Why NNN Investors Prefer Rhode Island State: Higher Growth & Competitive Cap Rates Explained

Future Holding for NNN Property Investments in Rhode Island

Triple Net Lease (NNN) properties, where tenants are responsible for property taxes, insurance, and maintenance, are an ideal investment option for those seeking passive income and reduced management responsibilities. In Rhode Island, the future of NNN property investments appears strong, supported by key economic and real estate trends:

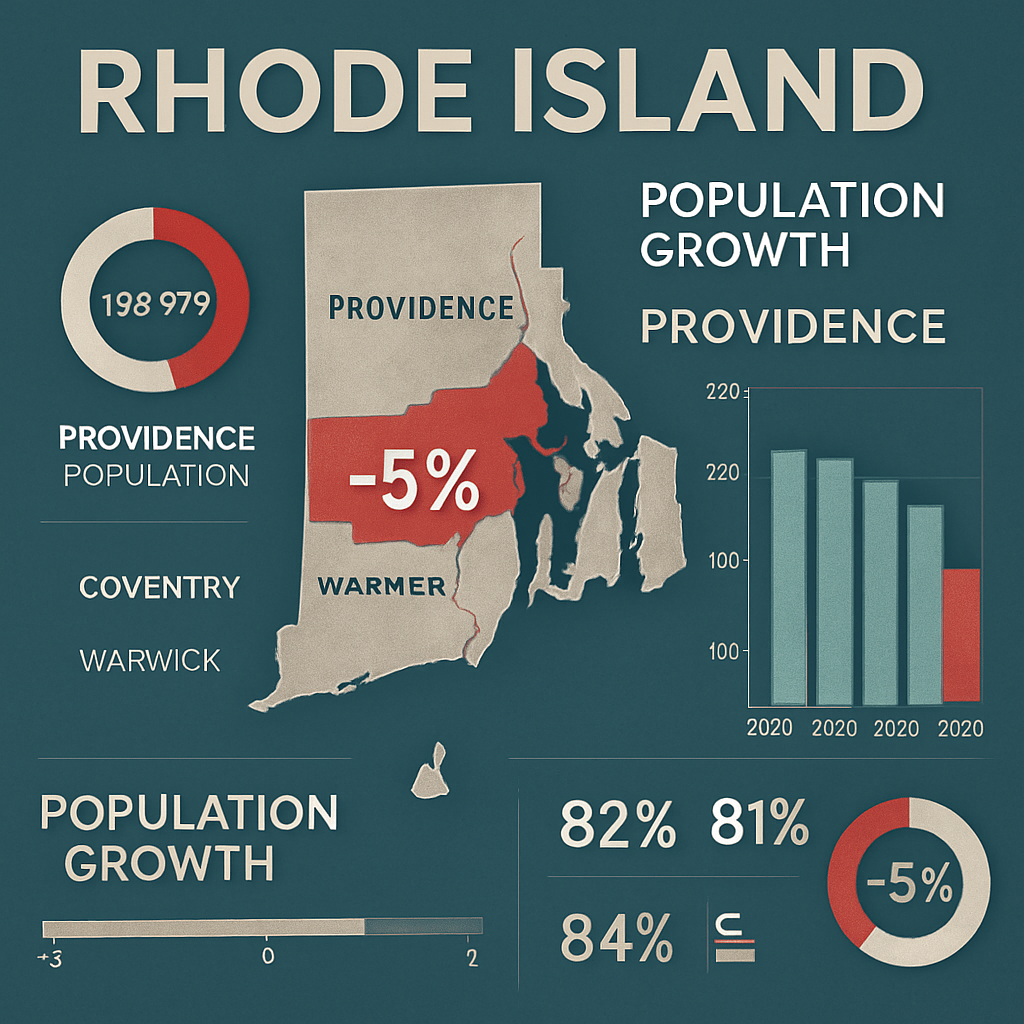

1. Economic and Population Growth

Rhode Island, though one of the smaller states by size and population, has demonstrated steady economic growth, particularly in areas such as Providence, Warwick, and Cranston. The state benefits from a strategic location in the Northeast corridor, close to Boston and New York City, which enhances its attractiveness for businesses and investors. Continued urban development and a growing service-sector economy support rising demand for commercial real estate, making NNN properties a smart long-term investment.

2. Stability and Demand for NNN Properties

With a strong emphasis on healthcare, education, and marine industries, Rhode Island hosts many national and regional tenants looking for stable lease arrangements. NNN properties in the state benefit from predictable income streams and minimal landlord involvement, especially in prime urban and suburban locations. This dependable structure appeals to investors seeking security, even in uncertain market conditions.

