Why NNN Investors Prefer Virginia State: Higher Growth & Competitive Cap Rates Explained

Future holding for NNN property investments in Virginia

Triple Net Lease (NNN) properties, where tenants pay taxes, insurance, and maintenance, remain a go-to for investors seeking stable, low-touch income. In Virginia, the outlook is supported by durable economic drivers, healthy tenant demand, and a steady deal pipeline.

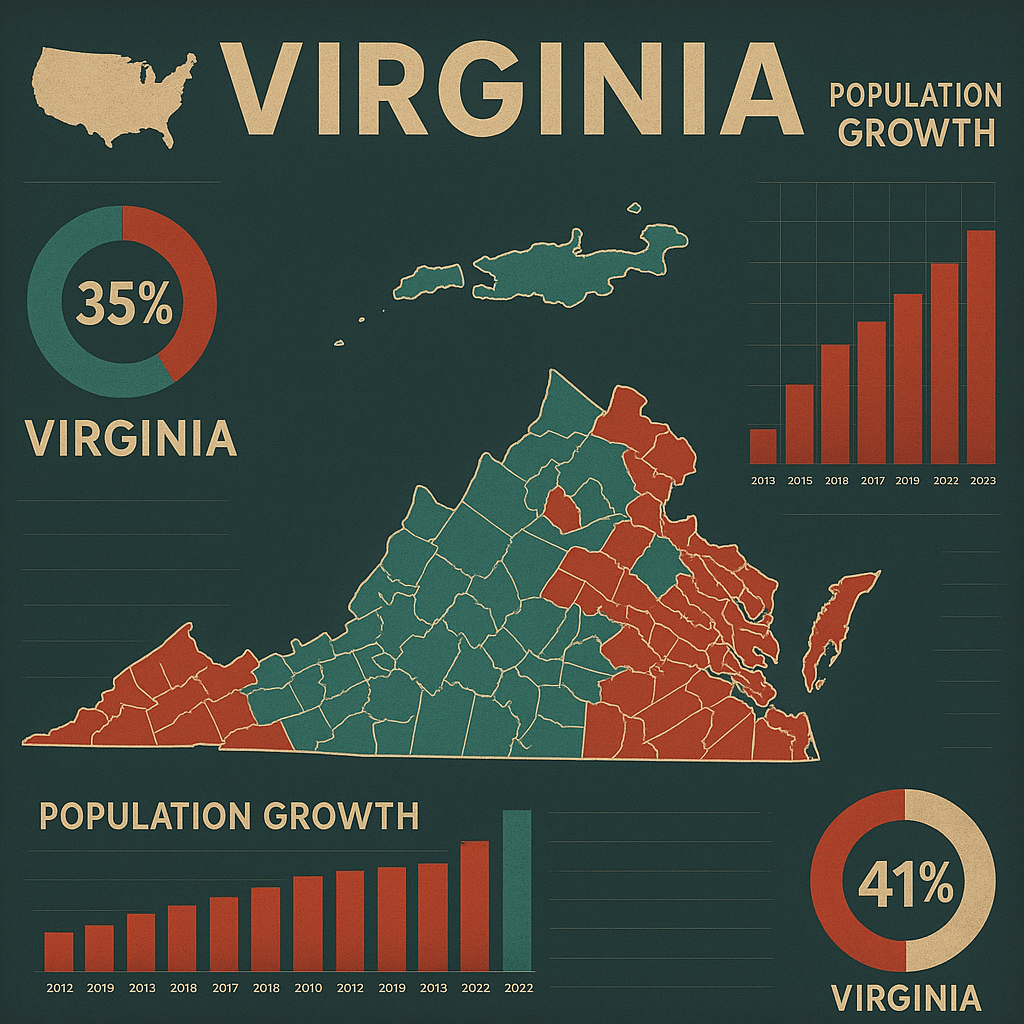

1. Economic and Population Growth

Virginia’s growth story centers on Northern Virginia (NOVA) and the Richmond metro. NOVA’s population has expanded dramatically over the past decades (2024 estimate ~2.60M), underpinned by federal, defense, tech, and healthcare employers. Richmond is currently the fastest-growing metro in the state, with migration (both domestic and international) as a key driver. Statewide population topped 8.8M in 2024 and continues to edge higher.

