Why NNN Investors Prefer Ohio State: Higher Growth & Competitive Cap Rates Explained

Future Holding for NNN Property Investments in Ohio

Triple Net Lease (NNN) properties, where tenants are responsible for property taxes, insurance, and maintenance, continue to be a reliable and attractive investment vehicle for passive investors. In Ohio, the outlook for NNN property investments remains strong, backed by solid economic fundamentals, population centers, and increasing commercial demand.

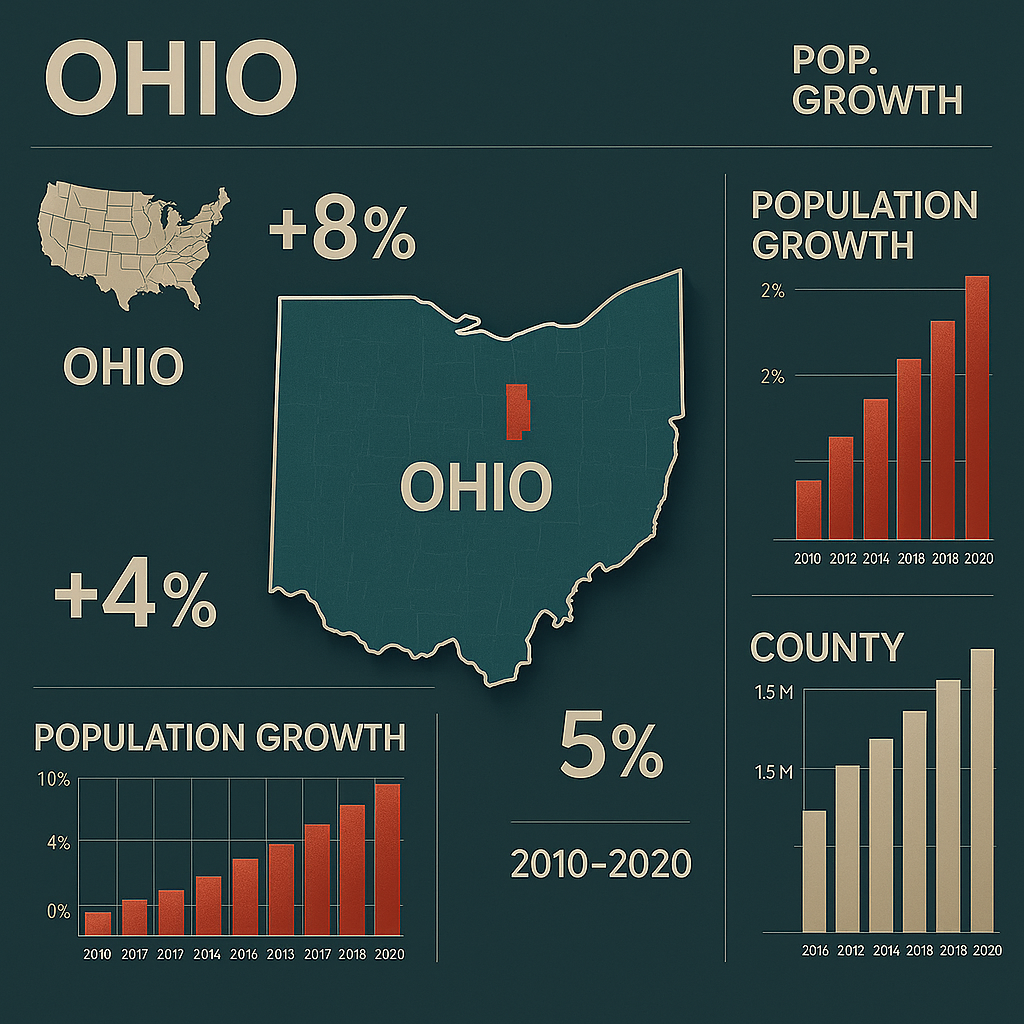

1. Economic and Population Growth

Ohio boasts a diversified economy led by healthcare, education, manufacturing, and logistics. Cities such as Columbus, Cincinnati, and Cleveland are experiencing steady population and job growth, particularly in tech and biomedical sectors. Columbus, for instance, has been one of the fastest-growing metro areas in the Midwest. This ongoing development fuels demand for commercial spaces, making Ohio an appealing location for NNN investors seeking long-term growth and tenant stability.

2. Stability and Demand for NNN Properties

NNN lease properties are in high demand across Ohio’s metropolitan and suburban areas, offering investors predictable, long-term income streams. The state’s business-friendly environment and relatively low operating costs encourage national brands and franchise tenants to expand, boosting demand for net lease retail, industrial, and medical office properties. This tenant reliability enhances the investment appeal, especially for investors seeking minimal management and steady cash flow.

