Why NNN Investors Prefer Texas State: Higher Growth & Competitive Cap Rates Explained

Future Outlook for NNN Property Investments in Texas

Triple Net Lease (NNN) properties, where tenants cover property taxes, insurance, and maintenance costs, have long been a preferred investment choice for those seeking steady income with minimal management responsibilities. In Texas, the future of NNN property investments remains promising, driven by several key factors:

1. Economic and Population Growth

Texas continues to attract significant population inflows, especially in metros like Austin, Dallas–Fort Worth, Houston, and San Antonio. This expansion fuels demand for new commercial developments by quick-service restaurants, pharmacies, convenience stores, and other retail operations, all ideal for NNN-type investments.

2. Stability and Demand for NNN Properties

NNN lease investments in Texas offer long-term, low-management income. Tenants typically assume payments for property taxes, insurance, and maintenance, minimizing landlord responsibilities. Lease terms often range from 10 to 25 years, ensuring income predictability and tenant retention.

3. Market Trends and Cap Rates

Across the U.S., average cap rates for NNN leases have risen—from about 5.25% in mid-2022 to around 5.5–7% as of early 2025, reflecting stronger yields for investors.

In Texas listings, cap rates vary but often fall within this national range. Examples from current listings show:

Walgreens in Fresno: ~7.0%

Mighty Wash Car Wash, Killeen: ~6.85%

7-Eleven, Austin: ~5.0%

This shows the availability of solid cap-rate opportunities across property types and locations.

4. Financing Considerations for NNN Investors

While specific underwriting criteria vary, NNN investments often command favorable financing due to their low-risk profile. Investors can leverage long-term, creditworthy leases and may benefit from tools like 1031 exchanges to defer taxes and grow their portfolios.

5. Local Market Opportunities in Texas

Texas features a broad array of NNN investment opportunities across property types—retail, fast food, pharmacies, car washes, banks, and industrial facilities. Several live listings highlight the variety:

Single-tenant industrial property (e.g., warehouse in San Antonio) with a ~7.50% cap rate and long lease term.

- Retail and retail-anchored spaces such as Walgreens, Dollar General, Take 5 Oil Change, with cap rates ranging from ~5.5% to ~7.8% across cities like Houston, Frisco, Bastrop, and others.

This diverse inventory enables investors to align acquisitions with their risk tolerance, regional preferences, and tenant-sector strategy.

Why NNN Investors Find Texas a Prime Market for Net Lease Properties

1. Competitive Cap Rates Across Texas

While national cap rates for properties like retail typically range between 5% and 7%, Texas offers particularly attractive opportunities, especially outside the top coastal metros. For example, QSR NNN properties in the U.S. South, including Texas, average about 6.18%, significantly higher than in the West or Midwest. In the Dallas–Fort Worth metro, current data shows cap rates in the low-mid 6% range for retail (around 6.6%) and 6.5% for industrial properties. These figures align well with Texas’s elevated growth and value proposition.

2. Affordable Acquisition Costs Relative to Coastal Markets

Texas generally offers more affordable commercial real estate costs compared to states like California or New York, while providing robust long-term upside through population growth and business expansions. These lower barriers to entry allow investors to acquire NNN assets with strong cash flow potential, especially in rapidly growing suburban markets.

3. Sustained Population Growth & Business Expansion

Texas leads the nation in growth:

The Dallas–Fort Worth area added 178,000 residents in one year, surpassing most metros nationwide.

Between 2023 and 2024, Texas added over 562,000 new residents, with projections of the population reaching 46.2 million by 2060.

The state notched the Governor’s Cup for the 13th straight year, welcoming 1,368 corporate projects in 2024, 36% of those located in the Dallas–Fort Worth area.

The Austin–San Antonio corridor sees explosive demographic and commercial momentum, anchoring retail, industrial, and mixed-use demand.

4. Ideal Tenant Profiles: Retail, QSR, Medical, Data Centers

Texas’s net lease landscape is diversified:

Retail and QSRs: High demand in growing suburbs, often anchored by brands like H-E-B, Home Depot, Whataburger, McDonald’s, and others, all ideal for NNN structures.

Healthcare & Medical Office: Rapid suburban growth fuels demand for outpatient and medical office buildings.

Industrial & Data Centers: Texas is a national leader, with DFW ranking among the top four U.S. data center markets, thanks to strong power infrastructure and high demand. This drives strong cap rate opportunities, particularly in well-located industrial sites

5. Texas Tax Environment: No State Income Tax vs. Franchise Tax Nuances

No state income tax: Texas doesn’t levy income tax on individuals, which can benefit investors structuring income through pass-through entities.

