Why NNN Investors Prefer North Carolina State: Higher Growth & Competitive Cap Rates Explained

Future Holding for NNN Property Investments in North Carolina

Triple Net Lease (NNN) properties, where tenants are responsible for property taxes, insurance, and maintenance, are an appealing option for investors seeking predictable income with minimal day-to-day management. In North Carolina, the outlook for NNN property investments is strong, supported by key economic, demographic, and market trends:

1. Economic and Population Growth

North Carolina continues to experience robust population and economic growth, particularly in metropolitan areas like Raleigh, Charlotte, and the Research Triangle. This growth drives demand for commercial properties, creating favorable conditions for NNN investments that offer long-term stability and the potential for appreciation.

2. Consistent Demand and Investment Stability

The structured nature of NNN leases, where tenants cover most operating expenses, ensures reliable income for property owners. Amid economic uncertainty or inflationary pressures, NNN assets in North Carolina remain in high demand due to their low-risk, stable cash flow characteristics, making them ideal for long-term real estate portfolios.

3. Market Trends and Attractive Cap Rates

Cap rates for NNN properties in North Carolina remain competitive, especially when compared to more saturated or lower-yield markets. With cap rates ranging between 5.5% and 7.5% depending on tenant quality and lease length, investors can achieve attractive returns while benefiting from a relatively stable investment environment.

4. Financing and Entry Considerations

Entering the NNN market in North Carolina generally requires a substantial capital base. Investors typically need a net worth of at least $1 million or an annual income above $200,000. Most NNN property deals require down payments in the range of 30% to 40%, making proper financial planning essential before acquisition.

5. Diverse Investment Opportunities

North Carolina offers a variety of NNN investment opportunities, from single-tenant retail locations in suburban growth corridors to industrial properties near logistics hubs. For instance, a net lease retail property in the Charlotte metro area with a nationally recognized tenant and built-in rent escalations provides strong cash flow and long-term security. Investors using a 1031 exchange can further enhance their portfolios while deferring capital gains taxes.

Triple-net (NNN) investors are increasingly identifying North Carolina as a top-tier destination for net lease investments. With its growing economy, competitive cap rates, and strong tenant demand, the state offers an ideal environment for stable, long-term returns. Here’s why NNN brokers and investors are turning their attention to North Carolina:

1. Competitive Cap Rates with Long-Term Growth Potential

North Carolina offers attractive cap rates, typically ranging from 5.5% to 7.5%, depending on tenant strength and lease structure. These rates present strong opportunities for investors seeking a balance of steady income and potential for long-term asset appreciation in a growing market.

2. Reasonably Priced Commercial Properties

Compared to coastal markets, North Carolina provides investors with more affordable entry points into quality commercial real estate. Investors can acquire NNN properties leased to national tenants—such as pharmacies, banks, and QSR chains—at relatively lower prices, allowing for strong cash flow and value growth.

3. Rapid Population Growth and Urban Expansion

The state is among the fastest-growing in the U.S., with cities like Charlotte, Raleigh, Durham, and Wilmington experiencing significant population inflows. This demographic boom drives demand for retail, service-based, and industrial properties, creating favorable conditions for NNN investments.

4. Strong Demand for Essential Retail and QSR Tenants

NNN investors are focusing on essential service providers and quick-service restaurants (QSRs) like Walgreens, Dollar General, Starbucks, and Chick-fil-A. North Carolina’s suburban expansion and retail-friendly zoning support a healthy pipeline of single-tenant net lease properties with creditworthy tenants and long-term leases.

5. Pro-Business Climate and Economic Development

North Carolina boasts a low corporate income tax rate, economic incentive programs, and a business-friendly regulatory environment. These factors encourage corporate relocations and expansions, especially in tech, finance, life sciences, and advanced manufacturing—fueling demand for commercial spaces suitable for NNN leasing.

6. Infrastructure and Industrial Growth

The state’s strategic location on the East Coast, with access to major ports (like Wilmington), railways, and interstates, supports rapid industrial and logistics development. Industrial NNN assets—such as distribution centers and flex-space warehouses, are increasingly sought after in regions like the Piedmont Triad and Research Triangle.

