Why NNN Investors Prefer Michigan State: Higher Growth & Competitive Cap Rates Explained

Future Holding for NNN Property Investments in Michigan

Triple Net Lease (NNN) properties, where tenants are responsible for property taxes, insurance, and maintenance, remain a top choice for investors seeking passive income and long-term security. In Michigan, the future for NNN property investments is bright, driven by a combination of economic strength, strategic location, and evolving market trends.

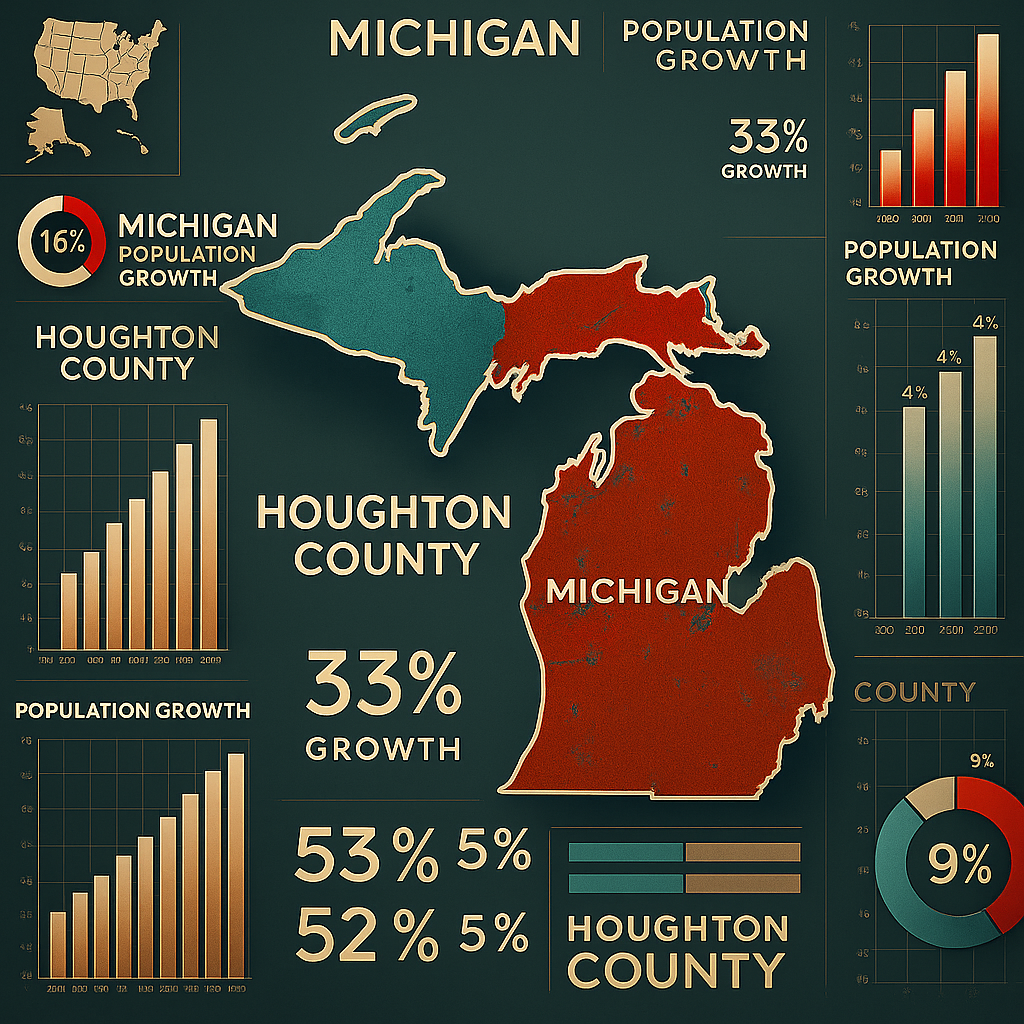

1. Economic and Population Growth

Michigan has shown steady economic diversification, moving beyond its historic reliance on the automotive industry. Cities like Grand Rapids and Ann Arbor have experienced consistent population growth, driven by strong healthcare, education, and tech sectors. This growth increases demand for retail, medical, and industrial real estate, key sectors for NNN investment opportunities.

