Why NNN Investors Prefer New Hampshire State: Higher Growth & Competitive Cap Rates Explained

Future Holding for NNN Property Investments in New Hampshire

Triple Net Lease (NNN) properties, where tenants cover property taxes, insurance, and maintenance costs, offer an attractive, low-maintenance investment strategy for investors seeking predictable income. In New Hampshire, the outlook for NNN property investments remains favorable due to several defining factors:

1. Economic and Population Growth

New Hampshire has experienced steady population growth, particularly in southern areas like Nashua, Manchester, and along the Massachusetts border. The state’s strategic location in the Northeast, combined with its business-friendly climate and absence of a general sales tax or state income tax, is drawing both residents and businesses. This growing demand supports a strong foundation for commercial real estate and NNN property investments.

2. Stability and Demand for NNN Properties

NNN lease properties offer investors long-term lease structures, typically ranging from 10 to 20 years, with built-in rent escalations. In New Hampshire, these assets are especially appealing due to the state’s low commercial vacancy rates and the consistent demand for essential retail and service-based tenants such as pharmacies, banks, and quick-service restaurants. Investors and brokers see ongoing demand for such properties, driven by the state’s stable economic environment.

3. Market Trends and Cap Rates

Cap rates in New Hampshire for NNN properties tend to remain competitive compared to neighboring Northeastern states. While the national market has seen moderate increases in cap rates, New Hampshire continues to offer relatively attractive returns with lower entry costs than metropolitan hubs like Boston. Investors are also capitalizing on the trend toward suburban and secondary markets, making New Hampshire an increasingly desirable target.

4. Financing Considerations for NNN Investors

Purchasing NNN properties in New Hampshire generally requires a solid financial base, including a net worth of $1 million or more, or an annual income exceeding $200,000. Down payments often range from 30% to 40%, depending on property type and location. NNN investors must also consider property-specific lease terms, tenant creditworthiness, and local market dynamics when arranging financing or expanding their portfolios.

5. Local Market Opportunities

New Hampshire offers a range of NNN investment opportunities, particularly in sectors like healthcare, convenience retail, and logistics. For instance, single-tenant properties leased to national brands in cities like Concord or Portsmouth provide stable returns with minimal landlord responsibility. Moreover, investors utilizing 1031 exchanges can find tax-deferred reinvestment options within the state’s growing inventory of NNN deals, enhancing long-term portfolio value.

Triple-net (NNN) investors are increasingly turning to New Hampshire as a strategic location for net lease properties, thanks to its favorable tax environment, strong demographics, and expanding commercial landscape. Here’s why NNN brokers and investors see New Hampshire as a compelling market:

1. Competitive Cap Rates in a Stable Market

While coastal metros often offer lower cap rates, New Hampshire provides NNN investors with cap rates typically ranging from 5.5% to 7%, depending on tenant strength and lease term. This balance between risk and return makes the state attractive for investors seeking long-term, stable income from essential service tenants.

2. Reasonable Property Pricing with Upside Potential

New Hampshire offers relatively affordable acquisition opportunities compared to neighboring states like Massachusetts or Connecticut. This pricing advantage allows NNN investors to secure well-located net lease properties leased to national credit tenants while maintaining solid cash flow and long-term appreciation prospects.

3. Population Growth & Economic Resilience

Southern New Hampshire, particularly cities like Nashua, Manchester, and Portsmouth, is experiencing notable population growth, driven by migration from high-cost urban areas and strong job markets. The state’s economic stability and pro-business environment further support growing demand for retail, medical, and industrial net lease properties.

4. Strong Demand for Essential Retail & National QSRs

NNN brokers report consistent demand in New Hampshire for essential retail tenants and quick-service restaurants (QSRs) such as Walgreens, CVS, Dollar Tree, Starbucks, and Dunkin’. These single-tenant net lease properties offer predictable cash flow and long-term occupancy in high-traffic areas across the state.

5. No General Sales Tax or State Income Tax on Wages

New Hampshire’s unique tax structure—with no general sales tax and no state income tax on earned income—attracts both businesses and individuals. While passive income through LLCs is taxed depending on structure and classification, the overall low-tax environment appeals to NNN investors seeking efficient portfolio performance and potential tax deferral via 1031 exchanges.