NOVA’s Amazon HQ2 continues to shape Arlington/Pentagon City, catalyzing mixed-use vibrancy and small-business activity, even as Amazon moderates near-term hiring timelines.

2. Stability and Demand for NNN Properties

Virginia’s NNN market is anchored by creditworthy, necessity-oriented tenants, pharmacies, QSRs, grocery-adjacent retail, medical, and service brands—well suited for passive, long-duration income. National single-tenant retail vacancy remains tight (≈4.5%), reflecting resilient demand for essential goods and food-related categories, tailwinds that carry into Virginia’s local markets.

3. Market Trends and Cap Rates

After rising through 2023–2024, net-lease cap rates appear near/at the cycle peak, with slight compression reported in H1 2025 as rate expectations stabilize. Practically, Virginia listings span roughly the 5%–6.75% range depending on tenant credit, term, location, and rent bumps (select examples shown below). Expect prime NOVA/Richmond assets with investment-grade tenants to price tighter than secondary markets.

Recent Virginia examples (illustrative):

Warrenton (Retail, 15-yr NNN) ~6.00% cap, asking ~$2.25M.

Virginia Beach (Office NNN) ~6.85% cap, asking ~$5.77M.

Public listings indicate continued availability across QSR, bank, pharmacy, and service sectors statewide. (Always verify current status.)

4. Financing Considerations for NNN Investors

Typical entry profiles in today’s net-lease market often include ~30%–40% equity/down payment, with many buyers meeting accredited-investor thresholds (e.g., $1M+ net worth or $200k+ income). Lending terms remain sensitive to tenant credit, lease term, and rent escalations; investors should size debt conservatively while rate volatility persists.

5. Local Market Opportunities

- Northern Virginia (Arlington, Fairfax, Loudoun, Prince William): Demand buoyed by federal/defense and tech ecosystems; HQ2 continues to spur walkable, amenity-rich nodes. Long-term leases to strong national brands are common; yields are typically tighter but supported by durable demographics.

- Richmond MSA: Fastest-growing metro in VA; strong migration supports retail/services footprints and medical users—fertile ground for NNN deal flow with balanced yield and stability.

- Secondary/Regional Markets (e.g., Fredericksburg corridor, Tidewater/Hampton Roads, Roanoke/Blacksburg): A mix of essential retail, bank, and service assets often trading at modestly higher caps than core NOVA. Active listings show ongoing opportunities for 1031 buyers seeking yield with recognizable brands.

Triple-net (NNN) properties, where tenants pay property taxes, insurance, and maintenance, continue to attract investors seeking stable, passive income. Virginia has become a prime market for NNN brokers and investors due to its strong economy, growing population, and diverse investment opportunities.

1. Attractive Cap Rates in Key Markets

While cap rates in Northern Virginia (near Washington, D.C.) tend to be lower due to high demand, typically in the 4.5%–5.5% range, secondary and tertiary markets such as Richmond, Hampton Roads, Roanoke, and Lynchburg often offer higher cap rates between 5.5% and 6.75%. This gives investors flexibility: tighter cap rates with long-term security in Northern Virginia or stronger yields in regional markets.

2. Strong & Diverse Economy

Virginia’s economy is consistently ranked among the nation’s strongest. Anchored by federal government, defense, technology, healthcare, and logistics, the state offers a recession-resistant environment for NNN investments. The presence of Amazon’s HQ2 in Arlington continues to drive mixed-use and retail growth, while Port of Virginia expansion supports industrial and logistics-related demand, creating long-term stability for net lease property owners.

3. Population Growth & Migration Trends

Virginia’s population now exceeds 8.8 million, with steady growth in Northern Virginia and Richmond, two of the fastest-growing areas. In-migration, combined with strong job opportunities and an educated workforce, supports long-term demand for retail, medical, and service-oriented NNN tenants.

