Why NNN Investors Prefer Oregon State: Higher Growth & Competitive Cap Rates Explained

Future Holding for NNN Property Investments in Oregon

Triple Net Lease (NNN) properties, where tenants are responsible for property taxes, insurance, and maintenance, offer passive income with minimal landlord responsibility. In Oregon, NNN property investments show a strong and growing future, supported by several market-driven advantages:

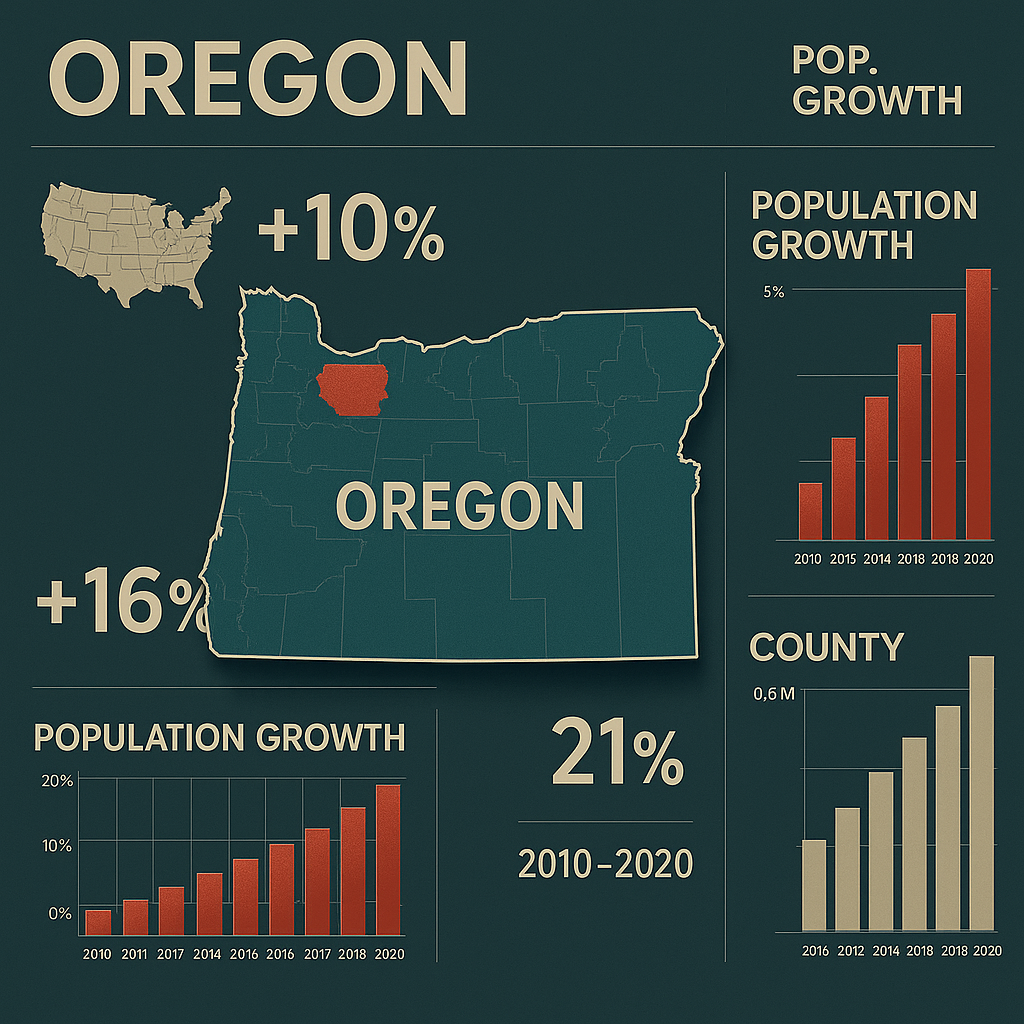

1. Economic and Population Growth

Oregon continues to experience steady population and economic growth, particularly in cities like Portland, Bend, and Eugene. This upward trend is driving demand for retail, industrial, and office spaces, creating more opportunities for NNN investors. As businesses expand and migrate to Oregon’s thriving metros, net lease properties become increasingly valuable assets for long-term real estate portfolios.

2. Stability and Demand for NNN Properties

The stability offered by NNN lease agreements is particularly attractive in Oregon’s active real estate markets. With tenants assuming responsibility for most property-related expenses, these investments provide dependable cash flow over multi-year lease terms. Investors can count on consistent income with reduced exposure to maintenance or operational risks, especially in high-demand areas near transportation corridors and tech hubs.