6. Growth in Healthcare, Logistics & Light Industrial Sectors

New Hampshire is seeing increased investment in healthcare facilities, last-mile logistics, and light industrial development, particularly along the I-93 and I-95 corridors. This expansion creates new opportunities for NNN investors targeting medical offices, distribution centers, and service-oriented net lease properties with long-term tenants and lease stability.

Income Taxes

New Hampshire’s Tax Advantages for NNN Investors: A Strategic Choice for Net Lease Properties

New Hampshire offers a uniquely favorable tax environment that appeals to NNN investors looking to preserve income, reduce tax burdens, and optimize returns. With no state income tax on wages and no general sales tax, the Granite State presents an investor-friendly setting for acquiring and holding net lease properties. Here’s why NNN brokers and investors view New Hampshire as a tax-efficient market:

1. No State Income Tax on Wages

New Hampshire does not impose a state income tax on wages, which makes it one of the most tax-friendly states in the U.S. for individuals. Although there is a 5% Interest & Dividends Tax (phasing out by 2027), rental income earned through NNN properties generally avoids state-level taxation, depending on entity structure and revenue classification. This allows investors to retain more of their rental income.

2. No General Sales Tax

New Hampshire is one of the few states with no statewide sales tax, reducing the cost of living and doing business. This advantage boosts consumer spending and enhances the retail environment, making the state more appealing for NNN investments in sectors like essential retail and quick-service restaurants (QSRs).

3. Phasing Out Interest & Dividends Tax

Historically, New Hampshire taxed interest and dividend income at 5%, but this tax is being phased out completely by 2027 under current legislation. This gradual elimination supports higher net income for individual investors and LLC members who might otherwise be taxed on passive income from net lease holdings.

4. No State Capital Gains Tax

New Hampshire does not impose a state capital gains tax, making it an excellent jurisdiction for investors planning a sale or engaging in a 1031 exchange. Investors can reinvest proceeds into new NNN properties without facing a state-level capital gains burden, maximizing long-term portfolio growth.

5. No Estate or Inheritance Tax

There is no state estate or inheritance tax in New Hampshire, which simplifies generational wealth transfer. NNN investors looking to pass down income-generating real estate to heirs can do so without facing additional state-level tax consequences, preserving asset value across generations.

6. Competitive Property Tax Rates

While property tax rates in New Hampshire are slightly higher than the national average, they are balanced by the absence of income and sales taxes. The average effective property tax rate is approximately 1.77%, and municipalities often offer stable assessments. Investors should factor in location-specific property taxes when evaluating net lease property returns but can benefit from the state’s overall tax neutrality.

Investing in triple net lease (NNN) properties in New Hampshire can be a strategic decision, particularly in regions experiencing population growth, economic diversification, and strong demand for essential services. With tenants responsible for taxes, insurance, and maintenance, NNN properties offer investors passive income and long-term stability. Based on recent trends, here are some of the most promising cities and counties in New Hampshire for NNN property investments:

1. Hillsborough County (Manchester & Nashua):

Population Growth: Hillsborough is the most populous county in New Hampshire, with steady annual growth. Manchester and Nashua continue to attract residents due to job availability and affordable living relative to Boston suburbs.

Economic Development: The area benefits from strong healthcare, manufacturing, and tech sectors. Nashua, in particular, draws businesses due to its proximity to the Massachusetts border and lack of sales tax.

Investment Potential: High foot traffic, economic resilience, and growing demand for retail, healthcare, and professional services make Hillsborough a prime location for NNN investments in both urban and suburban markets.