3. Market Trends and Cap Rates

Cap rates for NNN properties in Rhode Island remain competitive, reflecting a balanced investment environment. While generally lower than in high-growth Sunbelt states, Rhode Island’s cap rates offer a blend of security and moderate returns. As the market evolves, demand for quality net lease assets, particularly in retail and healthcare sectors, continues to rise, presenting new opportunities for NNN investors.

4. Financing Considerations for NNN Investors

To invest in Rhode Island’s NNN market, buyers typically need a net worth of at least $1 million or an annual income of $200,000+. Standard down payments range from 30% to 40%, depending on the tenant’s creditworthiness and lease terms. Investors entering the Rhode Island market must be prepared for a competitive environment but can benefit from relatively lower acquisition costs compared to larger Northeastern metros.

5. Local Market Opportunities

Rhode Island offers a range of NNN investment options, including single-tenant retail, medical office spaces, and industrial properties. In cities like Providence and Warwick, opportunities exist to acquire properties leased to national brands such as CVS, Dollar General, and Walgreens. For investors utilizing a 1031 exchange, Rhode Island’s stable market provides solid options for deferring capital gains while securing long-term, income-generating assets.

Triple-net (NNN) investors are increasingly turning to Rhode Island as a strategic location for net lease property investments, thanks to its strong tenant demand, resilient economy, and accessible property market. Here’s why NNN brokers and investors are recognizing Rhode Island as a smart choice for long-term growth and passive income:

1. Competitive Cap Rates in a Stable Market

Rhode Island offers competitive cap rates, often ranging between 5.5% to 6.5%, which strikes a balance between risk and return. While cap rates may not reach the highs of some emerging markets, the state’s economic and geographic stability makes it attractive for investors seeking reliable returns with national or regional tenants in place.

2. Accessible Property Prices for Northeastern Investors

Compared to neighboring Northeastern states like Massachusetts and Connecticut, Rhode Island presents more accessible entry points into the commercial real estate market. Investors can acquire well-located NNN properties, such as freestanding retail or medical offices, at more reasonable price levels, helping improve cash-on-cash returns while building equity in a strong market.

3. Steady Population and Economic Growth

Rhode Island continues to experience steady population growth in areas such as Providence, Warwick, and Cranston. The state benefits from proximity to major markets like Boston and New York, along with a diversified economy centered around healthcare, education, and maritime industries. These factors support long-term demand for retail, service, and industrial NNN properties.

4. Demand for Essential Retail and Service Tenants

NNN investors in Rhode Island find strong opportunities in leasing to essential retailers, pharmacies, and quick-service restaurants (QSRs). National tenants like CVS, Dollar Tree, Dunkin’, and Walgreens maintain a robust footprint throughout the state, offering consistent rental income and long-term lease stability for investors focused on recession-resistant sectors.

5. Strategic Location in the Northeast Corridor

Rhode Island’s strategic location between Boston and New York makes it an ideal market for distribution centers, last-mile logistics, and medical service providers. Investors can leverage the state’s transportation infrastructure and coastal access to support industrial and commercial leasing demand, especially in high-traffic corridors.

6. Attractive Opportunities for 1031 Exchange Investors

Rhode Island’s stable economic indicators and consistent rental demand make it an appealing market for 1031 exchange buyers. Investors looking to defer capital gains taxes can identify strong replacement properties with long-term leases and national tenants, aligning well with wealth preservation and passive income strategies.

Income Taxes

Rhode Island’s Tax Landscape for NNN Investors: What You Need to Know

Rhode Island presents a balanced tax environment that NNN investors should carefully consider when evaluating potential net lease property acquisitions. While not a no-tax state, Rhode Island offers certain benefits and competitive rates that can align well with long-term investment strategies. Here’s a breakdown of how the state’s tax policies impact NNN property investors:

1. State Income Tax on LLC Rental Income

In Rhode Island, passive income from rental properties held in an LLC is subject to state income tax. However, the state allows deductions and business expense write-offs that can reduce the taxable portion of rental income. Investors should work with tax professionals to optimize their structure and take advantage of all allowable deductions to reduce their overall tax liability.

2. Corporate Income Tax

Rhode Island imposes a flat corporate income tax rate of 7%, which is competitive for the Northeast region. Corporations holding NNN properties in Rhode Island can benefit from a predictable tax rate and business-friendly policies designed to support growth and reinvestment. The state also offers some incentives for businesses engaged in economic development or job creation.

