Why NNN Investors Prefer Minnesota State: Higher Growth & Competitive Cap Rates Explained

Future Holding for NNN Property Investments in Minnesota

Triple Net Lease (NNN) properties, where tenants assume responsibility for property taxes, insurance, and maintenance, remain a smart investment choice for those seeking predictable, low-management income. In Minnesota, the outlook for NNN property investments is strong, underpinned by key market drivers and economic trends:

1. Economic Growth and Urban Expansion

Minnesota continues to experience steady economic growth, led by strong sectors such as healthcare, technology, manufacturing, and renewable energy. Cities like Minneapolis, St. Paul, Rochester, and Duluth are experiencing ongoing development, which fuels demand for commercial real estate. This upward trend supports the long-term viability and appreciation potential of NNN assets in the state.

2. Consistent Demand and Lease Stability

The demand for NNN properties in Minnesota remains robust due to their minimal landlord responsibilities and long-term lease structures. Tenants typically sign 10- to 20-year leases with built-in rent escalations, providing consistent cash flow and stability, key features that continue to attract both institutional and private investors in fluctuating markets.

3. Cap Rates and Investment Trends

Cap rates for NNN investments in Minnesota have remained competitive, particularly in secondary and tertiary markets where higher yields are common. While major metros like Minneapolis may offer lower cap rates due to higher property values, outlying areas such as St. Cloud, Mankato, and Moorhead provide attractive opportunities for investors looking for better returns and growth potential.

4. Financing Landscape for NNN Investors

Entering the Minnesota NNN market typically requires investors to have a net worth of at least $1 million or an annual income above $200,000. Lenders often seek down payments in the range of 30% to 40%, depending on the asset’s tenant strength and lease length. Investors planning portfolio expansion or 1031 exchanges need to be prepared with proper financial positioning to capitalize on deals quickly.

5. Diverse Local Market Opportunities

Minnesota’s NNN property offerings include a mix of single-tenant retail spaces, medical facilities, industrial warehouses, and quick-service restaurants. Current listings include properties with national credit tenants and long lease terms in suburbs of Minneapolis-St. Paul as well as growing regional hubs. Investors looking for stable, income-producing assets are increasingly targeting these sectors for both new acquisitions and portfolio diversification.

Triple-net (NNN) investors are increasingly turning to Minnesota as a promising location for net lease properties, thanks to its strong economic fundamentals, stable population centers, and diversified tenant demand. Here’s why NNN brokers and investors view Minnesota as a high-potential market:

1. Competitive Cap Rates and Reliable Returns

Minnesota offers competitive cap rates that attract NNN investors seeking a balance between risk and reward. In suburban and secondary markets such as Rochester, Mankato, and St. Cloud, cap rates typically range between 5.5% to 7%, providing solid yields for investors while maintaining a strong tenant base and lower vacancy risks.

2. Stable Property Values and Lower Market Volatility

Compared to coastal states with highly speculative markets, Minnesota provides a more stable environment for property values. Its steady appreciation and lower entry prices in non-metro areas allow NNN investors to purchase properties with national tenants at reasonable costs, preserving capital and enhancing long-term cash flow potential.

3. Economic Strength and Population Stability

Minnesota boasts a diverse economy powered by healthcare, education, finance, agriculture, and technology. Major employers like the Mayo Clinic, Target, 3M, and UnitedHealth Group create steady job growth and economic resilience. Twin Cities metro and regional hubs continue to attract both residents and businesses, supporting sustained demand for commercial real estate.

4. Demand for Essential Retail and QSR Tenants

NNN brokers and investors are finding strong opportunities in Minnesota’s growing demand for essential retail and quick-service restaurants (QSRs), including brands like Walgreens, Dollar Tree, Starbucks, and Taco Bell. These recession-resistant tenants provide long-term lease stability, even in economic downturns, making them ideal for NNN lease structures.

5. Business-Friendly Tax Environment for Investors

While Minnesota does have a state income tax, it offers favorable tax treatment for commercial real estate investors through depreciation, cost segregation, and 1031 exchange eligibility. These incentives allow NNN investors to defer capital gains taxes and reinvest proceeds into income-generating properties across the state.