4. Strong Demand for Essential Retail & QSR Tenants

Just like in other states, NNN brokers and investors in Virginia focus on necessity-based tenants such as Dollar General, CVS, Walgreens, McDonald’s, Chick-fil-A, and Taco Bell. These businesses provide reliable, long-term leases and stable cash flow, even in economic downturns. Growing suburban and regional markets across Virginia ensure ongoing demand for these essential services.

5. Tax Advantages & 1031 Exchange Opportunities

Virginia offers a favorable investment climate for NNN property owners. While it does levy state income tax, it remains competitive compared to neighboring states. Importantly, Virginia NNN properties are widely available for 1031 exchanges, allowing investors to defer capital gains taxes while reinvesting in stable, long-term net lease assets.

6. Infrastructure & Industrial Development

Virginia is a hub for defense, technology, shipping, and logistics. The Port of Virginia (Norfolk) is one of the busiest on the East Coast and continues to expand, fueling industrial development. Coupled with strong aerospace, biotech, and cybersecurity sectors, this creates ongoing demand for supporting retail, service, and industrial NNN properties across the state.

Income Taxes

Virginia’s Tax Landscape for NNN Investors: Balancing Stability and Growth

While Virginia does not offer the same no-tax advantages as states like Alabama, it remains an attractive market for NNN property investors thanks to its strong economy, growing population, and competitive regional tax structure. Here’s what investors and NNN brokers should know about Virginia’s tax environment:

1. State Income Tax on Rental Income

Unlike Alabama, Virginia taxes rental income from LLCs or individuals at the state’s personal income tax rate. For investors holding NNN properties through an LLC, this means rental income is considered pass-through income and is subject to Virginia’s income tax brackets.

Virginia has a progressive personal income tax system ranging from 2% to 5.75% (top bracket applies to taxable income above $17,000).

While higher than some states, Virginia’s rates are still lower than high-tax states like California (13.3%) or New York (10.9%), allowing investors to retain more earnings compared to coastal markets.

2. Corporate Income Tax

For investors operating through a corporation, Virginia maintains a flat corporate income tax rate of 6%, one of the lowest in the Mid-Atlantic region.

This competitive rate allows corporate investors to reinvest more profits into expanding their NNN portfolios.

Neighboring states, like Maryland (8.25%) and Pennsylvania (8.99%), impose higher corporate tax rates, giving Virginia a relative advantage for regional investors.

3. Personal Income Tax Rates

Virginia’s tax brackets are straightforward and relatively low compared to other East Coast states:

2% on the first $3,000 of taxable income

3% on $3,001–$5,000

5% on $5,001–$17,000

5.75% on income over $17,000

This structure makes Virginia more favorable than states with double-digit brackets, though not as tax-light as income-free states like Florida or Texas.

4. No Estate or Inheritance Tax

Virginia does not levy a state-level estate tax or inheritance tax, making it easier for investors to pass on NNN properties to heirs without added state burdens. This is a long-term benefit for family offices, generational investors, and those building legacy wealth through net lease properties.

5. Property Tax Rates

Virginia offers moderately low property taxes, with an average effective property tax rate of around 0.82%.

This is below the national average (~0.99%) and significantly lower than high-property-tax states such as New Jersey (2.2%) and Illinois (2.1%).

For NNN investors, this translates to lower annual holding costs, improving long-term profitability.

6. Capital Gains Tax

Virginia taxes capital gains as regular income, up to the top rate of 5.75%.

This is far below California’s 13.3% capital gains rate, giving Virginia investors an advantage when planning 1031 exchanges or exit strategies.

Investing in triple net lease (NNN) properties in Virginia can be a strategic move, particularly in regions experiencing strong population growth and economic expansion. NNN leases shift property expenses such as taxes, insurance, and maintenance to tenants, giving investors steady, hands-off income. Based on recent data, here are some of the top Virginia counties and cities to consider:

1. New Kent County (Richmond Exurbs):

Population Growth: From 2020 to 2024, New Kent County’s population surged by 18.6%, making it the fastest-growing county in Virginia.

