Why NNN Investors Prefer Wyoming State: Higher Growth & Competitive Cap Rates Explained

Future holding for NNN property investments in Wyoming

Triple Net Lease (NNN) properties, where tenants cover property taxes, insurance, and maintenance costs, remain a solid choice for investors seeking predictable income with minimal management involvement. In Wyoming, the future of NNN property investments is supported by several unique advantages and emerging market opportunities:

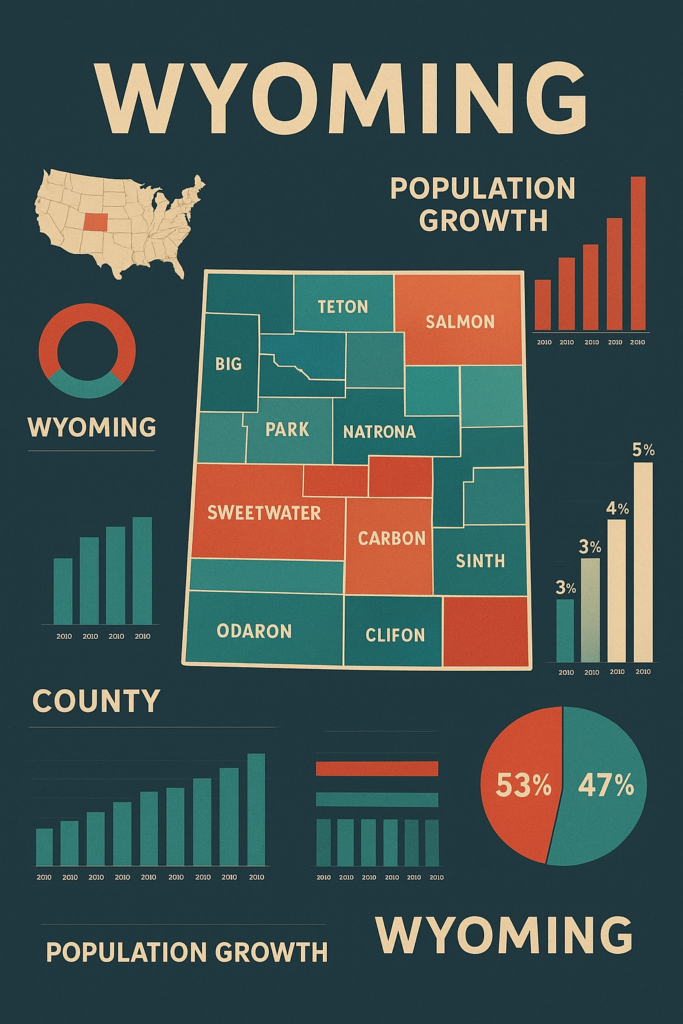

1. Economic and Population Growth

Wyoming’s economy is historically driven by energy, mining, and agriculture, but it has been diversifying with growth in tourism, logistics, and renewable energy sectors. While population growth is modest compared to other states, cities like Cheyenne and Casper have seen steady development, boosting demand for commercial and industrial real estate. This positions NNN properties as a reliable long-term investment.

2. Stability and Demand for NNN Properties

NNN leases provide predictable cash flow through long-term agreements, which is particularly valuable in Wyoming’s relatively stable but niche market. National retailers, quick-service restaurants, and service-based tenants continue to expand in secondary and tertiary markets, creating consistent opportunities for investors seeking low-risk returns.

3. Market Trends and Cap Rates

Wyoming typically offers higher cap rates compared to primary U.S. markets, appealing to investors who prioritize stronger cash flow over appreciation. As cap rates nationally trend upward, Wyoming’s net lease market remains competitive, allowing investors to secure higher yields while benefiting from tenant-covered expenses.

4. Financing Considerations for NNN Investors

Acquiring NNN properties in Wyoming follows similar financing requirements to other states. Investors should be prepared for down payments ranging from 30% to 40%, with typical qualifications including a net worth above $1 million or an annual income exceeding $200,000. Lenders often view Wyoming properties favorably when backed by strong national tenants, making financing accessible to qualified buyers.