6. Infrastructure Investment and Regional Development

Ongoing investments in transportation, broadband, and renewable energy are fueling regional development throughout Minnesota. Distribution hubs, industrial parks, and mixed-use developments are expanding, especially in areas like Duluth, Moorhead, and the southern Twin Cities suburbs. This creates demand for net lease properties across industrial, healthcare, and retail sectors.

Income Taxes

Minnesota’s Tax Landscape for NNN Investors: Key Considerations for Net Lease Property Success

Minnesota presents both opportunities and considerations for NNN investors when it comes to income taxes. While the state does levy income tax on rental income, strategic planning and use of LLCs, 1031 exchanges, and depreciation benefits can help investors optimize their tax position. Here’s what NNN brokers and investors should know about Minnesota’s tax environment:

1. State Income Tax on Rental Income

Minnesota taxes rental income earned through LLCs or personal ownership. Investors must report net lease income as part of their Minnesota tax return. However, deductions for mortgage interest, depreciation, insurance, and maintenance expenses help reduce the taxable portion of this income. Proper accounting and entity structuring can improve net returns.

2. Corporate Income Tax Rate

For NNN investors using corporate entities, Minnesota’s flat corporate income tax rate is 9.8%, one of the higher rates in the U.S. However, investors can still benefit from reinvestment strategies and expense deductions to manage tax liability. Choosing the right entity structure (LLC, S Corp, or C Corp) is crucial for tax efficiency.

3. Progressive Personal Income Tax Structure

Minnesota uses a progressive personal income tax system with the following 2025 rates:

5.35% on the first ~$31,000 (single) / ~$45,000 (joint)

6.80% on income over ~$31,000 / ~$45,000

7.85% on income over ~$95,000 / ~$180,000

9.85% on income over ~$190,000 / ~$315,000

Investors receiving rental income through pass-through entities (like LLCs) will be taxed at these rates. Tax planning is important to mitigate exposure and optimize income distribution.

4. No State-Level Capital Gains Tax Advantage

Minnesota treats capital gains as ordinary income, applying the same rates listed above. However, investors can use 1031 exchanges to defer capital gains taxes when selling one NNN property and purchasing another of equal or greater value, preserving wealth and avoiding immediate tax consequences.

5. No State Inheritance Tax, but Estate Tax Applies

Minnesota does not impose an inheritance tax, but it does levy an estate tax on estates valued over $3 million. The estate tax rate ranges from 13% to 16%, which is a consideration for high-net-worth NNN investors focused on generational wealth transfer. Proactive estate planning is recommended to minimize exposure.

6. Property Tax Rates and Assessment

Minnesota’s average effective property tax rate is around 1.02%, slightly above the national average. However, property taxes vary significantly by county and property type. Investors should consider local tax rates during acquisition and factor them into the long-term cost and yield analysis of NNN assets.

7. Depreciation and Deductions for Investors

Despite the absence of income tax exemptions on rental income, Minnesota allows full use of federal depreciation schedules and expense deductions, which can significantly lower taxable income. This is a valuable benefit for NNN investors with well-structured leases and consistent cash flow.

Triple-net (NNN) investments in Minnesota benefit from tenant-controlled expenses and are particularly compelling in high-growth regions. Here are six key areas to watch:

1. Wright County (exurbs of Twin Cities):

Population Growth: Expanded approximately 10.8% since 2020, making it one of Minnesota’s fastest-growing counties

Economic Development: The area is attracting new residential subdivisions, retail centers, and light industrial parks to serve spillover from Minneapolis–St. Paul.

Investment Potential: Ideal for NNN retail and service-anchored properties due to surging household numbers and rising consumer demand.

2. Sherburne County (north of Twin Cities):

Population Growth: Grew about 8.1% since 2020

Economic Development: Development of suburban housing, schools, and community facilities continues apace, catering to commuter families.

Investment Potential: Neighborhood retail strips, urgent care, and fast-casual spots in commuter corridors offer strong NNN opportunities.

3. Carver County (Twin Cities southwestern suburbs):

Population Growth: Approximately 6.0% growth since 2020.

Economic Development: High household-income region seeing new retail, medical offices, and light commercial developments.