Income Taxes

North Carolina’s Tax Advantages for NNN Investors: A Business-Friendly Environment for Net Lease Properties

North Carolina offers a balanced and competitive tax environment that supports profitable NNN (Triple Net Lease) property investments. With relatively low income tax rates, no estate tax, and a favorable corporate tax structure, North Carolina presents a compelling case for NNN investors seeking both stability and strong returns. Here’s why investors and NNN brokers are taking a closer look at North Carolina:

1. Flat State Income Tax Rate

North Carolina imposes a flat individual income tax rate of 4.5% (as of 2025), one of the lowest among states that levy a personal income tax. This rate applies to all income brackets, which provides predictability and simplicity for investors earning rental income from NNN properties.

2. Competitive Corporate Income Tax

For NNN investors operating through corporations or LLCs taxed as corporations, North Carolina is exceptionally attractive. The corporate income tax rate is just 2.5%, the lowest of any state that levies such a tax. This allows investors to retain more profits and scale their property portfolios more efficiently.

3. No Estate or Inheritance Tax

North Carolina does not impose an estate or inheritance tax, making it easier for investors to transfer real estate assets to heirs without incurring additional tax liabilities. This tax advantage supports long-term wealth preservation and legacy planning for NNN investors.

4. Moderate Property Tax Rates

The state’s average effective property tax rate is around 0.77%, which is lower than the national average. Property tax rates may vary by county, but they remain generally affordable—keeping holding costs manageable and increasing net returns for NNN property owners.

5. Capital Gains Taxed as Regular Income

North Carolina does not have a separate state capital gains tax. Instead, capital gains are taxed at the flat personal income tax rate of 4.5%. This simplifies tax planning for investors and offers a competitive edge over high-tax states where capital gains are heavily penalized.

6. Business-Friendly Tax Environment

The state’s pro-business stance, combined with tax credits, grants, and incentive programs for real estate and job-creating investments, creates a favorable ecosystem for NNN investors. Whether operating as individuals, LLCs, or corporations, investors benefit from transparency, low compliance burdens, and predictable tax obligations.

Investing in triple-net lease (NNN) properties in North Carolina offers long-term stability, consistent income, and lower management responsibilities. With tenants covering taxes, insurance, and maintenance, these properties are ideal for hands-off investors. Here are some of the top locations in North Carolina to consider for NNN property investments, based on recent demographic and economic trends:

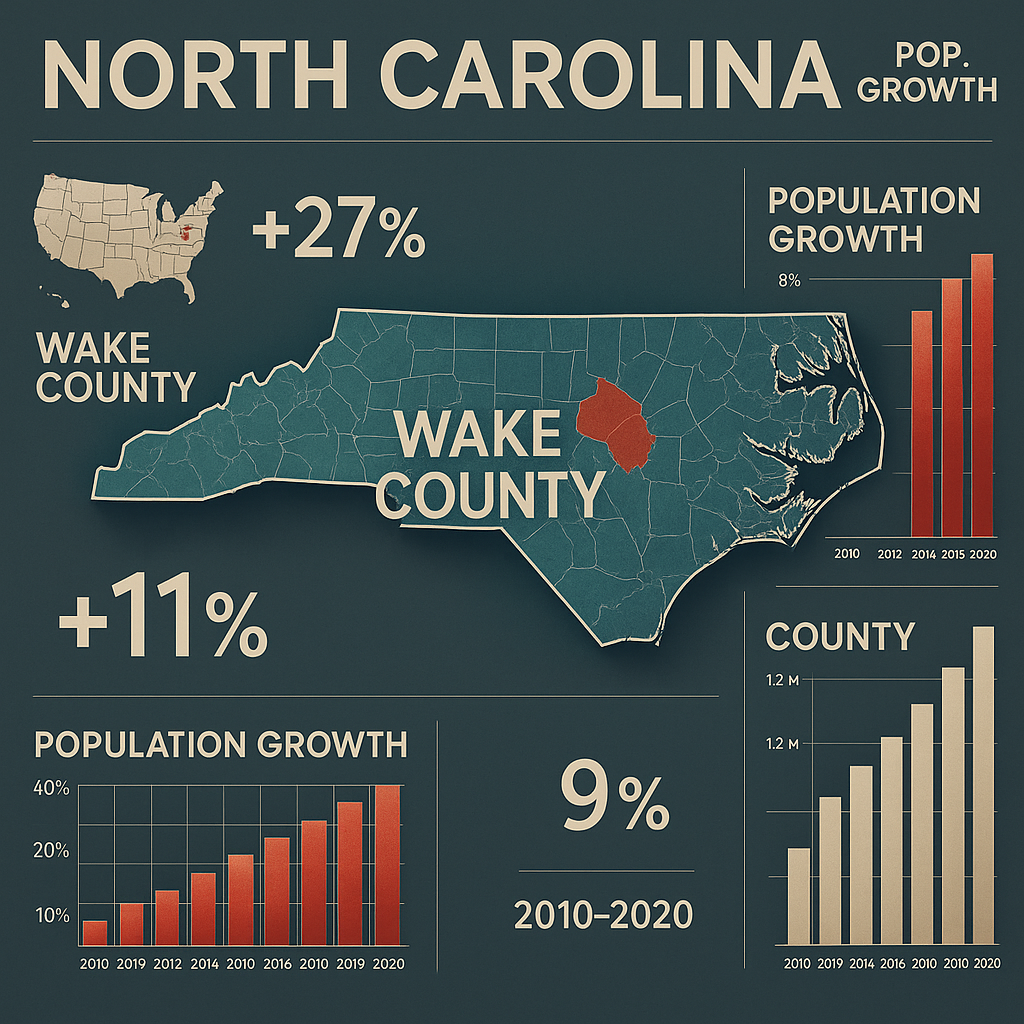

1. Wake County (Raleigh):

Population Growth: One of the fastest-growing counties in the Southeast, Wake County continues to attract new residents due to its strong job market and high quality of life. Raleigh’s metro area has seen sustained population increases year over year.

Economic Development: Home to the Research Triangle Park, Raleigh is a tech and life sciences hub with significant presence from companies like Apple, Google, and Cisco.

Investment Potential: High population and job growth make this area ideal for NNN properties in retail, medical offices, and service-based tenants.

2. Mecklenburg County (Charlotte):

Population Growth: Charlotte is the most populous city in North Carolina, with steady annual population gains and an influx of young professionals.

Economic Development: As a financial powerhouse (second-largest banking center in the U.S.), Charlotte attracts corporate headquarters, real estate development, and transportation infrastructure investment.

Investment Potential: The demand for retail, QSRs, banks, and office spaces supports strong NNN leasing opportunities.

3. Durham County (Durham):

Population Growth: Durham continues to grow as a central component of the Research Triangle area.

Economic Development: With a focus on biotech, healthcare, and education (Duke University), the county has a diverse and resilient economy.

Investment Potential: NNN properties in healthcare, research, and neighborhood retail sectors are in high demand due to stable tenant bases and steady foot traffic.

4. Union County (Monroe/Waxhaw Area):

Population Growth: Union County has seen notable suburban expansion due to its proximity to Charlotte and high quality of life.

Economic Development: New residential and commercial developments have increased demand for services and retail infrastructure.

Investment Potential: Strong opportunities for NNN retail and essential service tenants in growing suburban neighborhoods.

5. New Hanover County (Wilmington):

Population Growth: The Wilmington area has experienced consistent growth, driven by retirees and remote professionals relocating for coastal living.

Economic Development: The local economy benefits from port operations, tourism, and education (UNC Wilmington).

Investment Potential: High foot traffic areas and tourism support NNN properties in hospitality, dining, and essential retail.

6. Cabarrus County (Concord/Kannapolis):

Population Growth: Cabarrus County continues to expand as part of the Charlotte metropolitan area.

Economic Development: The region benefits from auto industry investments, healthcare, and retail development, including attractions like the Charlotte Motor Speedway.

Investment Potential: NNN properties in mixed-use developments and regional retail centers are increasingly attractive.

7. Buncombe County (Asheville):

Population Growth: Asheville and surrounding areas have seen growth fueled by tourism, healthcare, and lifestyle migration.

Economic Development: A strong arts, tourism, and wellness economy supports consistent demand for commercial real estate.

Investment Potential: Opportunities exist in retail and QSRs serving both locals and visitors, with potential for stable, long-term NNN leases.

Pros:

1️⃣ Competitive Cap Rates

Cap rates in North Carolina generally range from 5.5% to 7.5%, depending on asset class, location, and tenant quality. These rates offer an attractive return, especially in suburban and secondary markets, with less competition than top-tier states.

2️⃣ Strong Population and Job Growth

North Carolina is consistently ranked among the top states for inbound migration, with cities like Raleigh, Charlotte, and Wilmington growing rapidly. This fuels retail, service, and industrial demand—boosting long-term tenant stability and NNN investment performance.