3. Personal Income Tax Rates

Rhode Island uses a progressive personal income tax system with three brackets:

3.75% on income up to $73,450

4.75% on income between $73,451 and $166,950

5.99% on income above $166,950

These rates are moderate compared to neighboring high-tax states. NNN investors earning income as individuals or through pass-through entities can expect a manageable tax burden relative to other parts of the Northeast.

4. Estate and Inheritance Tax

Rhode Island does impose a state-level estate tax, but does not have an inheritance tax. The estate tax exemption threshold is approximately $1.7 million (as of 2025), meaning estates valued below this amount are not taxed. NNN investors planning long-term wealth transfer strategies should consider estate planning tools to minimize or avoid this tax when passing down properties.

5. Property Tax Rates

Rhode Island’s property tax rates are higher than the national average, with an effective property tax rate of approximately 1.3%. However, rates vary significantly by municipality. Cities like Providence and Cranston may have higher rates, while smaller towns may offer more favorable tax environments. NNN investors should factor in local property taxes when evaluating potential investments.

6. Capital Gains Tax Treatment

Rhode Island taxes capital gains as ordinary income, meaning gains are subject to the same personal income tax brackets listed above. The absence of a separate capital gains tax rate simplifies planning but can result in higher tax exposure on profitable sales. However, investors can still take advantage of Section 1031 exchanges to defer capital gains when reinvesting in like-kind NNN properties.

Investing in triple net lease (NNN) properties in Rhode Island can be a smart, long-term strategy for investors seeking stable, passive income with minimal management responsibilities. In a small but densely populated state, certain cities and counties stand out due to steady population growth, economic development, and commercial demand. Based on recent trends, here are some of the top areas in Rhode Island to consider for NNN property investments:

1. Providence County (Providence, Cranston, Pawtucket):

Population Growth: Providence County is the most populous county in the state, with a population exceeding 650,000. While overall growth is modest, urban revitalization efforts are drawing more residents and businesses into cities like Providence and Cranston.

Economic Development: Providence is a growing hub for healthcare, education, and creative industries. Major institutions such as Brown University and Lifespan Health drive local employment and attract long-term tenants.

Investment Potential: NNN properties in Providence County benefit from high foot traffic, consistent tenant demand, and opportunities in sectors like healthcare, education-related services, and QSRs (Quick-Service Restaurants).

2. Kent County (Warwick, West Warwick):

Population Growth: Kent County is home to approximately 170,000 residents, with Warwick being the second-largest city in the state. The area sees steady residential and commercial activity, driven by its accessibility and suburban appeal.

Economic Development: Warwick benefits from its proximity to T.F. Green International Airport and a mix of retail, logistics, and service industries. Its location near major highways supports regional commerce.

Investment Potential: NNN investors can find opportunities in logistics, retail strips, and single-tenant buildings leased to national brands. Warwick’s growing airport district is also attracting commercial development.

3. Washington County (South Kingstown, Narragansett, North Kingstown):

Population Growth: Known for its coastal towns and tourist appeal, Washington County has seen moderate population growth and seasonal traffic surges that support commercial activity.

Economic Development: Tourism, higher education (University of Rhode Island), and marine industries fuel the local economy. The region is also seeing increased investment in residential and mixed-use developments.

Investment Potential: Strong opportunities exist for NNN properties in retail, hospitality, and service sectors, especially those catering to tourists and seasonal residents in coastal towns.

4. Newport County (Newport, Middletown, Portsmouth):

Population Growth: While population growth is stable, Newport County enjoys a high influx of seasonal visitors and second-home residents, which supports ongoing commercial demand.

Economic Development: The area thrives on tourism, maritime industries, and military-related employment (Naval Station Newport). Economic stability is underpinned by hospitality and luxury retail sectors.

Investment Potential: NNN investors can target properties leased to national retail brands, restaurants, and service providers that benefit from Newport’s affluent consumer base and strong visitor numbers.

5. Bristol County (Bristol, Warren, Barrington):

Population Growth: With a population of just under 50,000, Bristol County is smaller in size but highly desirable due to its scenic waterfront communities and high median incomes.

Economic Development: The local economy is supported by education, tourism, and specialty retail. The town of Barrington, in particular, ranks as one of the most affluent communities in Rhode Island.

Investment Potential: Bristol County offers high-value NNN investment opportunities in boutique retail, medical office spaces, and service-based properties with long-term leases in place.