3. Market Trends and Cap Rates

Cap rates in Ohio for NNN investments tend to be higher than those found in coastal markets, often ranging from 6% to 7.5% depending on the asset type and tenant strength. This provides investors with better returns relative to the risk. Additionally, the increasing availability of net lease listings, particularly in emerging suburban corridors and near logistics hubs like Dayton and Toledo, offers investors a wider range of acquisition options in a competitive market.

4. Financing Considerations for NNN Investors

Prospective NNN investors in Ohio should consider standard financial entry points, which generally include a minimum net worth of $1 million or an annual income above $200,000. Down payments often range from 30% to 40% of the property value. Lenders are active in the region, especially for deals backed by national tenants with long-term leases, making Ohio a practical and accessible market for both new and seasoned NNN investors.

5. Local Market Opportunities

Ohio’s NNN property market presents multiple attractive opportunities, from retail drugstores and quick-service restaurants to logistics-oriented single-tenant industrial properties. For example, in the Columbus MSA, investors can find national tenant-occupied NNN properties with 10+ year leases and built-in rent escalations. These assets are ideal for investors pursuing 1031 exchanges, long-term wealth preservation, or diversification within growing Midwest markets.

Triple-net (NNN) investors are increasingly turning to Ohio as a prime location for net lease properties, thanks to its competitive cap rates, diverse economy, and growing urban centers. Here’s why NNN brokers and investors see Ohio as a lucrative market:

1. Competitive Cap Rates with Strong Market Stability

NNN investors are drawn to Ohio for its favorable cap rates, often ranging between 6% to 7.5%, depending on the tenant and location. These rates offer higher returns than many coastal states while maintaining the reliability of long-term national tenants. This makes Ohio an ideal market for investors looking to balance return and risk in stable economic regions.

2. Reasonable Property Prices in Key Metro Areas

Compared to larger coastal markets, Ohio’s commercial real estate market remains affordable and accessible. Investors can acquire NNN assets in key markets like Columbus, Cincinnati, and Cleveland at lower price points, which translates into lower entry costs and stronger cash flow potential. This affordability makes Ohio particularly attractive for both institutional and individual investors.

3. Urban Growth & Economic Expansion

Ohio’s urban centers, especially Columbus and Cincinnati, are experiencing rapid growth and diversification. Columbus has emerged as a tech and education hub, while Cincinnati and Cleveland have robust healthcare, logistics, and financial sectors. These cities continue to attract businesses and residents, increasing demand for commercial space and supporting the long-term value of NNN lease investments.

4. High Demand for National Tenants and QSRs

Essential retail and quick-service restaurants (QSRs) like Dollar General, Walgreens, Starbucks, Taco Bell, and Wendy’s remain strong performers in Ohio’s NNN market. These tenant categories are recession-resistant and benefit from steady foot traffic in both urban and suburban areas. Investors can capitalize on this demand with minimal landlord responsibilities.

5. Tax Incentives and Business-Friendly Environment

Ohio offers business-friendly incentives including property tax abatements, job creation tax credits, and infrastructure support. While passive LLC income is subject to some taxation, the state’s overall tax burden is lower than many densely populated states, making it attractive for investors utilizing 1031 exchanges or seeking steady post-tax returns.

6. Manufacturing, Healthcare & Logistics Growth

Ohio is a national leader in manufacturing, healthcare, and logistics, supported by its strategic Midwest location and strong transportation networks. Major employers like Procter & Gamble, Cleveland Clinic, and Intel (with its major semiconductor facility near Columbus) are expanding, creating ripple effects in retail and service demand. This industrial and corporate growth supports the ongoing need for NNN-leased properties across the state.

Income Taxes

Ohio’s Tax Landscape for NNN Investors: Key Considerations for Net Lease Properties

Ohio offers a mix of tax benefits and considerations for NNN (Triple-Net) investors. While it does not have the same no-tax advantages as some states, its overall tax structure remains relatively moderate, and strategic planning can still yield favorable net returns. Here’s why NNN investors and brokers should understand Ohio’s tax framework when evaluating investment opportunities:

1. Passive LLC Income: Taxed Under the Commercial Activity Tax (CAT)

Ohio does not have a traditional corporate income tax. Instead, LLCs and other business entities are subject to the Commercial Activity Tax (CAT). This gross receipts tax applies to most businesses with over $150,000 in annual receipts in Ohio. However, for many NNN investors, the first $1 million in gross receipts is taxed at a low flat rate of $150, with amounts above that taxed at 0.26%. This model can be favorable for investors with modest property portfolios or those structured efficiently.

2. No State-Level Tax on Out-of-State LLCs Without Nexus

NNN investors who own Ohio properties through an out-of-state LLC with no physical or economic nexus in Ohio may not be subject to the CAT or income tax. This highlights the importance of strategic entity structuring and working with knowledgeable tax advisors to minimize exposure based on domicile and business presence.

