Why NNN Investors Prefer Washington State: Higher Growth & Competitive Cap Rates Explained

Future Outlook for NNN Property Investments in Washington

Triple Net Lease (NNN) properties, where tenants cover taxes, insurance, and maintenance—remain an appealing asset class for investors seeking stable income with minimal oversight. In Washington State, several evolving trends suggest the NNN property market is poised for continued strength.

1. Economic & Infrastructure Momentum

Washington benefits from robust economic drivers, especially in the tech and logistics sectors. Demand for data center real estate has surged, fueled by AI expansion, renewable energy infrastructure, and tax incentives. Notably, Central Washington achieved an incredibly low vacancy rate of 0.16% in H2 2024, the lowest among North American markets, and Seattle’s vacancy dropped to 6.7%. Both markets are expanding capacity through significant construction pipelines with strong pre-leasing activity.

Industrial NNN demand is further supported by growth in logistics and distribution, driven by infrastructure development across the Puget Sound region and beyond.

2. Stability & Tenant-Driven Dynamics

NNN investments in Washington benefit from long-term leases and tenants responsible for property operations—key advantages amid market fluctuations. A notable offering is the Fix Auto NNN Asset in Poulsbo (Seattle MSA), featuring a corporate-guaranteed, single-tenant industrial lease with fixed 3% annual rent increases and over 8 years of remaining lease term, offering hands-off income for investors.

3. Market Trends & Cap Rates

Cap rates vary across the state depending on market and property type:

Industrial/Warehouse (Seattle): NNN lease rates range from $14–$19/SF/year, with vacancies around 7–9%.

- Southwest Washington (Tacoma, Olympia, Vancouver, Bellingham): NNN leases typically range between $10–$16/SF/year; some more affordable markets like Eastern Washington (Spokane, Yakima) range from $7.50–$13/SF/year.

- Retail & Multifamily Cap Rates: In areas like Bellevue and Vancouver, cap rates for retail and industrial typically span 6–7% for retail and around 6–7% for industrial properties.

NNN investors typically target cap rates in the 5%–7.5% range, with higher yields often signaling higher risk, especially for shorter leases or lower-credit tenants.

4. Financing Requirements for NNN Investors

While specific Washington-focused financing data is limited, NNN investment norms generally require:

Minimum net worth around $1 million or annual income exceeding $200,000.

Down payments typically in the 30%–40% of purchase price range.

These figures reflect broader industry standards and should be confirmed with regional lenders.

5. Washington-Specific NNN Investment Opportunities

- Industrial NNN Assets: The Poulsbo Fix Auto property offers a stable, long-term investment with built-in increases and an established corporate tenant.

- Retail NNN Listings: LoopNet lists multiple NNN retail buildings across Washington, with cap rates ranging from 5.25% to 6.77%, offering varied size and property profiles.

- Warehouse NNN Market: Puget Sound industrial and warehouse space remains in demand, providing solid rental yields and diverse location options.

Investors using 1031 exchanges may find Washington NNN properties attractive for tax-deferral strategies, given the state’s mix of stable long-term leases, growth markets, and diverse property types.

Triple-net (NNN) lease investments are gaining attention in Washington due to favorable market dynamics, tax advantages, and stable tenant demand. Here’s why Washington is increasingly appealing to NNN brokers and investors:

1. Competitive Cap Rates & Broad Market Opportunities

Washington’s NNN investment landscape presents cap rates that are often higher than those in ultra–high-cost states. For example:

- Vancouver, WA (retail areas): Cap rates between approximately 5.78%–7.04% across various property classes.

- Available listings:

- A property in Sunnyside, WA offers a 6.75% cap rate with a 10-year lease remaining.

- A La-Z-Boy in Spokane features a 6.19% cap rate and over 8 years of lease term.

These rates are competitive, especially in Seattle-adjacent areas where property values are high but cap rates remain in the mid-5s to 6s—striking a balance between return and stability.

2. Stable, Hands-Off Investment Structure

NNN properties offer long-term, tenant-responsible leases that reduce landlord involvement:

- Lease durations commonly range from 10 to 25 years, ensuring consistent cash flow.

- Tenants are typically established, creditworthy entities—minimizing vacancy and operational risk.

This setup is ideal for investors seeking reliable, low-maintenance returns.

