Why NNN Investors Prefer Nevada State: Higher Growth & Competitive Cap Rates Explained

Future holding for NNN property investments in Nevada

Triple Net Lease (NNN) properties, where tenants are responsible for property taxes, insurance, and maintenance, remain a popular investment option for those seeking predictable income with minimal day-to-day management. In Nevada, the outlook for NNN property investments is strong, supported by several key factors:

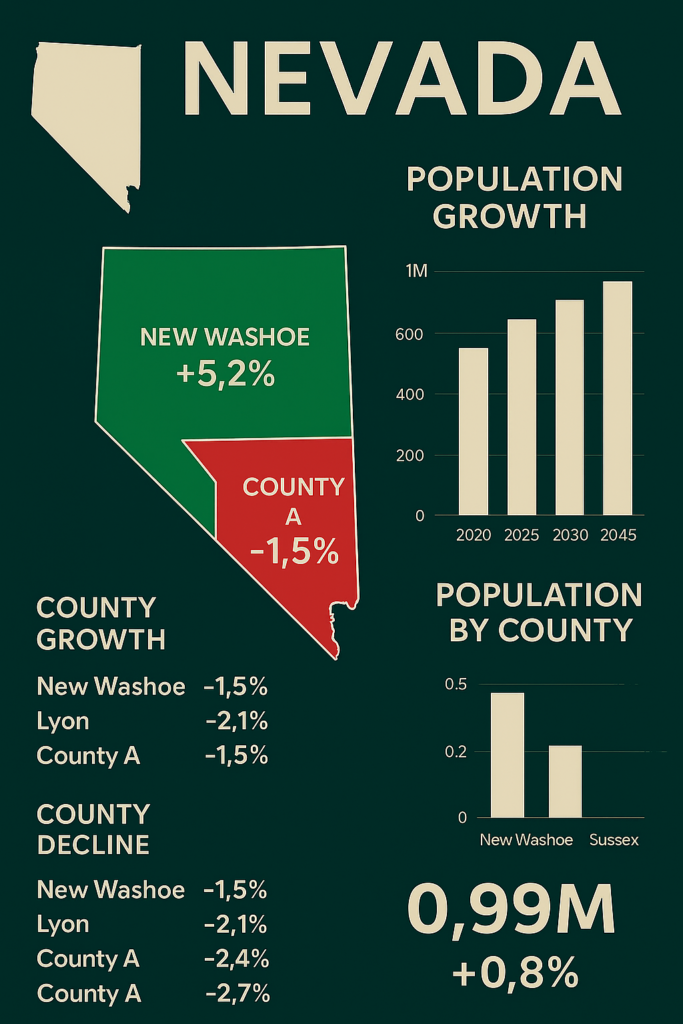

1. Economic and Population Growth

Nevada, particularly cities like Las Vegas, Reno, and Henderson, continues to experience robust economic and population growth. The state’s business-friendly environment, no personal income tax, and expanding tech and logistics sectors are driving demand for commercial real estate. This growth creates a solid foundation for NNN property investments, offering long-term stability and appreciation potential for investors.

2. Stability and Demand for NNN Properties

NNN lease properties in Nevada provide dependable, long-term income due to their lease structure, where tenants cover operational costs. This model offers predictable returns and is especially attractive during economic fluctuations. The consistent demand for commercial space—ranging from retail to industrial—ensures NNN properties remain a secure investment vehicle for both seasoned and new investors.

3. Market Trends and Cap Rates

Cap rates for NNN properties in Nevada have remained competitive, with many assets offering higher yields compared to coastal states. As interest rates and inflation concerns shape investment strategies, investors are finding value in Nevada’s NNN offerings. The state’s growing inventory of NNN listings provides a wider range of choices for investors seeking to balance risk and return.

4. Financing Considerations for NNN Investors

Entering Nevada’s NNN market typically requires a net worth of at least $1 million or an annual income above $200,000. Investors should prepare for down payments of 30% to 40% of a property’s purchase price. Having a clear understanding of these financial prerequisites is vital for those planning to enter or expand within the NNN space.

5. Local Market Opportunities

Nevada offers a diverse range of NNN investment opportunities, including single-tenant retail outlets, industrial warehouses, and medical office buildings. For example, an NNN-leased retail property in the Reno metro area—with national credit tenants and scheduled rent increases—presents an attractive option for investors seeking passive income and long-term value. Additionally, investors using a 1031 exchange can benefit from Nevada’s growing market to defer capital gains taxes and diversify their portfolios.

Triple-net (NNN) investors are increasingly turning to Nevada as a prime location for net lease properties, thanks to its strong cap rates, tax advantages, and booming economic landscape. Here’s why NNN brokers and investors see Nevada as a lucrative market:

1. Competitive Cap Rates with Strong Return Potential

Nevada offers attractive cap rates for NNN investments, often ranging from 5.5% to 7.5%, depending on asset type and location. These rates provide favorable returns compared to higher-priced, lower-yield markets. The state’s economic growth and business development climate contribute to stable, long-term income streams for NNN investors.