5. Local Market Opportunities

Wyoming’s commercial real estate market is smaller but offers strategic opportunities. Single-tenant retail, industrial, and service-oriented properties remain strong investment options, particularly in growth corridors along Interstate 25 and Interstate 80. For instance, net lease investments in convenience stores, logistics hubs, and healthcare facilities are gaining traction. Investors utilizing a 1031 exchange can leverage Wyoming NNN properties to diversify portfolios while deferring capital gains taxes.

Triple-net (NNN) investors are increasingly looking to Wyoming as a strategic market for net lease properties. With its favorable tax environment, stable economy, and growing demand for essential retail and industrial assets, Wyoming offers unique advantages for investors and NNN brokers. Here’s why the state is becoming an attractive choice for NNN investments:

1. Higher Cap Rates Compared to Larger Markets

Wyoming typically offers higher cap rates than major coastal states, often ranging between 6% to 7.5%, depending on location and tenant credit. This provides investors with stronger cash flow opportunities while still benefiting from the security of long-term, triple-net lease agreements.

2. Affordable Property Prices

Commercial real estate in Wyoming is generally more affordable compared to larger, high-demand states. This affordability allows investors to acquire single-tenant NNN properties with national credit tenants at lower entry costs, ensuring better returns and easier portfolio diversification.

3. Steady Population & Economic Growth

While Wyoming’s population growth is modest compared to fast-growing states, cities such as Cheyenne, Casper, and Gillette are experiencing steady development driven by energy, logistics, and service sectors. The state’s economic base is diversifying beyond traditional industries like mining and energy, creating new demand for retail, healthcare, and industrial properties.

4. Strong Demand for Essential Retail & Services

NNN brokers and investors see ongoing demand for essential retail, convenience stores, and quick-service restaurants (QSRs) such as Dollar General, Walgreens, and fast-food brands. These tenants thrive in Wyoming’s smaller markets, where they often serve as primary retail anchors, ensuring stable, long-term lease agreements.

5. No State Income Tax Advantage

One of Wyoming’s most significant benefits is its lack of state income tax, making it one of the most tax-friendly states for investors. This is especially advantageous for 1031 exchange investors, who can reinvest proceeds from other states into Wyoming NNN properties and maximize returns while deferring capital gains taxes.

6.Infrastructure & Industrial Expansion

Wyoming’s strategic location along Interstate 25 and Interstate 80 positions it as a logistics and transportation hub in the Mountain West. Growth in warehousing, distribution, and energy-related industries is driving demand for industrial and service-oriented net lease properties, creating long-term opportunities for investors seeking portfolio stability and growth.

Income Taxes

Wyoming ’s Tax Advantages for NNN Investors: A Smart Choice for Net Lease Properties

Wyoming is consistently ranked as one of the most tax-friendly states in the U.S., making it a top destination for NNN investors seeking higher net returns and lower tax burdens. With no personal or corporate income tax and favorable business policies, Wyoming offers unique financial benefits for those investing in net lease properties. Here’s why investors and NNN brokers are drawn to Wyoming:

1. No State Income Tax

Wyoming does not levy a personal or corporate income tax. This means rental income from NNN properties passes directly to investors without state-level taxation, significantly boosting cash flow and profitability. For investors looking to maximize returns, this is one of Wyoming’s strongest advantages.

2. No Corporate Income Tax

For those operating NNN investments through a corporate entity, Wyoming’s lack of a corporate income tax creates a major financial edge. Companies can retain more earnings and reinvest them into expanding their net lease portfolios without additional state tax burdens.

3. No Estate or Inheritance Tax

Wyoming does not impose an estate or inheritance tax. This allows investors to transfer NNN properties to heirs without extra financial barriers, preserving wealth across generations and simplifying long-term estate planning.

4. Low Property Tax Rates

Wyoming has one of the lowest property tax rates in the U.S., with an average effective rate of around 0.55%. Compared to states with high property taxes, Wyoming’s favorable structure reduces holding costs, increasing long-term investment profitability for NNN property owners.