2. Stability and Demand for NNN Properties

NNN lease structures offer investors dependable, long-term income, especially when tied to creditworthy tenants in sectors like healthcare, quick-service restaurants (QSR), and logistics. With minimal management obligations and strong tenant responsibility, these assets are well-positioned to remain resilient, even during economic downturns. Michigan’s stable tenant demand across urban and suburban markets ensures continued interest from NNN brokers and investors.

3. Market Trends and Cap Rates

Cap rates for NNN properties in Michigan have remained competitive, especially when compared to lower-yield states. Investors are increasingly targeting markets like Lansing, Kalamazoo, and Traverse City for higher returns. As interest rates fluctuate nationally, Michigan’s balance of risk and reward makes it an appealing environment for those looking to lock in higher cap rates and benefit from long-term lease agreements.

4. Financing Considerations for NNN Investors

Investors entering the NNN space in Michigan typically need a net worth exceeding $1 million or an annual income over $200,000. Lenders generally require a 30–40% down payment, depending on tenant quality and lease length. Understanding financing terms, including potential benefits of fixed-rate loans or interest-only periods, is essential for strategic portfolio expansion in Michigan’s competitive real estate market.

5. Local Market Opportunities

Michigan offers a wide array of net lease property options, from single-tenant retail stores along major interstates to industrial properties near transportation hubs like Detroit and Port Huron. For example, a single-tenant retail asset in suburban Detroit with a 10-year NNN lease and corporate-backed tenant is currently attracting investor attention. Many of these assets qualify for 1031 exchanges, allowing investors to defer capital gains while repositioning portfolios toward higher-growth markets.

Triple-net (NNN) investors are increasingly recognizing Michigan as a high-potential market for net lease property investments. With competitive cap rates, economic diversification, and a central location within the U.S., Michigan offers a compelling landscape for both seasoned NNN brokers and new investors. Here’s why Michigan is emerging as a stronghold for NNN investment:

1. Competitive Cap Rates and Stable Returns

NNN properties in Michigan offer cap rates typically ranging from 5.5% to 7%, providing a favorable balance of return and stability. Compared to densely populated coastal states, Michigan allows investors to achieve stronger yields with lower market volatility, especially in growing secondary cities such as Grand Rapids, Kalamazoo, and Lansing.

2. Accessible Property Prices with High Value Potential

Commercial property prices in Michigan remain accessible compared to top-tier markets. This affordability gives NNN investors the ability to acquire quality net lease assets, often with national tenants, at lower price points while generating solid cash-on-cash returns. As the state’s urban areas continue to revitalize, property values are positioned for long-term appreciation.

3. Economic Diversification & Workforce Growth

Michigan’s economy has evolved beyond the automotive industry, now boasting robust growth in healthcare, technology, logistics, and advanced manufacturing. Cities like Ann Arbor, Detroit, and Grand Rapids are seeing employment increases and infrastructure investment, which fuel commercial real estate demand, including single-tenant NNN assets.

4. High Demand for Essential Retail and National Brands

NNN investors targeting essential retail and QSR (quick-service restaurants) find strong opportunities across Michigan. Brands like Walgreens, Dollar General, Starbucks, Wendy’s, and 7-Eleven maintain a consistent presence in urban and rural markets alike, supported by dependable consumer demand. This makes Michigan ideal for stable, income-generating NNN leases.

5. Tax Advantages Through 1031 Exchanges

While Michigan does tax rental income, it remains a favorable state for 1031 exchange investors due to its wide availability of replacement properties and investor-friendly environment. Michigan’s strong inventory of single-tenant NNN assets provides investors with ample options to defer capital gains taxes while upgrading or diversifying their portfolios.

6. Infrastructure Expansion and Industrial Growth

Michigan benefits from major infrastructure assets, including ports, rail, and interstate connections to key Midwest markets. Detroit’s resurgence as a logistics and innovation hub, along with growth in regions like Port Huron and Flint, has increased demand for industrial and service-oriented NNN properties. This expanding infrastructure supports both tenant stability and future appreciation.