Investment Potential: National-tenant net lease assets (e.g., pharmacies, bank branches) with reliable tenant pools.

4. Isanti County & Washington County (northeastern and eastern suburbs):

Population Growth: Isanti ~5.0%, Washington ~4.8% since 2020

Economic Development: Washington County’s more mature infrastructure; Isanti favors emerging housing and retail in commuter nodes.

Investment Potential: NNN prospects include standalone QSRs and essential retail in growing suburban markets.

5. Dakota County (south Twin Cities metro):

Population Growth: Added about 4,168 residents in 2023 alone—the highest numeric gains in the state

Economic Development: Home to logistic hubs, corporate campuses (e.g., Eagan, Burnsville), and growing residential communities.

Investment Potential: Single-tenant net lease sites near interchanges and hospital/office developments are prime NNN targets.

6. Pine County (Greater Minnesota growth):

Population Growth: Fastest-growing county from 2022 to 2023, up ~2.25%.

Economic Development: Growth driven by affordable housing, retiree relocation, and outdoor recreation tourism.

Investment Potential: Retail and service-oriented NNN investments in small but growing regional centers.

Pros:

1️⃣ Stable Cap Rates with Moderate Returns

Cap rates in Minnesota, particularly in suburban and secondary markets, typically range from 5.5% to 7%. This provides reliable cash flow while still maintaining tenant quality and lease security.

2️⃣ Strong Economic Base

Minnesota has a diversified economy led by healthcare, technology, manufacturing, and finance. Major employers like Mayo Clinic, Target, 3M, UnitedHealth Group, and Best Buy ensure long-term economic stability and commercial real estate demand.

3️⃣ Consistent Population Growth in Suburbs

While urban core growth has slowed, suburban counties like Wright, Carver, and Sherburne are experiencing steady population increases. This growth supports demand for essential retail and service-based NNN tenants.

4️⃣ High Credit Tenant Presence

Minnesota markets are home to strong national and regional brands: CVS, Walgreens, McDonald’s, Starbucks, AutoZone, and Dollar Tree all operate in growing suburban markets. These creditworthy tenants make Minnesota attractive for NNN lease structures.

5️⃣ Infrastructure and Quality of Life

Minnesota invests heavily in public infrastructure, education, and healthcare. A high quality of life contributes to long-term population retention, workforce development, and retail demand.

6️⃣ Access to 1031 Exchange Opportunities

Minnesota’s active real estate market offers plenty of 1031 exchange opportunities, helping investors defer capital gains and reallocate into newer or higher-yield NNN assets.

7️⃣ Active Industrial and Logistics Growth

With expanding logistics hubs in areas like Shakopee, Eagan, and St. Cloud, there’s increasing demand for industrial NNN leases such as distribution centers and service-oriented tenants.

Cons:

1️⃣ Higher Income and Corporate Tax Rates

Minnesota’s personal income tax rate reaches up to 9.85%, and the corporate income tax is a flat 9.8%. This can reduce after-tax cash flow for investors compared to states with lower tax burdens.

2️⃣ Harsh Winters Impact Certain Tenants

Minnesota’s cold climate and snow-heavy winters can affect foot traffic for some retail tenants and may increase property maintenance and insurance costs.

