affordable suburban living near Washington, D.C.

Economic Development: Strong commuter ties to the capital, expanding retail corridors, and industrial development are fueling the local economy.

Investment Potential: With continued residential expansion, NNN properties in essential retail and logistics are gaining investor attention.

6. Harford County (Bel Air–Aberdeen):

Population Growth: Harford County’s population grew by about 2,100 residents over the past year.

Economic Development: The presence of Aberdeen Proving Ground (a major U.S. Army facility) supports defense, logistics, and tech industries in the region.

Investment Potential: Steady demand for neighborhood retail centers and service-based commercial properties makes Harford a solid location for NNN lease investments.

Pros:

1️⃣ Strong Tenant Demand in High-Density Areas

Maryland’s proximity to Washington, D.C., and dense population centers like Montgomery, Prince George’s, and Baltimore counties create high demand for essential retail, QSRs, and service-oriented tenants.

2️⃣ Economic Diversity

Maryland’s economy is anchored by sectors like biotechnology, cybersecurity, healthcare, government, and education.

3️⃣ Stable Rental Market

Due to strong employment and consistent population growth, NNN properties in Maryland often experience lower vacancy rates in prime suburban and urban zones.

4️⃣ Favorable 1031 Exchange Opportunities

Maryland honors federal 1031 exchange rules, allowing investors to defer capital gains taxes when reinvesting in like-kind NNN assets.

5️⃣ High-Income Demographics

Counties like Howard, Montgomery, and Anne Arundel have above-average median household incomes, supporting high consumer spending.

6️⃣ Infrastructure & Transit Investments

Ongoing projects like the Purple Line light rail and improvements to ports and highways support regional connectivity.

7️⃣ Access to Professional Services & Lenders

Maryland’s mature commercial real estate ecosystem offers plenty of financing options, local lenders, and NNN-specialized brokers.

Cons:

1️⃣ Higher Property and Income Taxes

Maryland has above-average property tax rates (~1.06%) and combined state/local income tax rates that may impact net returns.

2️⃣ Limited Inventory in Some Areas

Hot markets like Bethesda, Silver Spring, or Columbia have high demand but limited available NNN properties.

3️⃣ Regulatory Complexity

Maryland has strict zoning regulations and permitting processes, especially in historic or environmentally protected areas.

4️⃣ Seasonal Tenant Risk in Tourist Areas

Tourist-centric markets like Ocean City experience seasonal fluctuations in tenant sales, which may affect rental performance.

5️⃣ Higher Entry Costs in Premium Locations

In core metro areas like Montgomery County or the Baltimore suburbs, property prices are elevated due to demand.

Maryland NNN Properties for 1031 Exchange

Invest in Free Standing Single Tenant Triple Net (NNN) Properties in Maryland

Are you looking for a reliable 1031 exchange replacement property?

At Triple Net Investment Group, we specialize in the sale of single tenant NNN properties and triple net shopping centers across the United States. Our team is dedicated to helping investors find high-quality (Tenant Triple Net) NNN properties in Maryland and nationwide that align with their financial goals and 1031 exchange requirements.

With our in-depth market knowledge and personalized service, we provide tailored investment strategies for both buyers and sellers of commercial real estate. Whether you’re looking to defer capital gains through a 1031 tax-deferred exchange or want to diversify your portfolio with income-generating assets, our team offers a wide selection of vetted NNN investment properties.

Corporate Tenant Credit Ratings

Find out more about the credit rating of the tenant before purchasing.

How safe are the triple net investment grade free standing single tenant properties?

Market Analysis

What three things should I know before investing?

Call or e-mail us and we will get back to you within 24 hours. We know of properties for sale that aren’t listed or advertised.

Email: [email protected] Tel: 202-361-3050

We strive hard to provide clients with quality costumer service

We provide our clients with all of the information they need upfront to make an informed decision, even before a Letter of Intent is issued such as: tenant credit information, store sales, lease terms, options, renewal rates, rent escalations, location analysis, site analysis, market analysis, demographic data, cash on cash returns on investment, internal rate of returns after taxes, risks, likes, dislikes and so on. We will then strategies how to proceed on making a best offer. It is our goal to build a solid relationship with our clients and keep them updated on net lease investments, even though they may not have a need for years to come.(NNN Properties in Maryland)

We markets our listings locally, nationally and internationally

Triple Net Investment Group difference is a concept that is revolutionary in the commercial real estate brokerage business. In addition to marketing our deals to potential investors, We markets our listings to the entire brokerage community. We put our listings directly in front of thousands of commercial real estate agents in each state, region and local where the property is located.