Why NNN Investors Prefer Utah State: Higher Growth & Competitive Cap Rates Explained

Future holding for NNN property investments in Utah

Triple Net Lease (NNN) properties remain an attractive option for investors seeking stable income and low management involvement. In Utah, the future potential of NNN investments is supported by several key trends and opportunities:

1. Economic and Population Growth

Northern Utah’s industrial sector stayed robust through 2024, with the average asking lease rate reaching approximately $11.65 per square foot NNN, a sign of underlying demand and economic vitality in the region. Population growth, particularly in areas like Salt Lake City, Ogden, and Provo, is fueling demand for commercial real estate. This strengthens the case for single-tenant industrial and retail NNN assets, which benefit from expanding local economies.

2. Stability and Demand for NNN Properties

NNN properties in Utah offer long-term lease income with minimal landlord responsibilities; tenants cover taxes, insurance, maintenance, and sometimes even structural costs when designated as absolute net leases. Listing platforms like LoopNet highlight the persistent availability of NNN properties for sale in Utah, typically single-tenant assets with leases ranging 10–25 years.

3. Market Trends and Cap Rates

Cap rates on NNN properties throughout Utah show notable variation across listings:

Ogden office building (3,520 sf)—Cap Rate: 8.78%

Cedar City retail building (10,500 sf)—7.00%

Salt Lake City flex building (25,302 sf)—7.03%

Layton retail building (5,826 sf)—6.72%

Saint George retail with McDonald’s (5,205 sf)—low at 3.75%

4. Financing Considerations for NNN Investors

Financing NNN properties in Utah tends to be favorable, especially with strong lease terms:

Down payments can be 25–35% of the purchase price.

Loan terms often align closely with the remaining lease duration, and some may offer non-recourse financing and assumable mortgages—valuable tools when financing long-term deals.

For example, typical NNN financing might offer a 70% loan-to-value ratio; at a 6.55% interest rate, annual debt service would be structured accordingly.

5. Local Market Opportunities

Utah presents a wide array of NNN property opportunities across tenant types and regions:

Salt Lake City: Speedway/Speedway absolute NNN gas station—Cap Rate ~5.50%—with a national credit tenant and rent escalations built in.

Centerville (Jiffy Lube): ~5.71% cap rate, NNN, with lease term ~4.7 years remaining.

Taylorsville (Walgreens): Broad listing with 6.67% cap, nearly a decade lease term.

Diverse listings: Dollar General, AutoZone, Caliber Collision, O’Reilly Auto Parts, each offering cap rates between ~4.76% and 6.67%, depending on lease length and location.

Other opportunities via Keystone Realty: Cap rates from about 6.25% to 8.5% on tenants like Walgreens, Jiffy Lube, Dollar General, Jack in the Box, Dollar General—across construction types including free-standing buildings and service stations.

Additionally, Utah’s NNN market supports 1031 exchange strategies, helping investors defer capital gains and redeploy assets efficiently

Triple-net (NNN) properties continue to be a go-to for investors seeking low-management, long-term income. Here’s why Utah is becoming a standout market:

1. Competitive Cap Rates & Attractive Returns

While nationwide net-lease cap rates typically range between 5–7%, Utah’s market offers competitive alternatives depending on property type and location

- Northern Utah industrial NNN asking lease rates reached $11.65 per square foot by year-end 2024, signaling robust underlying demand.

- Historically, Salt Lake County industrial cap rates have fluctuated around 4.3%, reflecting strong investor interest in high-quality assets.

These stronger leasing fundamentals suggest that NNN properties, especially industrial or retail, may offer solid income growth and long-term value appreciation.