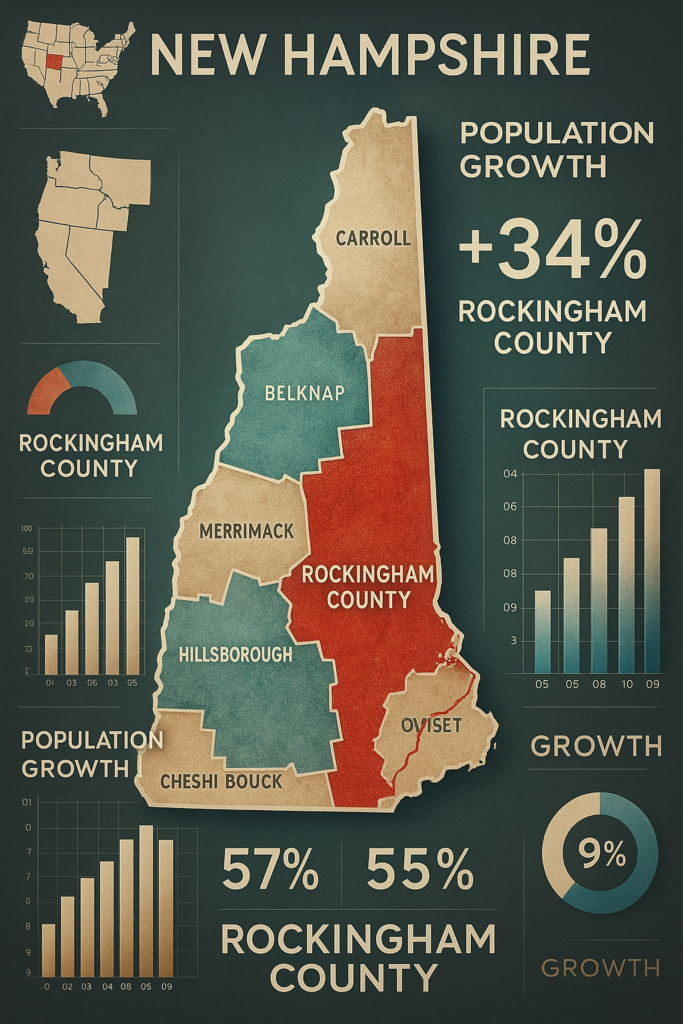

2. Rockingham County (Portsmouth, Salem, Derry):

Population Growth: Rockingham County has experienced consistent growth due to its desirable location along the coast and near Boston. Communities like Salem and Derry are growing suburban hubs.

Economic Development: Portsmouth is a commercial and tourism center, while Salem benefits from the growing retail economy, including major centers like Tuscan Village.

Investment Potential: Rockingham offers excellent opportunities for NNN investors, particularly in essential retail, quick-service restaurants (QSRs), and coastal service-based properties.

3. Merrimack County (Concord):

Population Growth: Concord and surrounding towns have shown stable population increases, supported by migration from higher-cost states and urban centers.

Economic Development: Concord, the state capital, has a robust government employment base, along with growing healthcare and retail sectors.

Investment Potential: NNN properties near government buildings, hospitals, and retail corridors in Concord are highly sought after for their stability and long-term tenant appeal.

4. Strafford County (Dover, Rochester):

Population Growth: Strafford County has seen accelerated growth, especially in Dover, one of the fastest-growing cities in the state.

Economic Development: Anchored by healthcare, education, and advanced manufacturing, the region attracts both businesses and residents.

Investment Potential: With strong residential and commercial expansion, Strafford is well-suited for NNN investments in medical offices, essential retail, and educational service centers.

5. Cheshire County (Keene):

Population Growth: While growth in Cheshire is moderate, Keene remains a stable market with a steady influx of students and professionals.

Economic Development: Keene State College and several regional hospitals support the local economy. There’s also a growing trend in small manufacturing and remote workforce migration.

Investment Potential: NNN opportunities exist in healthcare, education-adjacent retail, and local service sectors that cater to a consistent population base.

6. Grafton County (Lebanon, Hanover):

Population Growth: Grafton County has shown steady growth, particularly in Lebanon and Hanover, due to their strong educational and healthcare institutions.

Economic Development: Home to Dartmouth College and Dartmouth-Hitchcock Medical Center, the area benefits from a highly educated workforce and a knowledge-driven economy.

Investment Potential: NNN investments in medical, retail, and academic-supporting properties are attractive here, given the stable, affluent tenant base and institutional anchors.

Pros:

1️⃣ Competitive Cap Rates

New Hampshire offers cap rates in the 5.5%–7% range, depending on tenant credit and location. Investors can secure strong yields while benefiting from relatively low acquisition costs and long-term tenants.

2️⃣ No General Sales Tax or State Income Tax on Wages

The state does not impose a sales tax or personal income tax on earned wages. This makes New Hampshire a tax-friendly environment for individuals and enhances consumer retail spending—supporting tenant performance in NNN properties.