3. Market Trends and Cap Rates

Cap rates for NNN properties in Oregon are holding firm, with modest increases reflecting broader national trends. These rising cap rates can offer more favorable returns to investors compared to previous years. Moreover, increased inventory of NNN listings across the state gives investors a wider selection of properties, from brand-name retail stores to distribution centers serving the regional supply chain.

4. Financing Considerations for NNN Investors

Entering the Oregon NNN market typically requires a high net worth and access to capital. Investors should anticipate a 30% to 40% down payment and ensure they meet income thresholds that lenders favor, such as a $200,000+ annual income or $1 million+ net worth. Strategic financing, particularly in growth markets like Portland or Medford, enables investors to secure prime locations with long-term lease potential.

5. Local Market Opportunities

Oregon offers diverse NNN opportunities, including single-tenant retail outlets, medical offices, and industrial warehouses. A growing number of national tenants, such as pharmacies, quick-service restaurants, and logistics companies, are locking in multi-year leases, making these assets ideal for long-term holders. Additionally, 1031 exchange investors are increasingly targeting Oregon to defer capital gains and scale their portfolios through reinvestment into stabilized, income-generating properties.

Triple-net (NNN) investors are increasingly turning to Oregon as a prime location for net lease properties, thanks to its robust economic growth, strategic West Coast positioning, and expanding demand for commercial space. Here’s why NNN brokers and investors see Oregon as a high-potential market:

1. Competitive Cap Rates with Long-Term Upside

Oregon offers cap rates typically ranging from 5% to 7%, providing a balance between return and stability. While not as high as in some southern states, Oregon’s cap rates are often more attractive than those found in premium-tier urban markets like San Francisco or Seattle. The state’s growing economy and tenant stability make it a compelling choice for investors seeking reliable income streams with long-term appreciation potential.

2. Rising Property Values in Growth Markets

Although Oregon’s property prices have appreciated over the past decade, they still offer value compared to neighboring West Coast states. NNN investors can find opportunities in emerging submarkets like Bend, Medford, and Salem, where property values are on the rise but remain accessible. This provides an excellent entry point for investors seeking both yield and long-term equity growth.

3. Strong Population and Economic Growth

Oregon’s cities, particularly Portland, Eugene, and Bend, are seeing consistent population increases fueled by tech sector growth, quality of life, and a skilled workforce. This population and economic expansion drives demand for essential services, fueling growth in net lease sectors such as retail, healthcare, and logistics.

4. High Demand for National Retail and QSR Tenants

Investors are focusing on Oregon’s essential retail and quick-service restaurant (QSR) tenants such as Starbucks, Walgreens, Dutch Bros, 7-Eleven, and Chick-fil-A. With a focus on long-term leases and high-traffic locations, these tenants ensure predictable income and low turnover—ideal conditions for NNN investment strategies.

5. Tax Advantages for Real Estate Investors

While Oregon does not impose a state sales tax, real estate investors may also benefit from tax-efficient strategies like 1031 exchanges, which allow for deferral of capital gains taxes when reinvesting in like-kind properties. Investors utilizing LLC structures can strategically manage income and reduce tax exposure through proper planning.

6. Industrial and Logistics Expansion

Oregon is becoming a regional hub for distribution, warehousing, and light manufacturing, especially in the I-5 corridor connecting Portland with California and Washington. Industrial NNN properties are in high demand, with national and regional tenants seeking long-term leases in strategic locations, giving investors access to stable returns in a growing asset class.

Income Taxes

Oregon’s Tax Environment for NNN Investors: Considerations for Net Lease Property Investments

While Oregon offers a strong economic environment and high tenant demand for triple-net (NNN) investments, it’s essential for investors to understand the state’s tax structure. Unlike some tax-friendly states, Oregon imposes several taxes that investors should factor into their financial models. Here’s a breakdown of Oregon’s tax landscape and how it impacts NNN property investors:

1. State Income Tax on LLC and Rental Income

Oregon does tax rental income earned through LLCs and pass-through entities. Rental income is considered personal income if passed to individual members, and it is taxed at Oregon’s personal income tax rates. This means NNN investors operating through an LLC should be prepared for state tax obligations on net income generated by their properties.

2. Personal Income Tax Rates

Oregon has a progressive state income tax, with relatively high rates compared to other states. For 2025, the tax brackets are as follows:

4.75% on the first $4,050 of taxable income

6.75% on taxable income between $4,051 and $10,200

8.75% on income between $10,201 and $125,000

9.9% on income above $125,000

NNN investors who receive income through pass-through LLCs or direct ownership should calculate their net yield after Oregon’s income tax impact.