3. Favorable Tax Structure for Passive Income

Washington’s tax environment supports NNN investment through several advantages:

- No personal or corporate income tax—passive LLC income isn’t taxed at the state level.

- However, Business & Occupation (B&O) tax applies to gross receipts at the entity level—typically around 1.5%.

- Note: Washington does impose a 7% capital gains tax on long-term gains exceeding about $250,000 per year—though real estate gains and 1031 exchanges may be exempt.

Overall, Washington’s tax regime can enhance after-tax returns for NNN investors.

4. Sector Stability and Essential Retail Demand

NNN investments benefit from diverse tenant sectors with high stability:

Frequently leased to essential-service tenants such as Walgreens, Starbucks, fast-food chains, and established retailers or auto service providers.

- These tenants typically offer strong credit, long-term occupancy, and built-in lease escalations.

5. Industrial and Logistics Growth, Especially in Puget Sound

Washington’s economic backbone—particularly tech, logistics, and industrial sectors—drives demand for NNN assets:

- Seattle region and Puget Sound command high NNN industrial lease rates—from $14.00–$19.00/SF/year in Seattle to $10.00–$16.00/SF/year in markets like Tacoma and Vancouver.

- Eastern Washington (Spokane, Yakima) remains more affordable (around $7.50–$13.00/SF/year) but still viable for NNN investors.

These strong lease rates reflect Washington’s logistics and distribution strength, especially near ports and major highways.

6. Tax Efficiency Through Depreciation & 1031 Exchanges

Key tax advantages that enhance NNN yield:

- Landlords can deduct depreciation (typically over 39 years) and interest expense, potentially reducing taxable income substantially—even if cash flow remains positive.

- 1031 exchanges allow investors to defer capital gains taxes by reinvesting in similar NNN properties—preserving capital and enhancing long-term portfolio growth.

Income Taxes

Washington State’s Tax Landscape for NNN Investors

1. No State Income Tax on Rental Income or LLC Profits

Washington does not impose a personal or corporate income tax—this includes rental income earned through LLCs. NNN investors operating via an LLC or receiving rental income as individuals are not subject to state income tax on that income.

2. Business & Occupation (B&O) Tax Applies to Gross Receipts

Instead of income tax, Washington levies a Business & Occupation (B&O) tax based on gross revenue. While pure leases of real property (NNN rental income) are generally not subject to B&O tax, other activities such as providing licensed access may be taxable.

3. Estate Tax Exists—Inheritance Tax Does Not

Washington imposes a state estate tax, with elevated marginal rates:

Estate tax exclusion increases to approximately $3 million starting July 2025.

- Estate tax rates are progressive, from 10% on the first $1 million, up to 35% on estates exceeding $9 million.

- There is no inheritance tax imposed on beneficiaries.

4. Capital Gains Tax—but Real Estate Exempt

Washington has a state-level capital gains tax:

- Generally, a 7% tax applies to long-term capital gains above ~$250,000.

- As of January 2025, gains beyond $1 million face a higher rate of 9.9%, with the exemption raised to $3 million.

- Importantly, capital gains from real estate—including the sale of NNN properties—are exempt.

5. Moderate Property Tax Rates

Washington’s property tax rates are moderate, with an effective rate around 0.76% on owner-occupied properties.

These taxes typically fund local services such as schools, fire protection, and parks.

6. Federal Deductions Still Apply

Though state-level income tax doesn’t apply, federal tax benefits and deductions remain available to NNN investors:

- Deductions include mortgage interest, depreciation, property taxes, and other rental-related expenses (reported on Schedule E).

Investing in triple-net (NNN) properties in Washington can be strategically rewarding, especially in counties experiencing strong population growth and economic momentum. Below are key investment hotspots based on recent demographic trends and regional development:

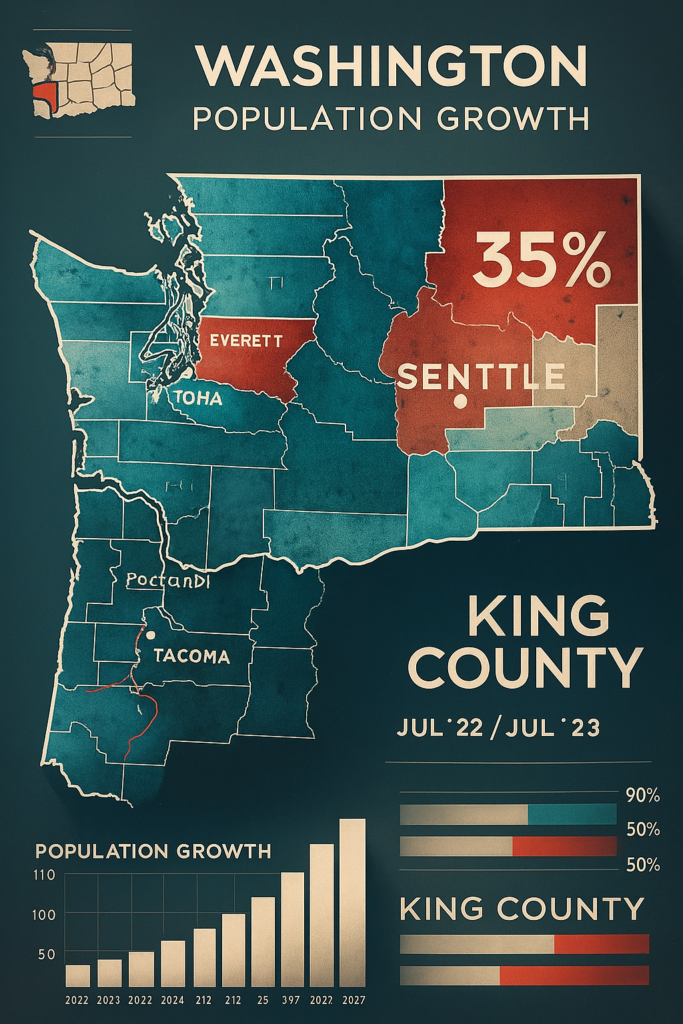

1. King County (Seattle Area):

Population Growth: Gained approximately 43,398 new residents between July 2023 and July 2024—the highest in the state.

Economic Development: As the core of Washington’s tech and innovation economy, with giants like Amazon, Microsoft, and Boeing, the demand for retail, office, and industrial NNN properties remains strong.

Investment Potential: High desirability due to stability and available infrastructure, though priced at a premium—with cap rates typically lower but offset by strong leasing fundamentals.

2. Snohomish County (Greater Seattle Metro):

Population Growth: Added 13,816 residents over the same period.

Economic Development: Suburban expansion, manufacturing, and aerospace industries (like Boeing in Everett) fuel demand across retail, logistics, and service sectors.

Investment Potential: Favorable suburban and industrial opportunities for NNN investors due to proximity and spillover from Seattle’s growth.

3. Clark County (Vancouver MSA):

Population Growth: Recorded 23,961 new residents recently.

Economic Development: Strong in-migration from Oregon (Portland area) and California; rising housing and business activity.

Investment Potential: Attractive for more affordable NNN retail and service properties, benefiting from cross-border dynamics and commuter growth.

4. Kittitas County (Ellensburg Area):

Population Growth: Identified as the fastest-growing county in 2024 at 2.7% growth.

Economic Development: Home to Central Washington University; growth supported by education, recreation, and regional infrastructure.

Investment Potential: Small market with high growth—potential for niche NNN investments like service-oriented retail and educational-related leases.

5. Grant County (Central/Eastern WA):

Population Growth: Also among fastest-growing counties at ~1.5%+ growth.

Economic Development: Agricultural productivity (irrigation systems), energy (hydro, wind, solar), and manufacturing sectors lead local development.

Investment Potential: Industrial and essential retail properties could benefit from solid, community-rooted tenant demand.

6. Lincoln County (Rural Eastern Washington):

Population Growth: Posted substantial growth around 9.7% over several years.

Economic Development: Rural land-based economy, energy, agriculture, and resource industries.

Investment Potential: Lower property costs, potential for strategic NNN investments tied to agriculture service or regional supply chains.

Pros:

1️⃣ Strong Population Growth in Key Counties

Washington is one of the fastest-growing states in the Pacific Northwest, with King, Snohomish, and Clark Counties seeing consistent in-migration. Population expansion fuels retail, service, and housing demand—benefiting NNN properties.