Economic Development: Located between Richmond and Williamsburg, it benefits from suburban expansion, new housing communities, and improved infrastructure.

Investment Potential: With rapid growth and a rising commuter population, New Kent is primed for NNN investments in grocery stores, retail, quick-service restaurants, and healthcare facilities.

2. Goochland County (Richmond Metro Area):

Population Growth: Goochland grew by 14.1% (2020–2024), one of the top rates in the state.

Economic Development: The county attracts professionals seeking suburban living near Richmond’s finance, government, and healthcare hubs.

Investment Potential: Exurban growth supports demand for community retail centers, pharmacies, and service-based NNN tenants.

3. Prince William County – Woodbridge (Northern Virginia):

Population Growth: Woodbridge is among the fastest-growing suburbs in the U.S., jumping from ~4,000 residents in 2018 to over 43,000 in 2023 (an 887% increase).

Economic Development: The area benefits from its location along the I-95 corridor, proximity to D.C., and commercial anchors like Potomac Mills.

Investment Potential: Explosive growth creates demand for retail, banking, medical clinics, and QSRs (quick-service restaurants) under NNN structures.

4. Stafford County (Northern Virginia Commuter Belt):

Population Growth: One of the fastest-growing and highest-income counties in Virginia, supported by heavy net in-migration from D.C. commuters.

Economic Development: Stafford has strong ties to federal employment, logistics, and data centers, with ongoing infrastructure improvements.

Investment Potential: High-income households drive demand for creditworthy NNN tenants like banks, pharmacies, and essential retail.

5. Winchester Metro Area (Northern Shenandoah Valley):

Population Growth: The Winchester metro area is the fastest-growing metro in Virginia, expanding nearly five times faster than the state average.

Economic Development: Growth is driven by affordability compared to Northern Virginia, attracting logistics companies, healthcare providers, and commuters.

Investment Potential: Rising demand for essential retail, grocery-anchored centers, and medical NNN leases positions Winchester as a strong investment hub.

6. Louisa & Caroline Counties (Richmond–Fredericksburg Corridor):

Population Growth: Both counties are experiencing strong growth as part of the suburban sprawl between Richmond and Fredericksburg.

Economic Development: New housing communities and infrastructure expansion are attracting families and commuters.

Investment Potential: Opportunities in neighborhood retail, healthcare, and convenience stores to serve the growing population base.

7. Roanoke & New River Valley (Blacksburg–Christiansburg–Radford MSA)

- Population Growth: While not the fastest-growing, this region is expanding steadily due to universities, medical systems, and tech sector jobs.

- Economic Development: Anchored by Virginia Tech and Carilion Clinic, with major investments in biotech, healthcare, and advanced manufacturing.

- Investment Potential: Demand for student-focused retail, service-based tenants, and medical office NNN properties is growing.

Pros:

1️⃣ Strong & Stable Economy

Virginia has one of the most diverse and resilient economies in the U.S., driven by government contracting, military, technology, healthcare, and education. Northern Virginia (NOVA) is a hub for federal agencies, defense contractors, and tech companies, making tenant demand strong and reliable.

2️⃣ High Tenant Demand in Northern Virginia & Urban Areas

NOVA (Arlington, Fairfax, Loudoun) and Richmond have consistent demand for retail, office, and industrial properties due to population growth and strong job markets. Essential retail and QSR (quick-service restaurants) thrive here.

3️⃣ Business-Friendly for Corporations

Virginia’s corporate income tax rate is 6%, slightly lower than the U.S. average. The state consistently ranks as a “Top State for Business” by CNBC due to workforce quality, infrastructure, and stable governance.

4️⃣ Growing Population & In-Migration

Virginia’s population exceeds 8.7 million (2024 est.), with growth concentrated in NOVA, Richmond, and Hampton Roads. Steady migration ensures consistent retail demand and supports NNN tenants.