3. No Sales Tax

A notable benefit for investors and tenants in Oregon is the absence of state sales tax. This is advantageous for retail tenants, especially national brands and QSRs, which may view Oregon as a cost-efficient location. As a result, demand for NNN retail space often remains high, which can support long-term occupancy and rental stability.

4. Real Estate and Property Tax Rates

Oregon’s property tax rates are moderate, with an average effective rate of approximately 0.90%. While not as low as in some southern states, the tax burden is still manageable, especially in areas with steady appreciation. Property tax assessments are based on limited annual increases, which helps investors project future costs with relative certainty.

5. No State-Level Estate or Inheritance Tax

Oregon does impose an estate tax, but only on estates valued above $1 million. Investors looking to transfer assets should plan accordingly. Trust structures and advanced estate planning strategies can help reduce the impact for NNN property owners with large holdings.

6. Capital Gains Taxation

Oregon does not have a separate capital gains tax, but capital gains are taxed as ordinary income at the same progressive personal income tax rates (up to 9.9%). NNN investors planning a sale or 1031 exchange should include this in their tax strategy, especially when calculating post-sale cash flow or reinvestment requirements.

Investing in triple net lease (NNN) properties in Oregon can be a strategic choice, particularly in areas experiencing strong population growth, business expansion, and economic diversification. NNN properties shift the responsibility of property taxes, insurance, and maintenance to the tenant, offering investors passive income with fewer operational demands. Based on recent trends and demographic shifts, here are the top locations in Oregon to consider for NNN investments:

1. Deschutes County (Bend-Redmond):

Population Growth: From 2023 to 2024, Deschutes County continued its upward trajectory, driven by in-migration from urban areas across the West Coast.

Economic Development: Bend has transformed into a thriving hub for remote work, tech startups, healthcare, and outdoor tourism. The region also boasts a growing craft beverage and hospitality industry.

Investment Potential: Bend’s rapid development and affluent population create demand for national retail chains, QSRs, medical facilities, and mixed-use developments, ideal for NNN investments.

2. Washington County (Hillsboro-Beaverton):

Population Growth: Washington County remains one of Oregon’s fastest-growing areas due to its suburban appeal and proximity to Portland.

Economic Development: Home to Intel’s largest campus and a growing tech sector, Hillsboro attracts a skilled workforce and ongoing infrastructure investment.

Investment Potential: The expanding residential base and commercial activity make it a strong market for NNN properties in office, healthcare, and retail sectors.

3. Lane County (Eugene-Springfield):

Population Growth: Lane County continues to see steady population growth, particularly in Eugene, driven by its reputation as a college town and quality of life.

Economic Development: Anchored by the University of Oregon, the region benefits from education, healthcare, and renewable energy sectors.

Investment Potential: Consistent demand from students, faculty, and healthcare workers supports NNN opportunities in retail, housing-adjacent services, and walkable neighborhood centers.

4. Marion County (Salem):

Population Growth: Salem, the state capital, has seen moderate but steady population growth as housing remains more affordable compared to Portland.

Economic Development: Government, agriculture, and manufacturing drive Salem’s economy, offering diverse opportunities for commercial development.

Investment Potential: A balanced tenant base and lower acquisition costs make Salem attractive for investors targeting stable, long-term NNN leases with essential businesses.

5. Jackson County (Medford-Ashland):

Population Growth: Southern Oregon continues to attract retirees and remote professionals, with Jackson County experiencing consistent growth.

Economic Development: Medford serves as the regional medical and retail hub, while Ashland’s tourism and cultural economy add diversity.

Investment Potential: Medford’s retail and healthcare demand supports NNN leasing to national pharmacy chains, clinics, and QSRs in high-traffic corridors.

6. Clackamas County (Happy Valley, Oregon City):

Population Growth: As part of the Portland metropolitan area, Clackamas County continues to expand, especially in fast-developing suburban communities like Happy Valley.

Economic Development: The region benefits from high residential development, excellent school districts, and a strong base of middle-to-upper-income households.

Investment Potential: New shopping centers, medical offices, and service-based businesses present strong opportunities for NNN investments with reputable national tenants.

Pros:

1️⃣ Strategic West Coast Location

Oregon sits between California and Washington, offering access to major markets and trade routes. Cities like Portland, Eugene, and Medford serve as vital regional distribution and retail hubs, attracting national tenants.

2️⃣ No State Sales Tax

Oregon is one of the few states with no state-level sales tax, making it attractive to retail tenants. This advantage enhances consumer spending and drives demand for NNN-leased retail properties.