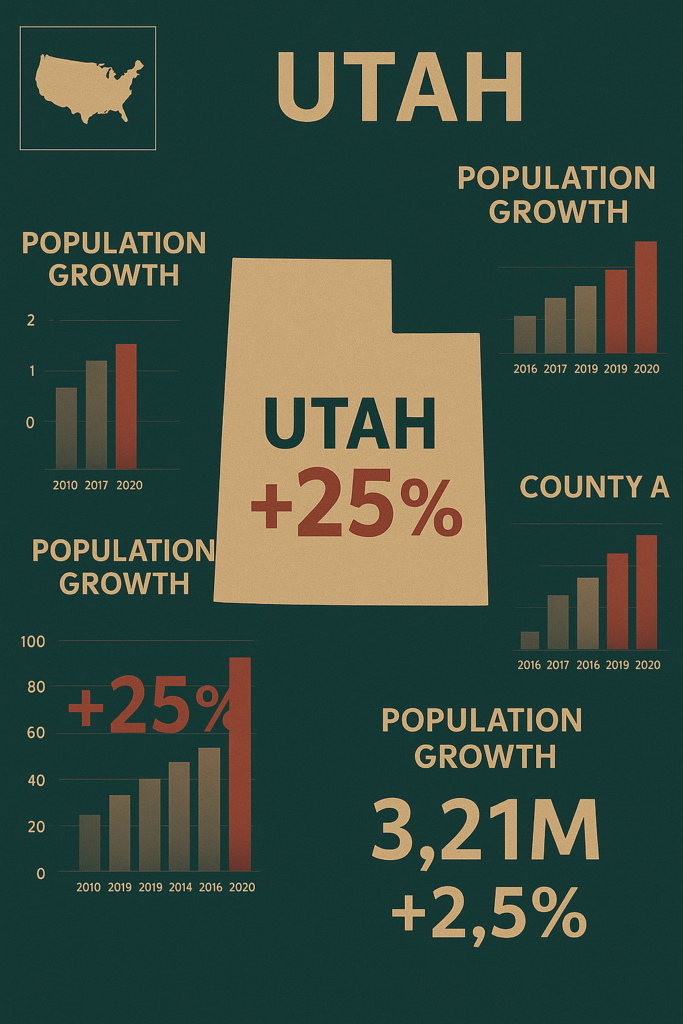

2. Continued Economic & Population Growth

Utah’s economy is one of the nation’s fastest-growing:

Real GDP grew 4.5% in 2024, exceeding the national average of 2.8%.

Nonfarm payrolls are up 2.3% year-over-year, with nearly 39,700 new jobs since June 2024.

Population growth remains strong across Utah, especially in the Salt Lake City, Provo/Orem, and St. George metro areas.

3. Robust Business-Friendly Environment

Utah offers an ecosystem of incentives and support tailored for growth:

EDTIF (Economic Development Tax Increment Financing) and REDTIF provide substantial tax credits, up to 50% in rural areas, for companies creating jobs or investing in Utah.

Additional grant programs, including IAA (Industrial Assistance Account), Technology & Life Sciences tax credits, and Talent Ready Utah grants, complement these incentives.

Utah’s Governor’s Office of Economic Opportunity oversees support for business recruitment, retention, and expansion, bolstering both urban and rural growth initiatives.

4. Thriving Tech & Innovation Hub

Utah’s Silicon Slopes, the technology corridor along the Wasatch Front, is a major draw for investors and tenants:

More than 1,000 tech companies call this area home, including Google, Goldman Sachs, and other prominent firms {{cite}}.

Together with venture and startup support programs like USTAR and the Venture Capital Enhancement Act, this creates a vibrant, innovation-driven ecosystem.

5. Infrastructure & Inland Port Growth

Significant infrastructure developments are shaping Utah’s economic landscape:

The Utah Inland Port initiative spans multiple strategic locations, like Spanish Fork, Box Elder, Juab, Tooele, Weber, and Beaver counties, fueling industrial and logistics growth statewide.

Local incentives in Economic Development Community Reinvestment Areas offer tax increment rebates tied to new property tax value, encouraging development of logistics, warehousing, and mixed-use projects.

Income Taxes

Utah offers a clear and relatively favorable tax landscape for net lease (NNN) property investors. Here’s how it breaks down:

1. LLC / Passive Income Tax Treatment

- LLCs are taxed as pass-through entities by default, meaning income, such as rental income from NNN properties, is reported on members’ individual tax returns rather than at the entity level.

- Utah taxes all personal income at a flat rate of 4.55% (as of January 1, 2024).

- This includes passive income categories like rental revenue. Utah does not offer a special exemption for passive LLC or rental income, it’s treated like any other personal income.

2. Corporate Income Tax

- If a corporation (e.g., a C-corporation) holds net lease properties, Utah imposes a flat corporate income tax of 4.55%.

- This rate applies uniformly across taxable income levels.