Income Taxes

Michigan’s Tax Landscape for NNN Investors: Strategic Considerations for Net Lease Property Ownership

Michigan offers a balanced tax environment that NNN investors should consider when evaluating net lease property opportunities. While it may not offer zero-tax incentives, Michigan’s streamlined and predictable tax structure can benefit both individual and corporate investors through moderate rates and clear tax rules. Here’s what NNN brokers and investors need to know:

1. Taxation of Passive LLC Income

In Michigan, rental income earned through an LLC is subject to state income tax. However, the state offers a flat individual income tax rate of 4.25%, which is lower than many high-tax jurisdictions. This consistent rate allows NNN investors to reliably forecast their tax liabilities and manage cash flow more effectively, especially when rental income is distributed through a pass-through entity like an LLC.

2. Corporate Income Tax Rate

For those investing in NNN properties through a corporate structure, Michigan imposes a 6.0% Corporate Income Tax (CIT). This flat rate applies uniformly to all corporate taxable income, providing a level of simplicity and predictability that aids in long-term investment planning and portfolio scaling.

3. Simplified Personal Income Tax

Michigan levies a flat personal income tax rate of 4.25% on all taxable income, regardless of income level. This simplicity benefits investors who own NNN properties individually or receive pass-through income from partnerships or LLCs. It streamlines personal tax planning and makes Michigan a predictable environment for ongoing property investments.

4. No State-Level Estate or Inheritance Tax

Michigan does not impose an estate or inheritance tax, which is a key advantage for investors focused on long-term wealth preservation. NNN property owners can transfer assets to heirs or business successors without the burden of additional state-level estate taxes, helping maintain the value of generational investments.

5. Moderate Property Tax Rates

Michigan’s average effective property tax rate is approximately 1.54%, which is near the national average. While higher than some low-tax states, property taxes vary by county and can be considerably lower in rural or secondary markets. NNN investors can offset these costs through long-term leases with tenants who typically bear full property tax responsibilities under triple-net structures.

6. Capital Gains Tax Structure

Michigan does not have a separate capital gains tax. Instead, capital gains are taxed as regular income at the state’s flat rate of 4.25%. For investors selling NNN properties or engaging in a 1031 exchange, this straightforward treatment of gains helps minimize tax surprises and aligns well with long-term investment strategies.

Investing in triple net lease (NNN) properties in Michigan can be a strategic move, particularly in areas experiencing significant population growth and economic development. NNN properties require tenants to handle property taxes, insurance, and maintenance, offering investors a more hands-off approach. Based on recent data, here are some of the top cities and counties in Michigan to consider for NNN property investments:

1. Ottawa County:

Population Growth: Increased by ~2,660 people from 2023 to 2024, fueled by ~1,993 net migration and ~654 natural increase, superior growth among Michigan’s largest counties

Economic Development: Booming suburban communities, service and industrial job growth, and easy access to Grand Rapids.

Investment Potential: Ideal for single-tenant retail (groceries, QSRs) and light industrial NNN assets that serve the expanding population and commuter base.

2. Kent County (Grand Rapids):

Population Growth: Estimated at ~661,354 in 2023, making it Michigan’s fourth-largest county.

Economic Development: A diverse economy with manufacturing, healthcare, education, and international travel via Gerald R. Ford International Airport.

Investment Potential: Strong for net lease properties—credit tenants in retail, medical offices, and studios around booming suburbs and transit routes.

3. Macomb County (Detroit’s northern suburbs):

Population Growth: Increased to ~886,175 in 2024

Economic Development: Combines suburban living with industrial growth, auto suppliers, and proximity to Detroit’s logistics and commerce.

Investment Potential: Attractive for NNN net lease industrial buildings, QSRs, and essential retail in dense suburban corridors.

4. Livingston County (Detroit–Ann Arbor corridor):

Population Growth: A fast-growing bedroom community (~193,866 residents), with rising service and industrial sectors.

Economic Development: Major employers include manufacturing and logistics; growth is supported by seamless commutes via I‑96, US 23.

Investment Potential: Suited for NNN-leased industrial flex spaces and convenience retail serving commuters and families.