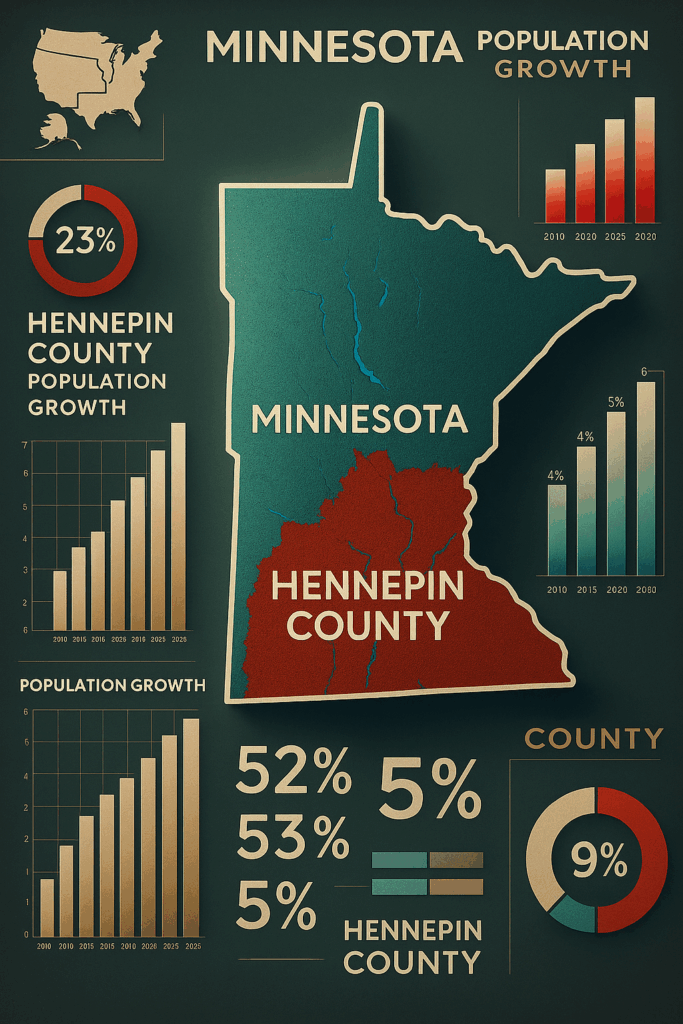

3️⃣ Property Tax Rates Are Above Average

Minnesota’s average effective property tax rate is around 1.02%, higher than the U.S. average (~0.90%). This can affect long-term holding costs, especially in metro counties like Hennepin and Ramsey.

4️⃣ Slower Appreciation in Rural Areas

Rural and northern regions of the state experience modest property appreciation, limiting upside for investors seeking aggressive equity growth.

5️⃣ Limited Population Growth in Urban Core

While suburbs are growing, core urban centers like Minneapolis have seen slower or even declining growth post-2020, influenced by migration patterns and shifting housing preferences.

6️⃣ Strict Zoning and Development Rules

Minnesota cities often have rigid planning and zoning regulations, which can slow down redevelopment timelines and affect value-add strategies in NNN properties.

Minnesota NNN Properties for 1031 Exchange

Invest in Free Standing Single Tenant Triple Net (NNN) Properties in Minnesota

Are you looking for a reliable 1031 exchange replacement property?

At Triple Net Investment Group, we specialize in the sale of single tenant NNN properties and triple net shopping centers across the United States. Our team is dedicated to helping investors find high-quality (Tenant Triple Net) NNN properties in Minnesota and nationwide that align with their financial goals and 1031 exchange requirements.

With our in-depth market knowledge and personalized service, we provide tailored investment strategies for both buyers and sellers of commercial real estate. Whether you’re looking to defer capital gains through a 1031 tax-deferred exchange or want to diversify your portfolio with income-generating assets, our team offers a wide selection of vetted NNN investment properties.

Corporate Tenant Credit Ratings

Find out more about the credit rating of the tenant before purchasing.

How safe are the triple net investment grade free standing single tenant properties?

Market Analysis

What three things should I know before investing?

Call or e-mail us and we will get back to you within 24 hours. We know of properties for sale that aren’t listed or advertised.

Email: [email protected] Tel: 202-361-3050

We strive hard to provide clients with quality customer service

We provide our clients with all of the information they need upfront to make an informed decision, even before a Letter of Intent is issued such as: tenant credit information, store sales, lease terms, options, renewal rates, rent escalations, location analysis, site analysis, market analysis, demographic data, cash on cash returns on investment, internal rate of returns after taxes, risks, likes, dislikes and so on. We will then strategies how to proceed on making a best offer. It is our goal to build a solid relationship with our clients and keep them updated on net lease investments, even though they may not have a need for years to come. ( NNN Properties in Minnesota )

We markets our listings locally, nationally, and internationally

Triple Net Investment Group difference is a concept that is revolutionary in the commercial real estate brokerage business. In addition to marketing our deals to potential investors, We markets our listings to the entire brokerage community. We put our listings directly in front of thousands of commercial real estate agents in each state, region and local where the property is located.