2️⃣ Thriving & Diverse Economy

Home to major employers like Amazon, Microsoft, Boeing, and Costco, plus strong healthcare, education, and agriculture sectors. This economic diversity provides stability for NNN tenants across industries.

3️⃣High Tenant Demand in Urban & Suburban Markets

Seattle, Bellevue, Vancouver, and Spokane drive strong retail and service demand, while suburban areas are expanding rapidly, supporting neighborhood shopping centers and essential service tenants.

4️⃣ Rising Property Appreciation in Growth Corridors

Counties such as Clark (Vancouver MSA) and Snohomish are experiencing notable appreciation due to in-migration from Oregon and California, offering long-term upside for investors.

5️⃣ No Corporate or Personal Income Tax

Washington does not levy a state personal income tax, which can make it an attractive market for investors compared to high-tax states.

6️⃣ Strategic Location & Trade Connectivity

With major ports in Seattle and Tacoma, access to Asian trade routes, and strong logistics infrastructure, Washington supports robust industrial and distribution property demand—ideal for NNN industrial tenants.

7️⃣ Growing Demand for Essential & Service-Based Tenants

Population shifts into suburban and secondary markets (Clark, Kittitas, Grant) support essential businesses such as Dollar General, Walgreens, Starbucks, and QSRs, strengthening NNN leasing opportunities.

Cons:

1️⃣ Higher Property Costs in Prime Markets

King and Snohomish counties command premium prices with lower cap rates, making entry more expensive compared to secondary markets.

2️⃣ Business & Regulatory Environment

Washington has higher business regulations and costs compared to many Sunbelt states, which can impact tenant operations and leasing dynamics.

3️⃣ Natural Disaster Risks

Certain regions face earthquake risks (Seattle fault lines) and wildfire exposure in Eastern Washington, potentially impacting insurance and tenant risk profiles.

4️⃣ Tenant Concentration in Tech & Port Economies

While the economy is diverse, many urban tenants are indirectly tied to the tech and trade sectors. Economic slowdowns in these industries may impact some commercial tenants.

5️⃣ Limited Affordability in Urban Hubs

High real estate prices in Seattle and Bellevue can limit cap rate returns. Investors seeking higher yields may need to look toward secondary markets like Spokane, Clark, or Grant counties.

Washington NNN Properties for 1031 Exchange

Invest in Free Standing Single Tenant Triple Net (NNN) Properties in Washington

Are you looking for a reliable 1031 exchange replacement property?

At Triple Net Investment Group, we specialize in the sale of single tenant NNN properties and triple net shopping centers across the United States. Our team is dedicated to helping investors find high-quality (Tenant Triple Net) NNN properties in Washington and nationwide that align with their financial goals and 1031 exchange requirements.

With our in-depth market knowledge and personalized service, we provide tailored investment strategies for both buyers and sellers of commercial real estate. Whether you’re looking to defer capital gains through a 1031 tax-deferred exchange or want to diversify your portfolio with income-generating assets, our team offers a wide selection of vetted NNN investment properties.

Corporate Tenant Credit Ratings

Find out more about the credit rating of the tenant before purchasing.

How safe are the triple net investment grade free standing single tenant properties?

Market Analysis

What three things should I know before investing?

Call or e-mail us and we will get back to you within 24 hours. We know of properties for sale that aren’t listed or advertised.

Email: [email protected] Tel: 202-361-3050

We strive hard to provide clients with quality customer service

We provide our clients with all of the information they need upfront to make an informed decision, even before a Letter of Intent is issued such as: tenant credit information, store sales, lease terms, options, renewal rates, rent escalations, location analysis, site analysis, market analysis, demographic data, cash on cash returns on investment, internal rate of returns after taxes, risks, likes, dislikes and so on. We will then strategies how to proceed on making a best offer. It is our goal to build a solid relationship with our clients and keep them updated on net lease investments, even though they may not have a need for years to come.(NNN Properties in Washington)

We markets our listings locally, nationally and internationally

Triple Net Investment Group difference is a concept that is revolutionary in the commercial real estate brokerage business. In addition to marketing our deals to potential investors, We markets our listings to the entire brokerage community. We put our listings directly in front of thousands of commercial real estate agents in each state, region and local where the property is located.