2. Business-Friendly Tax Structure

Nevada is one of the few states with no state income tax, making it especially appealing for NNN investors seeking to maximize post-tax returns. For investors utilizing 1031 exchanges, Nevada offers a strategic opportunity to defer capital gains taxes while reinvesting in stable, income-generating properties.

3. Rapid Population Growth and Economic Expansion

Major metropolitan areas like Las Vegas, Henderson, and Reno have seen substantial population growth fueled by employment opportunities, quality of life, and affordable housing. This demographic surge boosts demand for commercial real estate, including NNN-leased retail, healthcare, and service-oriented properties.

4. Demand for Essential Retail & QSR Tenants

Nevada continues to show high demand for essential retail and quick-service restaurants (QSRs), such as Walgreens, Dollar Tree, 7-Eleven, Starbucks, and Chick-fil-A. These tenants often sign long-term NNN leases, making them attractive to investors looking for dependable income and minimal management.

5. Affordable Entry Compared to Coastal Markets

While real estate in coastal states is often cost-prohibitive, Nevada provides more accessible price points for high-quality NNN assets. This lower barrier to entry enables investors to acquire properties with national tenants and strong credit profiles without sacrificing returns.

6. Industrial and Infrastructure Growth

Nevada’s strategic location as a logistics and distribution hub—particularly with proximity to California and major interstate corridors—has accelerated industrial development. Companies in tech, e-commerce, and manufacturing are expanding in Nevada, driving demand for NNN-leased industrial and retail properties across the state.

Income Taxes

Nevada’s Tax Advantages for NNN Investors: A Prime Location for Net Lease Properties

Nevada offers some of the most favorable tax policies in the United States, making it an ideal destination for NNN (Triple-Net) investors seeking to optimize their returns and reduce tax liability. Its investor-friendly tax environment supports long-term profitability, estate planning, and portfolio growth. Here’s why NNN investors and brokers are increasingly targeting Nevada for net lease property investments:

1. No State Income Tax on Rental or Passive Income

Nevada imposes no personal state income tax, meaning rental income earned from NNN properties held through an LLC or personally is not taxed at the state level. This provides a significant advantage for investors looking to retain more of their passive income and improve net returns.

2. No Corporate Income Tax

Nevada is one of the few states that does not levy a corporate income tax. This is highly beneficial for NNN investors operating through corporate entities or REITs. Without state-level corporate taxes, more capital remains available for reinvestment, property upgrades, or expanding NNN portfolios.

3. No Franchise or Gross Receipts Tax

Unlike many other states, Nevada does not impose a franchise tax or a tax on gross receipts. Businesses and investors can operate without the burden of these taxes, simplifying compliance and improving overall ROI on net lease properties.

4. No Estate or Inheritance Tax

Nevada also does not impose an estate or inheritance tax, making it a strategic location for estate planning. NNN investors can pass down properties to their heirs without incurring additional state-level taxes, preserving family wealth and generational investments.

5. Competitive Property Tax Rates

Nevada maintains moderate property tax rates, with an average effective property tax rate of approximately 0.55%. This is considerably lower than in many high-tax states, reducing long-term holding costs for NNN properties and increasing cash flow for investors.

6. Capital Gains Exempt from State Tax

Nevada does not tax capital gains at the state level. Whether you’re selling a net lease property outright or engaging in a 1031 exchange, the absence of a state capital gains tax significantly boosts net proceeds and facilitates tax-deferred reinvestment strategies.

NNN properties—in which tenants cover property taxes, insurance, and maintenance—offer hands-off, predictable income. Below are the top Nevada counties and metros showing strong potential for NNN investments based on recent population and economic data:

1. Clark County (Las Vegas Metro):

Population Growth: Clark County’s population reached ~2.37 million in 2023, a 1.7% increase from 2022. Projections estimate steady annual growth of 1.4–1.6% into 2024–25

Economic Development: Major expansions in hospitality, entertainment, logistics, and industrial infrastructure, including distribution centers, are fueling economic momentum.

Investment Potential: Strong demand for retail, QSRs, and industrial NNN properties in the Las Vegas metro offers opportunities with long-term leases and growth tailwinds.

2. Washoe County (Reno Metro):

Population Growth: Washoe County grew from roughly 486,492 (2020) to an estimated 507,280 in 2024—around a 4.3% increase

Economic Development: Reno has attracted high-tech manufacturing, EV battery plants, and logistics hubs, notably Tesla’s Gigafactory near the Tahoe Reno Industrial Center

Investment Potential: Retail, office, and industrial NNN properties near Reno and the industrial corridor offer stable tenancies with attractive cap rates.

3. Storey County (Tahoe Reno Industrial Center & Virginia City area):

Population Growth: Although population is small (~4,100 in 2020), employment exceeded 18,000 by 2018 due to industrial development

Economic Development: Home to the massive Tahoe Reno Industrial Center, hosting Tesla, Panasonic, Home Depot, Walmart, and more

Investment Potential: Industrial and logistics NNN assets near TRIC offer standout opportunities, with tenants shouldering operating expenses.