5. Grand Traverse County (Traverse City region):

Population Growth: Grew to ~96,421 in 2023; the most populous county in Northern Michigan

Economic Development: Thriving tourism, hospitality, healthcare, and arts sectors centered on Traverse City and regional attractions.

Investment Potential: Excellent for essential retail, hospitality-related NNN assets, and medical offices serving both tourists and residents.

Pros:

1️⃣ Competitive Cap Rates

Michigan offers cap rates ranging from 5.5% to 7%, particularly in secondary and tertiary markets like Grand Rapids, Lansing, and Traverse City.

2️⃣ Predictable Flat Tax Structure

Michigan has a flat personal income tax rate of 4.25% and a 6.0% corporate tax.

3️⃣ Moderate Property Taxes

The average effective property tax rate in Michigan is around 1.54%, with some counties offering lower rates.

4️⃣ Affordable Market Entry

Commercial property prices in Michigan—especially in suburban and rural areas—remain more accessible than major metropolitan markets.

5️⃣ Diverse, Growing Economy

Michigan’s economy has diversified beyond auto manufacturing, now thriving in healthcare, education, aerospace, agribusiness, and logistics.

6️⃣ Strong Demand for Essential Retail & QSRs

Michigan has consistent demand for net lease tenants like Dollar General, Starbucks, CVS, Tractor Supply Co., and McDonald’s.

7️⃣ 1031 Exchange-Friendly Market

Michigan’s diversity of markets and inventory allows investors to complete 1031 exchanges efficiently, helping them defer capital gains taxes while reinvesting.

Cons:

1️⃣ Slower Population Growth

Michigan’s overall population growth is modest, with some counties experiencing outmigration.

2️⃣ Weather & Maintenance Risks

Michigan experiences cold winters, heavy snow, and freeze-thaw cycles, which can impact building integrity and insurance costs.

3️⃣ Market Fragmentation

Unlike large Sunbelt states with a few dominant growth hubs, Michigan’s NNN opportunities are scattered across mid-sized cities.

4️⃣ Moderate Appreciation Potential

While stable, Michigan real estate markets tend to appreciate more slowly than high-growth states.

5️⃣ Limited Urban Core Revitalization

Outside of Detroit and Grand Rapids, many urban centers in Michigan are still transitioning or underdeveloped.

Michigan NNN Properties for 1031 Exchange

Invest in Free Standing Single Tenant Triple Net (NNN) Properties in Michigan

Are you looking for a reliable 1031 exchange replacement property?

At Triple Net Investment Group, we specialize in the sale of single tenant NNN properties and triple net shopping centers across the United States. Our team is dedicated to helping investors find high-quality (Tenant Triple Net) NNN properties in Michigan and nationwide that align with their financial goals and 1031 exchange requirements.

With our in-depth market knowledge and personalized service, we provide tailored investment strategies for both buyers and sellers of commercial real estate. Whether you’re looking to defer capital gains through a 1031 tax-deferred exchange or want to diversify your portfolio with income-generating assets, our team offers a wide selection of vetted NNN investment properties.

Corporate Tenant Credit Ratings

Find out more about the credit rating of the tenant before purchasing.

How safe are the triple net investment grade free standing single tenant properties?

Market Analysis

What three things should I know before investing?

Call or e-mail us and we will get back to you within 24 hours. We know of properties for sale that aren’t listed or advertised.

Email: [email protected] Tel: 202-361-3050

We strive hard to provide clients with quality costumer service

We provide our clients with all of the information they need upfront to make an informed decision, even before a Letter of Intent is issued such as: tenant credit information, store sales, lease terms, options, renewal rates, rent escalations, location analysis, site analysis, market analysis, demographic data, cash on cash returns on investment, internal rate of returns after taxes, risks, likes, dislikes and so on. We will then strategies how to proceed on making a best offer. It is our goal to build a solid relationship with our clients and keep them updated on net lease investments, even though they may not have a need for years to come.(NNN Properties in Michigan)

We markets our listings locally, nationally and internationally

Triple Net Investment Group difference is a concept that is revolutionary in the commercial real estate brokerage business. In addition to marketing our deals to potential investors, We markets our listings to the entire brokerage community. We put our listings directly in front of thousands of commercial real estate agents in each state, region and local where the property is located.