5. No Separate Capital Gains Tax

Capital gains in Wyoming are not subject to a separate state tax. Since there’s no state income tax at all, gains from the sale of NNN properties are only taxed at the federal level. This makes Wyoming particularly attractive for 1031 exchange investors planning to reinvest or exit while minimizing tax exposure.

6. Business-Friendly Environment

Wyoming consistently ranks as one of the best states for business due to its low regulatory burden, favorable LLC laws, and strong asset protection statutes. Many NNN investors choose to form Wyoming LLCs to benefit from privacy protections and streamlined business operations.

Investing in triple net lease (NNN) properties in Wyoming can be a smart strategy, especially in areas experiencing steady growth and economic diversification. Since NNN properties require tenants to cover property taxes, insurance, and maintenance, they offer investors a stable, low-management option. Based on recent data and market trends, here are some of the top cities and counties in Wyoming to consider for NNN property investments:

1. Laramie County (Cheyenne):

Population Growth: Cheyenne, Wyoming’s capital and largest city, continues to see population increases due to its government, military, and logistics-driven economy.

Economic Development: Cheyenne is home to F.E. Warren Air Force Base, major logistics corridors along I-25 and I-80, and growing industries in data centers and manufacturing.

Investment Potential: With strong population stability and expanding logistics infrastructure, Laramie County is well-positioned for NNN investments in retail, industrial, and service-oriented properties.

2. Natrona County (Casper):

Population Growth: Casper remains one of the most populated cities in Wyoming, maintaining a steady population base with modest increases.

Economic Development: Casper is a regional hub for energy, healthcare, and education, serving surrounding rural communities with essential retail and services.

Investment Potential: Demand for healthcare facilities, essential retail, and service-based tenants makes Natrona County a strong choice for NNN property investors.

3. Campbell County (Gillette):

Population Growth: Gillette has seen population stability, supported by energy-related migration and employment.

Economic Development: Known as the “Energy Capital of the Nation,” Gillette plays a vital role in coal, oil, and natural gas production while diversifying into manufacturing and services.

Investment Potential: With a workforce tied to long-term energy demand and a need for community services, Campbell County offers opportunities in QSRs, retail centers, and industrial NNN properties.

4. Sweetwater County (Rock Springs & Green River):

Population Growth: Sweetwater County has maintained steady population numbers due to its strong energy and transportation sectors.

Economic Development: The area is a hub for trona mining, manufacturing, and distribution, supported by its location along I-80.

Investment Potential: Industrial and service-oriented NNN properties are well-positioned here, catering to both local workers and logistics networks.

5. Albany County (Laramie):

Population Growth: Laramie’s population is bolstered by the presence of the University of Wyoming, which brings a consistent flow of students, faculty, and professionals.

Economic Development: Education, healthcare, and research drive Laramie’s economy, supported by a growing tech presence.

Investment Potential: Retail, student housing, and service-based NNN investments perform well in Albany County thanks to the university’s stability.

6. Teton County (Jackson):

Population Growth: Teton County, home to Jackson, has seen steady population and wealth migration, driven by second-home buyers and lifestyle demand.

Economic Development: Tourism, luxury real estate, and hospitality are key economic drivers due to Yellowstone and Grand Teton National Parks.

Investment Potential: High-income residents and year-round tourism create strong demand for NNN retail, dining, and hospitality investments.

Pros:

1️⃣ No State Income Tax

Wyoming has no personal or corporate income tax. NNN investors keep more of their rental income, making it one of the most tax-friendly states in the U.S.

2️⃣ Low Property Taxes

With an average effective property tax rate of about 0.55%, Wyoming ranks among the lowest in the country. This reduces holding costs and improves long-term returns.

3️⃣ Higher Cap Rates than Coastal States

Cap rates in Wyoming are generally 6%–7.5%, depending on tenant credit and location. This offers stronger cash flow compared to major metropolitan markets.