4. Lyon County (Western Nevada):

Population Growth: While exact recent figures are limited, Lyon County benefits from spillover migration from Reno and Carson City as affordable housing expands

Economic Development: Growth in energy, logistics, and distribution sectors is increasing demand in smaller urban and rural commercial centers.

Investment Potential: Neighborhood retail and service NNN opportunities are emerging in towns such as Fernley and Silver Springs.

5. Carson City (Independent City & County equivalent):

Population Growth: As the state capital, Carson City maintains steady public-sector employment, moderate growth, and rising median incomes (~$75,561 statewide in 2023)

Investment Potential: Government-adjacent office spaces and retail centers catering to daily commuters offer reliable NNN income opportunities.

6. Elko County (Elko Micropolitan Area):

Economic Development: Elko leads in mining, especially gold, alongside ranching and tourism

Investment Potential: While more cyclical, NNN properties tied to essential services, community retail, and support industries present niche opportunities driven by the mining economy.

Pros:

1️⃣ Strong Cap Rates

Nevada offers competitive cap rates typically ranging between 5.5% to 7.5%, depending on asset type and location.

2️⃣ No State Income Tax on Rental Income

Nevada has no state income tax, including on rental income from NNN properties held in an LLC or individually.

3️⃣ Moderate Property Tax Rates

With an average effective property tax rate around 0.55%, Nevada remains relatively affordable compared to high-tax states.

4️⃣ Affordable Entry Points (Outside of Las Vegas Core)

Secondary and tertiary markets like Carson City, Elko, and parts of Washoe County offer affordable commercial real estate prices.

5️⃣ Growing Economy & Population

Nevada’s economy is expanding rapidly, especially in Las Vegas, Reno, and the Tahoe-Reno Industrial Corridor.

6️⃣ Business-Friendly Tax and Legal Environment

With no corporate income tax, no franchise tax, and no capital gains tax, Nevada is one of the most business-friendly states.

7️⃣ Strong Tenant Mix in Essential Retail & Industrial

Nevada has seen continued demand for NNN properties leased to tenants like Starbucks, Walgreens, AutoZone, Chick-fil-A, 7-Eleven, and logistics/warehouse users.

Cons:

1️⃣ Limited Inventory in High-Growth Submarkets

While Las Vegas and Reno are booming, high-quality NNN assets with long leases can be hard to find, leading to competition and pricing pressure.

2️⃣ Water Scarcity and Environmental Concerns

Nevada faces long-term water availability challenges, particularly in southern regions.

3️⃣ Market Volatility in Tourism-Driven Areas

Cities like Las Vegas are heavily reliant on tourism and hospitality, which can fluctuate with economic cycles or global events.

4️⃣ Slower Urban Development Outside Major Metros

Beyond Las Vegas and Reno, some regions have limited high-density or mixed-use development.

5️⃣ Property Insurance & Natural Disaster Risk

While not as severe as coastal hurricane zones, Nevada does have seismic activity (especially near western counties) and wildfire risk in rural areas.

Nevada NNN Properties for 1031 Exchange

Invest in Free Standing Single Tenant Triple Net (NNN) Properties in Nevada

Are you looking for a reliable 1031 exchange replacement property?

At Triple Net Investment Group, we specialize in the sale of single tenant NNN properties and triple net shopping centers across the United States. Our team is dedicated to helping investors find high-quality (Tenant Triple Net) NNN properties in Nevada and nationwide that align with their financial goals and 1031 exchange requirements.

With our in-depth market knowledge and personalized service, we provide tailored investment strategies for both buyers and sellers of commercial real estate. Whether you’re looking to defer capital gains through a 1031 tax-deferred exchange or want to diversify your portfolio with income-generating assets, our team offers a wide selection of vetted NNN investment properties.

Corporate Tenant Credit Ratings

Find out more about the credit rating of the tenant before purchasing.

How safe are the triple net investment grade free standing single tenant properties?

Market Analysis

What three things should I know before investing?

Call or e-mail us and we will get back to you within 24 hours. We know of properties for sale that aren’t listed or advertised.

Email: [email protected] Tel: 202-361-3050

We strive hard to provide clients with quality customer service

We provide our clients with all of the information they need upfront to make an informed decision, even before a Letter of Intent is issued such as: tenant credit information, store sales, lease terms, options, renewal rates, rent escalations, location analysis, site analysis, market analysis, demographic data, cash on cash returns on investment, internal rate of returns after taxes, risks, likes, dislikes and so on. We will then strategies how to proceed on making a best offer. It is our goal to build a solid relationship with our clients and keep them updated on net lease investments, even though they may not have a need for years to come.(NNN Properties in Nevada)

We markets our listings locally, nationally and internationally

Triple Net Investment Group difference is a concept that is revolutionary in the commercial real estate brokerage business. In addition to marketing our deals to potential investors, We markets our listings to the entire brokerage community. We put our listings directly in front of thousands of commercial real estate agents in each state, region and local where the property is located.