3. Moderate Personal Income Tax Rates

Ohio has a graduated personal income tax, with recent reforms lowering rates across the board. As of 2024:

Income under $26,050: 0%

$26,051 to $100,000: 2.75%

$100,001 to $115,300: 3.69%

Over $115,300: 3.75%

These moderate rates make Ohio more attractive than high-tax states, especially for NNN investors reporting pass-through income on their personal returns.

4. No Estate or Inheritance Tax

Ohio repealed its estate tax in 2013 and does not impose an inheritance tax, making it a favorable environment for generational wealth transfer. Investors can hold and pass down NNN properties in Ohio without incurring additional state-level death taxes, preserving more value for heirs and beneficiaries.

5. Average Property Tax Rates

Ohio’s effective property tax rate averages around 1.52%, slightly above the national average. Rates vary by county and municipality, with suburban and metro areas like Franklin (Columbus) and Hamilton (Cincinnati) typically levying higher rates. Investors should analyze property-specific tax burdens during due diligence to ensure holding costs align with income expectations.

6. Capital Gains Taxed as Regular Income

Ohio does not have a separate capital gains tax. Capital gains are taxed as part of personal or business income under the state’s income tax system. While this does not offer a lower rate for long-term gains, it provides predictability in tax planning. Investors using 1031 exchanges can still defer capital gains taxes at the federal level when reinvesting into other like-kind properties, including those in Ohio.

Investing in triple net lease (NNN) properties in Ohio is a strategic opportunity for investors seeking passive income and long-term asset growth. With tenants responsible for property taxes, insurance, and maintenance, NNN investments are ideal for hands-off investors. Based on recent population and economic trends, here are some of the top cities and counties in Ohio to consider for NNN property investments:

1. Franklin County (Columbus):

Population Growth: Franklin County remains the fastest-growing county in Ohio, adding over 18,000 new residents between 2023 and 2024, fueled largely by domestic migration and job creation.

Economic Development: Columbus has emerged as a national tech and finance hub, bolstered by major developments such as the Intel semiconductor plant and expansions by Amazon and JPMorgan Chase.

Investment Potential: With high job growth and demand for retail, medical, and service spaces, NNN investors can benefit from steady returns in areas like Grove City, Westerville, and Dublin.

2. Hamilton County (Cincinnati):

Population Growth: While modest overall, certain neighborhoods and suburbs such as Blue Ash, West Chester, and Mason are seeing steady population inflow and housing development.

Economic Development: Cincinnati’s diverse economy includes consumer goods, healthcare, logistics, and financial services, with major employers like Procter & Gamble and Kroger driving demand.

Investment Potential: The county’s strong retail base and suburban growth offer solid opportunities for NNN retail centers and national tenant leases.

3. Delaware County (North of Columbus):

Population Growth: Delaware County continues to be one of the fastest-growing counties in the Midwest, with consistent year-over-year gains.

Economic Development: The area is known for its high median incomes, excellent school districts, and proximity to Columbus tech corridors.

Investment Potential: Ideal for NNN investments in QSRs, grocery-anchored centers, and healthcare properties, particularly in areas like Powell and Lewis Center.

4. Cuyahoga County (Cleveland):

Population Growth: While Cleveland’s urban core has seen slight declines, revitalized neighborhoods and suburbs (e.g., Lakewood, Parma, and Strongsville) show positive net migration.

Economic Development: Cleveland benefits from a strong healthcare and biomedical sector, anchored by the Cleveland Clinic and University Hospitals.

Investment Potential: These stable institutions support demand for NNN medical office buildings, pharmacies, and service-based retail in nearby areas.

5. Warren County (Suburbs of Cincinnati/Dayton):

Population Growth: One of Ohio’s fastest-growing suburban counties, adding thousands of new residents annually, particularly in cities like Mason, Lebanon, and Springboro.

Economic Development: High quality of life, new home developments, and proximity to both Cincinnati and Dayton have made it a hotspot for families and professionals.

Investment Potential: Investors should consider NNN opportunities in essential retail, child care, and medical centers in this high-demand, high-growth area.

6. Licking County (East of Columbus):

Population Growth: Licking County is experiencing significant growth driven by Intel’s $20+ billion chip manufacturing complex, attracting thousands of new workers and suppliers.

Economic Development: This project, along with complementary infrastructure and housing investments, is transforming the area into a major industrial-tech corridor.

Investment Potential: Excellent potential for NNN industrial facilities, service-based retail, and housing-supportive commercial properties in cities like Newark and Heath.

Pros:

1️⃣ Competitive Cap Rates

Ohio offers attractive cap rates in the 6%–7.5% range, depending on asset class and location.