Franchise tax considerations: Texas DOES impose a franchise (margin) tax unless structured as a “passive entity.” However, under Texas law, LLCs cannot qualify as passive entities, even if 90% of their income is passive; only certain partnerships and trusts may avoid the tax. Rental income typically doesn’t count as passive either (unless royalties/minerals). So while Texas is tax-friendly on income, investors need to structure ownership carefully to minimize franchise tax exposure.

6. Infrastructure & Strategic Growth Catalysts

Texas’s commercial real estate vitality is underpinned by robust infrastructure and strategic development:

Retail construction in Austin is booming, with over 1.24 million sq ft expected by year-end 2025, double the previous year, and occupancy at 97%.

Massive developments in San Antonio’s Far Westside have attracted major tenants like Whataburger and McDonald’s, driven by rapid housing growth.

DFW’s population boom, corporate relocations, and mixed-use developments, particularly in Frisco, Prosper, and Celina, are reshaping the market’s commercial DNA.

Data center and industrial expansion across San Antonio, Austin, and Dallas, fueled by AI, cloud, and e-commerce, continues to elevate demand for NNN-type industrial real estate

Income Taxes

Texas’s Tax Advantages for NNN Investors: A Strategic Choice for Net Lease Properties

1. No State Income Tax on Rental or Passive Income

Texas does not levy a state income tax, this includes rental income and income passed through LLCs. NNN investors retain more net income, only subject to federal income taxes.

2. No Corporate Income Tax, but Franchise Tax Applies

Texas has no corporate income tax but imposes a franchise tax (“privilege tax”) on most business entities operating in the state. This tax is based on revenue or margin, not net profit, and applies to LLCs, corporations, partnerships, and more.

Thresholds and Rates: Businesses with annual revenue under ~$2.47 million are exempt from the franchise tax. Simplified EZ-Computation options (~0.331%) apply up to $20 million, though with limited deductions.

Passive Entity Exemption: If structured correctly as a qualifying partnership or trust, an entity may be considered passive and exempt from franchise tax. However, LLCs cannot qualify as passive entities under Texas law, even if 90% of their income is passive.

3. No State Capital Gains Tax

Texas does not impose a separate capital gains tax, capital gains are treated as regular income at the federal level only.

- Federal Implications: Capital gains from commercial property are taxed federally at 0%, 15%, or 20%, depending on income level and holding period. Depreciation recapture is taxed at up to 25%.

4. No State Estate or Inheritance Tax

Texas imposes no estate or inheritance tax at the state level. Estate transfers of NNN property can proceed without additional state-level estate or inheritance taxation.

5. Property Taxes High, but Locally Assessed and Variable

- No state-level property tax, but local governments levy property taxes, which fund schools, public safety, and infrastructure. These are among the highest in the nation, with an effective statewide average of about 1.6%.

- Rural exemptions possible: Some rural counties offer significantly lower median property tax bills—ranging from $466 to $833 annually.

6. Sales Tax – Secondary Factor for NNN Investments, but Worth Knowing

Although less critical for NNN investors, Texas sales tax may impact tenant operations and costs:

State rate: 6.25%; combined local possible up to 8.25%

- Items like groceries, medicines, and baby supplies are exempt.

Investing in triple-net (NNN) properties in Texas can be a smart, hands-off strategy, especially in counties experiencing booming population growth and economic development. NNN properties shift operating costs to tenants, making them ideal for investors focusing on passive income. Based on recent data (2023–2024), here are some standout Texas counties worth noting:

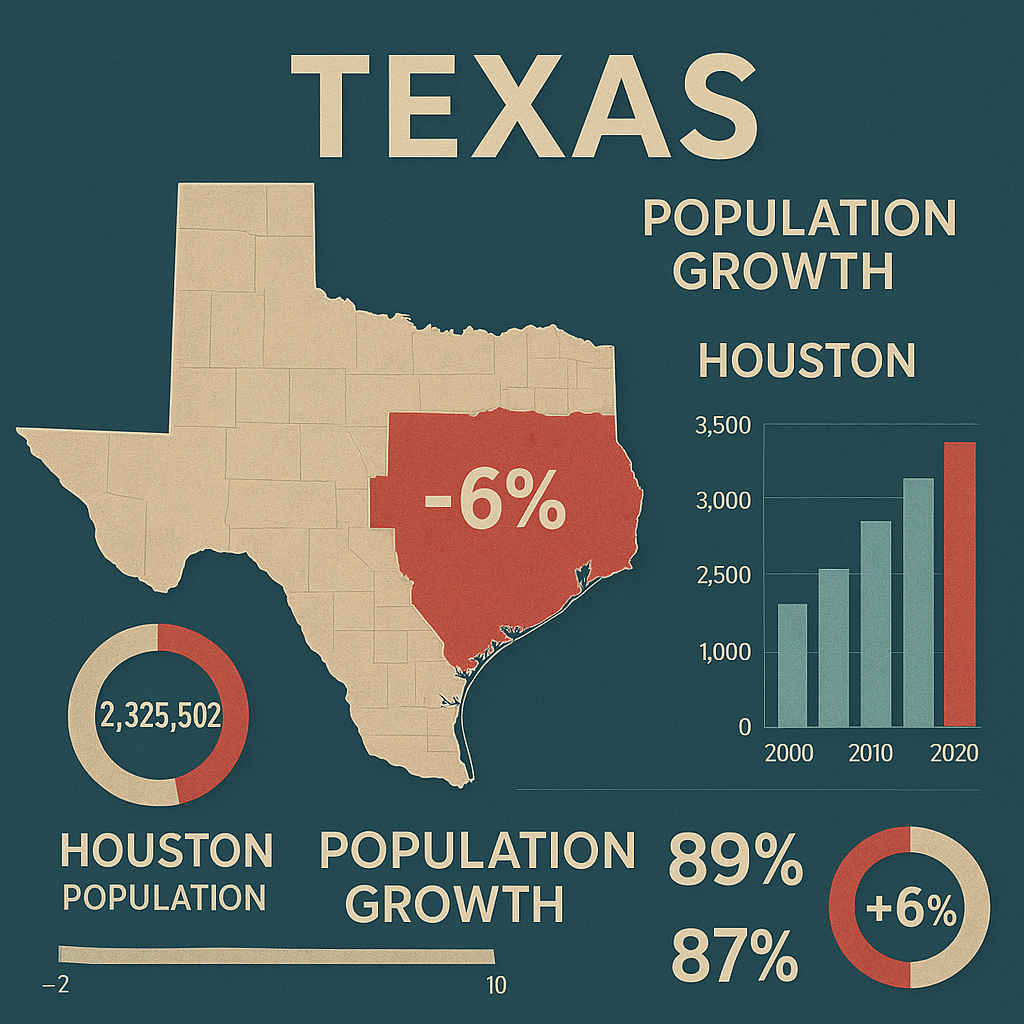

1. Harris County (Houston Metro):

Population Growth: +105,852 people, largest numeric growth among all U.S. counties.

Economic Development: Anchor of the Houston–The Woodlands–Pasadena metro area, a national hub for energy, healthcare, logistics, and aerospace.

Investment Potential: Huge demand for NNN assets catering to retail (especially convenience), QSRs, industrial facilities, gas stations, and medical offices in high-traffic corridors.

2. Collin County (Dallas Suburbs):

Population Growth: +46,694 people, 4th largest numeric increase nationally.

Economic Development: One of the wealthiest and fastest-growing counties around Dallas; strong corporate relocations, tech emergence, and high-income demographics.

Investment Potential: Prime for NNN properties in retail strip centers, suburban banks, pharmacies, and convenience formats serving affluent residents.

3. Montgomery County (Greater Houston Region):

Population Growth: +34,268 people; one of the top counties by numeric growth.

Economic Development: A mix of exurban growth, affordable housing demand, and spillover from Houston’s growth trajectory.

Investment Potential: Strong demand for NNN investments in convenience retail, regional QSRs, and auto services.

4. Tarrant County (Fort Worth Metro):

Population Growth: +32,793 residents.

Economic Development: Part of the vibrant Dallas–Fort Worth–Arlington MSA, diverse economy in aviation, logistics, and defense.

Investment Potential: Opportunities abound in industrial NNN properties, automotive service locations, and suburban storefronts.

5. Kaufman County (East of Dallas):

Population Growth: +6.0%, the fastest percentage increase among Texas counties of 100K+ population.

Economic Development: Second-fastest-growing county nationwide by percentage, commuter-heavy population drawn by affordable exurbs.

Investment Potential: Ideal for NNN assets in growing suburbs, think new convenience stores, QSRs, banks, and local retail centers.

6. Liberty County (Houston Outskirts):

Population Growth: +5.4%—top-tier growth in Texas by percentage.

Economic Development: Benefiting from the spillover of Houston’s urban expansion and affordability-driven migration.

Investment Potential: Appealing for investors in NNN retail formats, especially essential services and neighborhood gathering spots.

7. Caldwell County (Austin–San Antonio Corridor)

- Percent Growth: +4.6%.

- Economic Development: Part of the fast-growing San Antonio–Austin corridor, attracting residential and small-business development.

- Investment Potential: Strong demand for NNN investment in strip retail, QSRs, regional banks, and service providers amid rising suburbanization.