3. Personal Income Tax Rates

- Utah simplifies taxation with a single-rate personal income tax of 4.55% for all residents, regardless of income bracket.

- This flat model contrasts with tiered systems in many states.

4. Estate and Inheritance Tax

- Utah does not impose an inheritance tax; it was abolished effective around 2005.

- There is also no separate state-level estate tax, making estate planning and intergenerational wealth transfers simpler for NNN investment holdings.

5. Property Tax Rates

- Property taxes in Utah are collected locally and vary by location. The average effective property tax rate is around 0.55%, notably low compared to many states.

- Utah does not levy an intangible property tax, which can be relevant for property-related credits or valuations.

6. Capital Gains Tax Treatment

- Utah taxes capital gains, both short-term and long-term, as ordinary income, using the flat 4.55% rate.

- There is no preferential or lower rate for long-term capital gains at the state level.

- Keep in mind: Federal capital gains taxes still apply (0%, 15%, 20%, plus potential NIIT), but Utah adds 4.55% on top.

Triple-net (NNN) property investments thrive where population, economic growth, and strong tenant demand intersect. Based on recent data, here are some of the most promising areas in Utah to consider:

1. Utah County (Provo–Orem–Lehi Area):

Population Growth: Utah County added 21,853 residents between mid-2023 and mid-2024, accounting for about 43% of statewide growth.

Economic Development: A booming tech corridor dubbed “Silicon Slopes” spans Lehi–Provo, hosting giants like Adobe and Qualtrics. The county also functions as a major logistics hub along the Wasatch Front, with tight industrial supply, low vacancy (~4%), and fast absorption of new space. Further, projections show significant population and job growth ahead—an estimated 164,000 more residents and 87,000 new jobs by 2033

Investment Potential: High tenant demand in retail, office, and industrial sectors, supported by buzzing tech and logistics dynamics, makes Utah County a prime NNN investment target.

2. Salt Lake County (Salt Lake City Area):

Population Growth: Gained 15,730 residents from 2023–2024, with international migration accounting for much of the increase. The city of Salt Lake added 4,450 new residents (2.1%) and led the state in housing development with 9,675 new units.

Economic Development: As the state capital and largest metro area, Salt Lake City boasts deep infrastructure, job concentration, and a growing cosmopolitan core attracting young professionals and diverse businesses.

Investment Potential: Ideal for NNN investments in housing-adjacent retail, office, and mixed-use properties, especially near transit and newly developed housing areas.

3. Washington County (St. George Area):

Population Growth: Contributed approximately 5,858 new residents, significant share of statewide growth.

Economic Development: St. George is a fast-growing tourism and retirement hub, supported by a warm climate and regional amenities.

Investment Potential: Strong prospects for NNN properties in hospitality, essential retail, and lifestyle services catering to a growing and diverse population.

4. Tooele County:

Population Growth: Experienced the fastest growth rate among larger counties: 3.1% increase (~2,448 people) between mid-2023 and mid-2024.

Economic Development: Primely positioned as a commuter and industrial adjunct to Salt Lake City, benefiting from regional spillover and infrastructure expansion.

Investment Potential: Attractive for logistics, suburban retail, and industrial NNN opportunities, especially as housing demand pushes expansion outward.

5. Iron County (Cedar City Area):

Population Growth: Posted around 2.7–2.8% growth, gaining approximately 1,703 new residents, solid performance among rural counties.

Economic Development: Cedar City provides a stable economic base rooted in education (Southern Utah University), tourism, and growing regional services.

Investment Potential: Emerging opportunities for NNN investments in hospitality, retail, and service sectors that support both tourism and local growth.

6. Other Growth-Tier Counties:

- Rich, Juab, and Wasatch Counties each posted growth rates exceeding 2%.

- These areas represent early-stage markets for regional retail and service-based NNN opportunities.

Pros:

1️⃣ Higher Cap Rates Compared to Coastal Markets

Utah’s NNN properties typically offer cap rates in the 5.5%–7% range, higher than low-yield states like California or New York.

Investors benefit from stronger cash flow without sacrificing long-term stability.

2️⃣ No State Tax on Passive LLC Income

If structured correctly, Utah does not impose state tax on rental income earned through pass-through LLCs, which is attractive for NNN investors.

3️⃣ Moderate Property Taxes

Utah has relatively low property tax rates (~0.60% effective rate), helping to reduce holding costs for long-term investors.