3️⃣ Growing Population in Key Markets

Areas like Deschutes County (Bend), Washington County (Hillsboro), and Clackamas County (Happy Valley) are seeing consistent population growth. This supports retail expansion, housing development, and essential services, ideal sectors for NNN investments.

4️⃣ Economic Diversity

Oregon’s economy is supported by tech, healthcare, education, manufacturing, and logistics. This diversity helps stabilize the commercial real estate market and ensures demand for various tenant types in NNN properties.

5️⃣ High Demand from National Tenants

NNN investors in Oregon benefit from strong demand by national tenants such as Starbucks, Walgreens, 7-Eleven, Chipotle, Dutch Bros, and medical clinics. These tenants often seek long-term leases in both urban and suburban growth areas.

6️⃣ Environmental and Lifestyle Appeal

The state’s emphasis on quality of life, sustainability, and green space makes it appealing to consumers and businesses alike. This lifestyle appeal helps attract a steady flow of professionals and new residents, which drives long-term commercial demand.

7️⃣ Opportunities in Medical & Essential Retail

The healthcare sector is rapidly expanding, especially in secondary cities like Eugene, Salem, and Medford. NNN properties leased to urgent care centers, dental offices, and pharmacies provide stable, recession-resistant income.

Cons:

1️⃣ High State Income Tax

Oregon has a progressive income tax system with a top marginal rate of 9.9%, which affects individual investors receiving income from LLCs or pass-through structures. This can reduce net returns unless offset by strong yields or tax planning.

2️⃣ Moderate to High Property Costs in Metro Areas

Major urban areas like Portland have relatively high real estate prices, which can reduce initial cap rates and increase entry costs. Investors may need to explore emerging submarkets for better value.

3️⃣ Slower Permit and Zoning Processes

Oregon’s development approval processes can be slow and highly regulated, especially in urban areas. Delays in permitting or zoning may impact redevelopment or build-to-suit NNN projects.

4️⃣ Earthquake Risk (Western Oregon)

While not as frequent as hurricanes or tornadoes in other states, Oregon, especially along the Cascadia Subduction Zone, faces seismic risk. Earthquake preparedness and insurance costs should be factored into investment analysis.

5️⃣ Tenant Demand Concentrated in Select Areas

While cities like Portland, Bend, and Hillsboro are thriving, rural and eastern Oregon can experience lower demand and higher vacancy risk. Investors should prioritize tenant analysis and population trends when evaluating locations.

6️⃣ Political and Regulatory Climate

Oregon has progressive land-use laws and urban growth boundaries that may limit supply expansion but also create complexity in site selection. Investors should work with local experts to navigate state-specific regulations.

Oregon NNN Properties for 1031 Exchange

Invest in Free Standing Single Tenant Triple Net (NNN) Properties in Oregon

Are you looking for a reliable 1031 exchange replacement property?

At Triple Net Investment Group, we specialize in the sale of single tenant NNN properties and triple net shopping centers across the United States. Our team is dedicated to helping investors find high-quality (Tenant Triple Net) NNN properties in Oregon and nationwide that align with their financial goals and 1031 exchange requirements.

With our in-depth market knowledge and personalized service, we provide tailored investment strategies for both buyers and sellers of commercial real estate. Whether you’re looking to defer capital gains through a 1031 tax-deferred exchange or want to diversify your portfolio with income-generating assets, our team offers a wide selection of vetted NNN investment properties.

Corporate Tenant Credit Ratings

Find out more about the credit rating of the tenant before purchasing.

How safe are the triple net investment grade free standing single tenant properties?

Market Analysis

What three things should I know before investing?

Call or e-mail us and we will get back to you within 24 hours. We know of properties for sale that aren’t listed or advertised.

Email: [email protected] Tel: 202-361-3050

We strive hard to provide clients with quality customer service

We provide our clients with all of the information they need upfront to make an informed decision, even before a Letter of Intent is issued such as: tenant credit information, store sales, lease terms, options, renewal rates, rent escalations, location analysis, site analysis, market analysis, demographic data, cash on cash returns on investment, internal rate of returns after taxes, risks, likes, dislikes and so on. We will then strategies how to proceed on making a best offer. It is our goal to build a solid relationship with our clients and keep them updated on net lease investments, even though they may not have a need for years to come.(NNN Properties in Oregon)

We markets our listings locally, nationally and internationally

Triple Net Investment Group difference is a concept that is revolutionary in the commercial real estate brokerage business. In addition to marketing our deals to potential investors, We markets our listings to the entire brokerage community. We put our listings directly in front of thousands of commercial real estate agents in each state, region and local where the property is located.