Pros:

1️⃣ Attractive Cap Rates

While cap rates can vary, national data suggests that suburban retail and office properties typically yield between 5% to 7%. Given Texas’s robust growth markets, investors often find competitive yields in the mid-to-high cap-rate range relative to more saturated coastal metros.

2️⃣ No State Income Tax on Rental or Passive Income

Texas imposes no state income tax, meaning rental income—whether held directly or via an LLC, is only subject to federal taxation.

3️⃣ Strong Economic & Population Growth

Texas leads the country in population growth, particularly in metros like Austin, Dallas–Fort Worth, and Houston. This fuels demand for net-lease properties in retail, QSRs, medical, and industrial sectors, offering stable, long-term tenancy.

4️⃣ Affordable Entry (Relative to Coastal Markets)

While prices have risen, Texas still offers relatively affordable acquisitions, especially compared to California or New York, helping investors scale or diversify their portfolios across high-growth submarkets.

5️⃣ Business-Friendly Climate & Growth Incentives

Texas is known for its favorable business environment, no corporate income tax and proactive economic development policies, bolstering tenant stability across sectors like energy, aerospace, healthcare, and logistics.

6️⃣ Diverse Tenant Base & Sectors

From QSRs and pharmacies to data centers, industrial logistics, and medical offices, Texas supports a broad spectrum of creditworthy tenants suitable for NNN structures.

Cons:

1️⃣ High Property Taxes (Local Level)

Texas lacks state income tax but compensates with relatively high property taxes. The statewide effective rate averages around 1.67%, compared to the U.S. median of about 1.02%. Major counties like Harris (~2.13%), Dallas (~2.22%), Tarrant (~2.26%), and Travis (~1.95%) reflect this trend.

2️⃣ Rising Tax Burden

Property tax bills have climbed notably, Austin leads the nation in effective property tax rates (~1.8%), with San Antonio (~1.7%) and Houston also high at ~1.7%. In some areas, property taxes now account for nearly 20% of monthly housing costs.

3️⃣ Limited Tax Relief for Investments

While Texas expanded homestead exemptions (up to $100K for school taxes via recent ballot Proposition 4), these relate only to primary residences, not to commercial or NNN investment properties

4️⃣ Geographic Variability in Tax Costs

Property tax burdens vary widely across the state. Rural counties may have relatively low tax bills (e.g., Ward County with ~$833 annually), but major MSA counties remain among the highest.

5️⃣ LLC Structure Offers No Tax Shield

An LLC’s main benefit is liability protection, not tax savings. Rental income flows through and is taxed personally, and LLCs do not avert franchise taxes or other liabilities unless structured differently.

Texas NNN Properties for 1031 Exchange

Invest in Free Standing Single Tenant Triple Net (NNN) Properties in Texas

Are you looking for a reliable 1031 exchange replacement property?

At Triple Net Investment Group, we specialize in the sale of single tenant NNN properties and triple net shopping centers across the United States. Our team is dedicated to helping investors find high-quality (Tenant Triple Net) NNN properties in Texas and nationwide that align with their financial goals and 1031 exchange requirements.

With our in-depth market knowledge and personalized service, we provide tailored investment strategies for both buyers and sellers of commercial real estate. Whether you’re looking to defer capital gains through a 1031 tax-deferred exchange or want to diversify your portfolio with income-generating assets, our team offers a wide selection of vetted NNN investment properties.

Corporate Tenant Credit Ratings

Find out more about the credit rating of the tenant before purchasing.

How safe are the triple net investment grade free standing single tenant properties?

Market Analysis

What three things should I know before investing?

Call or e-mail us and we will get back to you within 24 hours. We know of properties for sale that aren’t listed or advertised.

Email: [email protected] Tel: 202-361-3050

We strive hard to provide clients with quality customer service

We provide our clients with all of the information they need upfront to make an informed decision, even before a Letter of Intent is issued such as: tenant credit information, store sales, lease terms, options, renewal rates, rent escalations, location analysis, site analysis, market analysis, demographic data, cash on cash returns on investment, internal rate of returns after taxes, risks, likes, dislikes and so on. We will then strategies how to proceed on making a best offer. It is our goal to build a solid relationship with our clients and keep them updated on net lease investments, even though they may not have a need for years to come.(NNN Properties in Texas)

We markets our listings locally, nationally and internationally

Triple Net Investment Group difference is a concept that is revolutionary in the commercial real estate brokerage business. In addition to marketing our deals to potential investors, We markets our listings to the entire brokerage community. We put our listings directly in front of thousands of commercial real estate agents in each state, region and local where the property is located.