5️⃣ Strong Property Appreciation in NOVA

Unlike Alabama, Virginia sees higher appreciation rates, especially in Northern Virginia near D.C. Investors benefit from both rental income and long-term equity growth.

6️⃣ Diverse Tenant Base

From essential retail (7-Eleven, CVS, Dollar General) to national QSR brands (Starbucks, Chick-fil-A, McDonald’s) and logistics/industrial tenants (Amazon, FedEx), Virginia offers a wide mix of NNN opportunities.

7️⃣ Strategic Location & Infrastructure

Virginia’s ports (Norfolk), airports (Dulles, Reagan), and interstate network support logistics and distribution tenants. Amazon’s HQ2 in Arlington boosts long-term economic and real estate demand.

Cons:

1️⃣ Higher Property Costs in Prime Markets

NOVA and Richmond have significantly higher property prices compared to states like Alabama. Cap rates are lower (5%–6%) in high-demand areas, which can reduce immediate cash flow.

2️⃣ State Income Tax

Virginia taxes both personal and corporate income. Personal income tax rates are progressive up to 5.75%, which is higher than tax-free states (Texas, Florida). Rental income through LLCs is taxable at the state level.

3️⃣ Property Taxes Higher than Southeast Average

While not as high as New Jersey or Illinois, Virginia’s average property tax rate (~0.82%) is higher than Alabama’s (~0.40%), adding to long-term holding costs.

4️⃣ Tenant Demand Uneven Across the State

Northern Virginia, Richmond, and Hampton Roads are strong, but rural areas in southern and western Virginia may face weaker tenant demand, higher vacancies, and slower growth.

5️⃣ Competition in Prime Markets

Because NOVA is highly desirable, investors face heavy competition for NNN assets, driving up prices and lowering yields compared to secondary markets.

6️⃣ Regulatory & Zoning Complexity

Compared to business-friendly states like Alabama, Virginia’s local zoning and permitting processes can be slower, especially in urban/suburban counties.

Virginia NNN Properties for 1031 Exchange

Invest in Free Standing Single Tenant Triple Net (NNN) Properties in Virginia

Are you looking for a reliable 1031 exchange replacement property?

At Triple Net Investment Group, we specialize in the sale of single tenant NNN properties and triple net shopping centers across the United States. Our team is dedicated to helping investors find high-quality (Tenant Triple Net) NNN properties in Virginia and nationwide that align with their financial goals and 1031 exchange requirements.

With our in-depth market knowledge and personalized service, we provide tailored investment strategies for both buyers and sellers of commercial real estate. Whether you’re looking to defer capital gains through a 1031 tax-deferred exchange or want to diversify your portfolio with income-generating assets, our team offers a wide selection of vetted NNN investment properties.

Corporate Tenant Credit Ratings

Find out more about the credit rating of the tenant before purchasing.

How safe are the triple net investment grade free standing single tenant properties?

Market Analysis

What three things should I know before investing?

Call or e-mail us and we will get back to you within 24 hours. We know of properties for sale that aren’t listed or advertised.

Email: [email protected] Tel: 202-361-3050

We strive hard to provide clients with quality customer service

We provide our clients with all of the information they need upfront to make an informed decision, even before a Letter of Intent is issued such as: tenant credit information, store sales, lease terms, options, renewal rates, rent escalations, location analysis, site analysis, market analysis, demographic data, cash on cash returns on investment, internal rate of returns after taxes, risks, likes, dislikes and so on. We will then strategies how to proceed on making a best offer. It is our goal to build a solid relationship with our clients and keep them updated on net lease investments, even though they may not have a need for years to come.(NNN Properties in Virginia)

We markets our listings locally, nationally and internationally

Triple Net Investment Group difference is a concept that is revolutionary in the commercial real estate brokerage business. In addition to marketing our deals to potential investors, We markets our listings to the entire brokerage community. We put our listings directly in front of thousands of commercial real estate agents in each state, region and local where the property is located.