These are higher than coastal markets like California or New York, giving investors better cash-on-cash returns and a stronger yield spread over financing costs.

2️⃣ Strong Economic and Industry Diversification

Ohio has a diverse economy, including healthcare, logistics, education, manufacturing, and tech. Major employers like Cleveland Clinic, Amazon, Procter & Gamble, and Intel are fueling job growth and tenant demand, especially in Columbus, Cincinnati, and Cleveland.

3️⃣ Growing Metro Areas

Cities like Columbus are among the fastest-growing metros in the Midwest, with strong in-migration and housing development. This population growth supports expanding retail demand, creating long-term stability for NNN investors.

4️⃣ Moderate Property Tax Rates

Ohio’s average effective property tax rate is ~1.52%—higher than the national average, but lower than many Northeast states. Investors benefit from predictable tax bills and can find tax-incentivized zones in redevelopment areas.

5️⃣ Affordable Commercial Real Estate

Compared to high-cost markets, Ohio’s commercial property prices are relatively low, especially in secondary and suburban markets. This allows NNN investors to enter the market at lower acquisition costs and achieve healthy returns.

6️⃣ Favorable Tax Treatment for 1031 Exchanges

Ohio recognizes federal 1031 like-kind exchanges, enabling investors to defer capital gains taxes when reinvesting into qualified NNN properties in-state or out-of-state.

7️⃣ Expanding Essential Retail & Service Sectors

Ohio has a strong base of national tenants in essential retail (Dollar General, Walgreens, Tractor Supply), QSRs (Taco Bell, Wendy’s), and medical/dental tenants. Demand is steady in both urban and suburban corridors, making NNN leases secure and low-risk.

Cons:

1️⃣ Slower Appreciation Than Sunbelt States

Ohio’s real estate market is more stable than speculative, with moderate annual appreciation.

Investors looking for rapid capital gains may find faster growth in markets like Texas or Florida.

2️⃣ Harsh Winters Can Affect Property Operations

Severe winters in northern and central Ohio may lead to higher maintenance costs and seasonal foot traffic declines. This can slightly affect retail tenants, particularly QSRs and gas stations.

3️⃣ Localized Tenant Demand

Tenant strength and leasing velocity vary widely between metros and rural areas. While Columbus and Cincinnati are strong, some rural counties or post-industrial towns may face slower tenant interest.

4️⃣ Higher Property Taxes in Some Counties

Certain high-growth counties (e.g., Franklin, Delaware, and Cuyahoga) have above-average property taxes, which may impact net returns if not factored into underwriting.

5️⃣ Limited High-Density Urban Retail Growth

While Ohio has robust suburban development, its urban cores have less high-end retail momentum compared to tier-1 markets. Investors seeking luxury retail or urban lifestyle centers may find fewer options in the state.

Ohio NNN Properties for 1031 Exchange

Invest in Free Standing Single Tenant Triple Net (NNN) Properties in Ohio

Are you looking for a reliable 1031 exchange replacement property?

At Triple Net Investment Group, we specialize in the sale of single tenant NNN properties and triple net shopping centers across the United States. Our team is dedicated to helping investors find high-quality (Tenant Triple Net) NNN properties in Ohio and nationwide that align with their financial goals and 1031 exchange requirements.

With our in-depth market knowledge and personalized service, we provide tailored investment strategies for both buyers and sellers of commercial real estate. Whether you’re looking to defer capital gains through a 1031 tax-deferred exchange or want to diversify your portfolio with income-generating assets, our team offers a wide selection of vetted NNN investment properties.

Corporate Tenant Credit Ratings

Find out more about the credit rating of the tenant before purchasing.

How safe are the triple net investment grade free standing single tenant properties?

Market Analysis

What three things should I know before investing?

Call or e-mail us and we will get back to you within 24 hours. We know of properties for sale that aren’t listed or advertised.

Email: [email protected] Tel: 202-361-3050

We strive hard to provide clients with quality customer service

We provide our clients with all of the information they need upfront to make an informed decision, even before a Letter of Intent is issued such as: tenant credit information, store sales, lease terms, options, renewal rates, rent escalations, location analysis, site analysis, market analysis, demographic data, cash on cash returns on investment, internal rate of returns after taxes, risks, likes, dislikes and so on. We will then strategies how to proceed on making a best offer. It is our goal to build a solid relationship with our clients and keep them updated on net lease investments, even though they may not have a need for years to come.(NNN Properties in Ohio)

We markets our listings locally, nationally and internationally

Triple Net Investment Group difference is a concept that is revolutionary in the commercial real estate brokerage business. In addition to marketing our deals to potential investors, We markets our listings to the entire brokerage community. We put our listings directly in front of thousands of commercial real estate agents in each state, region and local where the property is located.