3️⃣ Strategic Location in the Northeast

New Hampshire borders Massachusetts and is within driving distance of Boston, Portland (ME), and New York. Ideal for distribution, retail, and healthcare NNN properties with strong commuter and logistics networks.

4️⃣ Population & Economic Growth in Key Regions

Counties like Rockingham, Hillsborough, and Strafford are seeing steady population increases, especially in cities like Manchester, Nashua, Portsmouth, and Dover. Demand for essential retail and service-based tenants is rising, supporting NNN investments.

5️⃣ Business-Friendly Tax Environment

No capital gains tax, no estate or inheritance tax, and phased elimination of the 5% Interest & Dividends Tax (fully gone by 2027). This creates long-term tax advantages for NNN investors, especially those holding properties in LLCs or using 1031 exchanges.

6️⃣ Essential Retail & QSR Demand

High demand for national tenants like Walgreens, CVS, Dunkin’, McDonald’s, and Dollar Tree in suburban and commuter-friendly areas. Provides stable tenant base and long-term lease security.

7️⃣ Diverse Property Options

Opportunities across suburban medical offices, logistics hubs, retail centers, and education-related service properties. Investors can diversify within the NNN space depending on strategy and region.

Cons:

1️⃣ Higher Property Taxes

New Hampshire has relatively high property tax rates (~1.77% average effective rate) compared to many other states.

2️⃣ Limited Urban Density

While towns like Manchester and Portsmouth are growing, New Hampshire lacks large urban metro centers.

3️⃣ Slower Growth in Northern & Rural Areas

Population and economic expansion are primarily concentrated in the southern half of the state. Northern regions may present limited tenant demand and longer lease-up times.

4️⃣ Seasonal Business Impact

Tourism-heavy regions (e.g., White Mountains, Lakes Region) may rely on seasonal traffic. Properties in these areas may experience fluctuating tenant revenues, impacting lease negotiations and renewals.

5️⃣ Competition for High-Quality Assets

Due to the state’s small size and strong fundamentals, inventory of high-credit NNN listings is limited. Investors may face stiff competition and compressed cap rates for the most desirable assets.

New Hampshire NNN Properties for 1031 Exchange

Invest in Free Standing Single Tenant Triple Net (NNN) Properties in New Hampshire

Are you looking for a reliable 1031 exchange replacement property?

At Triple Net Investment Group, we specialize in the sale of single tenant NNN properties and triple net shopping centers across the United States. Our team is dedicated to helping investors find high-quality (Tenant Triple Net) NNN properties in New Hampshire and nationwide that align with their financial goals and 1031 exchange requirements.

With our in-depth market knowledge and personalized service, we provide tailored investment strategies for both buyers and sellers of commercial real estate. Whether you’re looking to defer capital gains through a 1031 tax-deferred exchange or want to diversify your portfolio with income-generating assets, our team offers a wide selection of vetted NNN investment properties.

Corporate Tenant Credit Ratings

Find out more about the credit rating of the tenant before purchasing.

How safe are the triple net investment grade free standing single tenant properties?

Market Analysis

What three things should I know before investing?

Call or e-mail us and we will get back to you within 24 hours. We know of properties for sale that aren’t listed or advertised.

Email: [email protected] Tel: 202-361-3050

We strive hard to provide clients with quality customer service

We provide our clients with all of the information they need upfront to make an informed decision, even before a Letter of Intent is issued such as: tenant credit information, store sales, lease terms, options, renewal rates, rent escalations, location analysis, site analysis, market analysis, demographic data, cash on cash returns on investment, internal rate of returns after taxes, risks, likes, dislikes and so on. We will then strategies how to proceed on making a best offer. It is our goal to build a solid relationship with our clients and keep them updated on net lease investments, even though they may not have a need for years to come.(NNN Properties in New Hampshire)

We markets our listings locally, nationally and internationally

Triple Net Investment Group difference is a concept that is revolutionary in the commercial real estate brokerage business. In addition to marketing our deals to potential investors, We markets our listings to the entire brokerage community. We put our listings directly in front of thousands of commercial real estate agents in each state, region and local where the property is located.