Pros:

1️⃣ Stable Cap Rates with Low Volatility

Rhode Island offers stable cap rates, typically in the 5.5%–6.5% range, making it attractive for risk-averse investors seeking consistent returns. The state’s mature real estate market tends to be less volatile, which benefits long-term holders of NNN properties.

2️⃣ Strategic Northeast Location

Situated between Boston and New York City, Rhode Island provides excellent access to major urban centers and transportation corridors. This location supports demand for logistics, retail, and service-based NNN tenants.

3️⃣ Affluent and Educated Population

Cities like Providence, Barrington, and Newport have high median household incomes and a well-educated population, increasing demand for quality retail and professional services, ideal tenants for NNN investors.

4️⃣ Economic Anchors in Healthcare, Education & Tourism

Rhode Island’s economy is driven by higher education (Brown University, URI), healthcare (Lifespan, Care New England), and tourism. These sectors provide economic resilience and a steady tenant base for NNN properties.

5️⃣ Urban Revitalization & Mixed-Use Growth

Providence and surrounding areas are experiencing urban redevelopment with new commercial and mixed-use projects. This revitalization boosts tenant demand and increases the attractiveness of NNN investments in urban cores.

6️⃣ Business Incentives for Development

Rhode Island offers various incentives for real estate development, including tax credits for urban revitalization zones and job creation programs. These programs can attract quality tenants and reduce vacancy risk.

7️⃣ Tight Retail Market with Low Vacancy

Retail vacancy rates in many parts of Rhode Island remain below the national average, especially for essential and service-based tenants. This tight market gives NNN investors better tenant retention and leasing power.

Cons:

1️⃣ Higher Property Taxes

Rhode Island has above-average property tax rates (~1.3% effective rate), especially in certain municipalities like Providence. This can increase holding costs for NNN investors, even when tenants cover taxes.

2️⃣ Smaller Market Size

As one of the smallest U.S. states, Rhode Island has a limited number of major metro areas. This can restrict the volume and variety of available NNN investment properties compared to larger states.

3️⃣ Slower Population Growth

Rhode Island’s population growth is modest, with some areas experiencing stagnation. While urban centers remain strong, investors should be selective about location to ensure tenant demand.

4️⃣ Capital Gains & Estate Taxes

Rhode Island taxes capital gains as ordinary income and imposes a state-level estate tax for estates above ~$1.7 million. These factors can impact exit strategies and long-term estate planning for NNN investors.

5️⃣ Seasonal and Regional Economic Dependence

Some local economies, especially in coastal and tourist areas, can be seasonally driven, which may affect certain tenant types. Investors should analyze lease terms and tenant performance in those regions accordingly.

Rhode Island NNN Properties for 1031 Exchange

Invest in Free Standing Single Tenant Triple Net (NNN) Properties in Rhode Island

Are you looking for a reliable 1031 exchange replacement property?

At Triple Net Investment Group, we specialize in the sale of single tenant NNN properties and triple net shopping centers across the United States. Our team is dedicated to helping investors find high-quality (Tenant Triple Net) NNN properties in Rhode Island and nationwide that align with their financial goals and 1031 exchange requirements.

With our in-depth market knowledge and personalized service, we provide tailored investment strategies for both buyers and sellers of commercial real estate. Whether you’re looking to defer capital gains through a 1031 tax-deferred exchange or want to diversify your portfolio with income-generating assets, our team offers a wide selection of vetted NNN investment properties.

Corporate Tenant Credit Ratings

Find out more about the credit rating of the tenant before purchasing.

How safe are the triple net investment grade free standing single tenant properties?

Market Analysis

What three things should I know before investing?

Call or e-mail us and we will get back to you within 24 hours. We know of properties for sale that aren’t listed or advertised.

Email: [email protected] Tel: 202-361-3050

We strive hard to provide clients with quality customer service

We provide our clients with all of the information they need upfront to make an informed decision, even before a Letter of Intent is issued such as: tenant credit information, store sales, lease terms, options, renewal rates, rent escalations, location analysis, site analysis, market analysis, demographic data, cash on cash returns on investment, internal rate of returns after taxes, risks, likes, dislikes and so on. We will then strategies how to proceed on making a best offer. It is our goal to build a solid relationship with our clients and keep them updated on net lease investments, even though they may not have a need for years to come.(NNN Properties in Rhode Island)

We markets our listings locally, nationally and internationally

Triple Net Investment Group difference is a concept that is revolutionary in the commercial real estate brokerage business. In addition to marketing our deals to potential investors, We markets our listings to the entire brokerage community. We put our listings directly in front of thousands of commercial real estate agents in each state, region and local where the property is located.