3️⃣ Business-Friendly Tax Climate

North Carolina has a flat personal income tax of 4.5% and the lowest corporate income tax rate (2.5%) in the U.S. among states with such a tax. These rates promote a healthy business environment, supporting tenants’ longevity and growth.

4️⃣ Affordable Real Estate in Growth Corridors

Compared to states like California or New York, North Carolina offers moderately priced commercial real estate, especially in fast-growing suburbs and tertiary markets. This allows investors to secure NNN properties with national tenants at accessible price points.

5️⃣ Diverse and Expanding Economy

North Carolina has a diversified economy—spanning tech, healthcare, finance, biotech, logistics, and higher education. The Research Triangle (Raleigh-Durham-Chapel Hill) and Charlotte metro are magnets for corporate expansion and workforce talent.

6️⃣ Infrastructure and Industrial Growth

Strategic location on the East Coast with access to ports (Wilmington), interstates, and rail makes North Carolina attractive for logistics, warehousing, and last-mile distribution centers, ideal for NNN industrial and flex-space investments.

7️⃣ Reliable Essential Tenant Base

NNN investors can find long-term leases with national tenants like Dollar General, CVS, Starbucks, Chick-fil-A, Circle K, and AutoZone in both urban and suburban markets. These essential businesses thrive in both up and down markets.

Cons:

1️⃣ Slower Cap Rate Compression in Core Markets

As demand increases in prime areas like Raleigh and Charlotte, cap rates have compressed, making it harder to find undervalued NNN deals in these markets. Investors may need to explore suburban or rural areas for better yields.

2️⃣ Higher Property Taxes Than Some Southeastern States

North Carolina’s average effective property tax rate is ~0.77%, which is higher than some neighboring states. This can slightly increase holding costs, particularly for investors focused on long-term passive income.

3️⃣ Market Competition in Top Cities

Charlotte, Raleigh, and Durham attract significant investor attention, which can drive up prices and increase competition for high-credit tenants and prime NNN properties.

4️⃣ Regional Natural Disaster Risks

While less extreme than coastal states, eastern North Carolina faces hurricane exposure, and some mountain or inland areas can have flooding concerns. Investors should assess insurance costs and climate-related risks.

5️⃣ Urban Development Zoning Variability

Zoning regulations and municipal red tape can vary widely across counties. In some fast-growing areas, new commercial development may face delays or require more due diligence, impacting acquisition timelines.

North Carolina NNN Properties for 1031 Exchange

Invest in Free Standing Single Tenant Triple Net (NNN) Properties in North Carolina

Are you looking for a reliable 1031 exchange replacement property?

At Triple Net Investment Group, we specialize in the sale of single tenant NNN properties and triple net shopping centers across the United States. Our team is dedicated to helping investors find high-quality (Tenant Triple Net) NNN properties in North Carolina and nationwide that align with their financial goals and 1031 exchange requirements.

With our in-depth market knowledge and personalized service, we provide tailored investment strategies for both buyers and sellers of commercial real estate. Whether you’re looking to defer capital gains through a 1031 tax-deferred exchange or want to diversify your portfolio with income-generating assets, our team offers a wide selection of vetted NNN investment properties.

Corporate Tenant Credit Ratings

Find out more about the credit rating of the tenant before purchasing.

How safe are the triple net investment grade free standing single tenant properties?

Market Analysis

What three things should I know before investing?

Call or e-mail us and we will get back to you within 24 hours. We know of properties for sale that aren’t listed or advertised.

Email: [email protected] Tel: 202-361-3050

We strive hard to provide clients with quality customer service

We provide our clients with all of the information they need upfront to make an informed decision, even before a Letter of Intent is issued such as: tenant credit information, store sales, lease terms, options, renewal rates, rent escalations, location analysis, site analysis, market analysis, demographic data, cash on cash returns on investment, internal rate of returns after taxes, risks, likes, dislikes and so on. We will then strategies how to proceed on making a best offer. It is our goal to build a solid relationship with our clients and keep them updated on net lease investments, even though they may not have a need for years to come.(NNN Properties in North Carolina)

We markets our listings locally, nationally and internationally

Triple Net Investment Group difference is a concept that is revolutionary in the commercial real estate brokerage business. In addition to marketing our deals to potential investors, We markets our listings to the entire brokerage community. We put our listings directly in front of thousands of commercial real estate agents in each state, region and local where the property is located.