4️⃣ Affordable Commercial Real Estate vs. Western Neighbors

Compared to high-cost states like Colorado or California, Utah’s commercial property prices are more affordable, allowing easier entry for new investors.

5️⃣ Strong Economy & Population Growth

Utah is consistently ranked as one of the fastest-growing states in the U.S., driven by growth in Salt Lake City, Utah County (Provo-Orem), and Washington County (St. George).

Key industries: technology (Silicon Slopes), outdoor recreation, logistics, healthcare, and education.

Population growth fuels retail demand and stability in NNN leases.

6️⃣ Business-Friendly Environment

Utah’s pro-business policies, low unemployment rate (~3%), and state incentives for tech and logistics companies support tenant stability.

7️⃣ Diverse Tenant Base

From essential retail (Walmart, Walgreens, Dollar Tree, 7-Eleven) to fast-growing QSRs (Chick-fil-A, In-N-Out, Raising Cane’s) and tech-related logistics hubs (Amazon, UPS, FedEx), Utah offers a healthy tenant mix for NNN investors.

Cons:

1️⃣ Lower Cap Rates in High-Growth Areas

While statewide cap rates are competitive, prime markets like Salt Lake City, Lehi, and Park City have tighter yields (closer to 5%) due to strong investor demand.

2️⃣ Rising Property Prices

Rapid population growth has pushed up real estate prices, especially in Salt Lake and Utah counties. Entry costs are higher than in slower-growth states.

3️⃣ Tenant Demand is Uneven Across Rural Areas

While urban centers thrive, some rural Utah counties may struggle to attract national tenants, requiring investors to focus carefully on location.

4️⃣ Seismic Risk (Earthquakes)

Utah lies along the Wasatch Fault, which carries earthquake risk. This may affect insurance costs and tenant operations.

5️⃣ Limited Luxury & Urban Retail Options

Utah’s retail market is still largely focused on essential businesses and suburban development. Investors seeking high-density urban or luxury tenants may find limited opportunities outside Salt Lake City.

6️⃣ Economic Dependence on Tech & Tourism

While diverse, Utah’s economy is heavily influenced by Silicon Slopes (tech sector) and tourism (ski resorts, national parks). Any slowdown in these sectors could affect tenant demand in certain areas.

Utah NNN Properties for 1031 Exchange

Invest in Free Standing Single Tenant Triple Net (NNN) Properties in Utah

Are you looking for a reliable 1031 exchange replacement property?

At Triple Net Investment Group, we specialize in the sale of single tenant NNN properties and triple net shopping centers across the United States. Our team is dedicated to helping investors find high-quality (Tenant Triple Net) NNN properties in Utah and nationwide that align with their financial goals and 1031 exchange requirements.

With our in-depth market knowledge and personalized service, we provide tailored investment strategies for both buyers and sellers of commercial real estate. Whether you’re looking to defer capital gains through a 1031 tax-deferred exchange or want to diversify your portfolio with income-generating assets, our team offers a wide selection of vetted NNN investment properties.

Corporate Tenant Credit Ratings

Find out more about the credit rating of the tenant before purchasing.

How safe are the triple net investment grade free standing single tenant properties?

Market Analysis

What three things should I know before investing?

Call or e-mail us and we will get back to you within 24 hours. We know of properties for sale that aren’t listed or advertised.

Email: [email protected] Tel: 202-361-3050

We strive hard to provide clients with quality customer service

We provide our clients with all of the information they need upfront to make an informed decision, even before a Letter of Intent is issued such as: tenant credit information, store sales, lease terms, options, renewal rates, rent escalations, location analysis, site analysis, market analysis, demographic data, cash on cash returns on investment, internal rate of returns after taxes, risks, likes, dislikes and so on. We will then strategies how to proceed on making a best offer. It is our goal to build a solid relationship with our clients and keep them updated on net lease investments, even though they may not have a need for years to come.(NNN Properties in Utah)

We markets our listings locally, nationally and internationally

Triple Net Investment Group difference is a concept that is revolutionary in the commercial real estate brokerage business. In addition to marketing our deals to potential investors, We markets our listings to the entire brokerage community. We put our listings directly in front of thousands of commercial real estate agents in each state, region and local where the property is located.