4️⃣ Affordable Commercial Property Prices

Compared to high-cost states, Wyoming’s commercial real estate is relatively affordable. Investors can acquire single-tenant NNN assets at lower entry points while still securing national credit tenants.

5️⃣ Business-Friendly Environment

Wyoming consistently ranks as one of the most business-friendly states due to its low regulatory burden, favorable LLC laws, and strong asset protection statutes. Many investors form Wyoming LLCs for tax and privacy benefits.

6️⃣ Stable Economy with Energy & Tourism

The state’s economy is supported by energy (coal, oil, natural gas, renewables), logistics, and tourism. Towns like Cheyenne, Casper, and Jackson see stable tenant demand from both residents and visitors.

7️⃣ 1031 Exchange-Friendly

Wyoming’s tax advantages and availability of essential retail and industrial properties make it a strong market for investors completing a 1031 exchange to defer capital gains taxes.

Cons:

1️⃣ Slower Population Growth

Wyoming has one of the smallest populations in the U.S. (fewer than 600,000 people). Growth is steady but slow, limiting tenant demand compared to fast-growing states.

2️⃣ Tenant Demand is Market-Specific

Strong NNN opportunities exist in cities like Cheyenne, Casper, and Jackson, but rural areas may struggle to attract or retain national tenants. Investors must focus on strategic locations.

3️⃣ Economic Dependence on Energy

While Wyoming is diversifying, its economy still relies heavily on the energy sector. Market downturns in coal, oil, or natural gas could affect long-term tenant stability.

4️⃣ Limited High-Density Retail & Urban Growth

Wyoming lacks large metropolitan areas and luxury retail hubs. The market leans toward essential businesses (Dollar General, Walgreens, QSRs, convenience stores), with fewer options for investors targeting upscale tenants.

5️⃣ Weather & Climate Risks

Harsh winters and heavy snow in certain regions can impact logistics, foot traffic, and tenant operating costs. While not hurricane-prone, weather is still a factor for some investors.

Wyoming NNN Properties for 1031 Exchange

Invest in Free Standing Single Tenant Triple Net (NNN) Properties in Wyoming

Are you looking for a reliable 1031 exchange replacement property?

At Triple Net Investment Group, we specialize in the sale of single tenant NNN properties and triple net shopping centers across the United States. Our team is dedicated to helping investors find high-quality (Tenant Triple Net) NNN properties in Wyoming and nationwide that align with their financial goals and 1031 exchange requirements.

With our in-depth market knowledge and personalized service, we provide tailored investment strategies for both buyers and sellers of commercial real estate. Whether you’re looking to defer capital gains through a 1031 tax-deferred exchange or want to diversify your portfolio with income-generating assets, our team offers a wide selection of vetted NNN investment properties.

Corporate Tenant Credit Ratings

Find out more about the credit rating of the tenant before purchasing.

How safe are the triple net investment grade free standing single tenant properties?

Market Analysis

What three things should I know before investing?

Call or e-mail us and we will get back to you within 24 hours. We know of properties for sale that aren’t listed or advertised.

Email: [email protected] Tel: 202-361-3050

We strive hard to provide clients with quality customer service

We provide our clients with all of the information they need upfront to make an informed decision, even before a Letter of Intent is issued such as: tenant credit information, store sales, lease terms, options, renewal rates, rent escalations, location analysis, site analysis, market analysis, demographic data, cash on cash returns on investment, internal rate of returns after taxes, risks, likes, dislikes and so on. We will then strategies how to proceed on making a best offer. It is our goal to build a solid relationship with our clients and keep them updated on net lease investments, even though they may not have a need for years to come.(NNN Properties in Wyoming)

We markets our listings locally, nationally and internationally

Triple Net Investment Group difference is a concept that is revolutionary in the commercial real estate brokerage business. In addition to marketing our deals to potential investors, We markets our listings to the entire brokerage community. We put our listings directly in front of thousands of commercial real estate agents in each state, region and local where the property is located.