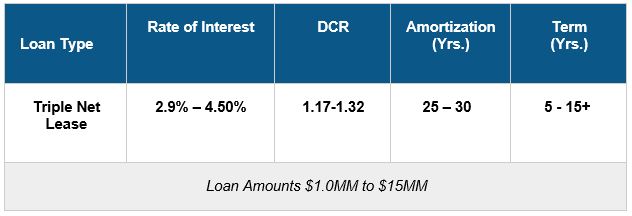

If you are in the market currently for a NNN triple net lease property, and debating whether a spike in interest rates may occur, you may be faced with financing terms such as this:

A significant interest rate spike, say 25-50bp, could affect the value of NNN net-lease properties in multiple facets, since these higher interest rates charged by lenders will constrain the cap rates that investors are willing to pay for net-lease investment properties. Note that an interest rate spike could very well result in higher ROR and lower prices offered by NNN alternatives that could deploy capital elsewhere from the triple net lease arena, thus further lowering expectations and reducing NNN property values.

Also, an interest rate spike will definitely signal and include a higher inflation number, a sign of growth and a heating economic environment. As inflation spikes, NNN investors will likely have to increase their cash outlays for brokered properties and portfolios, further signaling increasing profits for services and products offered by tenants of triple net properties as consumer purchasing power expands! Tenants and their businesses now enter a cycle of growth, expansion and profitability, thus becoming capable of paying higher rents over time. Higher rents will certainly propel developers to build a greater number of NNN investment properties as tenant demand for square feet escalates. Despite an interest-rate spike, demand will still accelerate since NNN properties intrinsically continue to afford a passive, reliable and solid, bond-like rate of return. So, even if investors may witness a 25-50 bps interest rate spike from the Fed, buy/sell prices will not spike before a few months forward of the interest rate spike. Competition and therefore cap rates for best in class net lease investment properties do not flag – ever. The worst that can happen is that NNN investors will see a latency between the interest rate spike and cap rates increasing for NNN properties on average. But for NNN net lease investors on tight leashes and short time-lines to close, it is best to not wait, especially if currently their due diligence reveals higher potential rates of return. Read on.

Interest rates (and spikes!) are important as most NNN purchases occur with the use of leverage. If a NNN investor uses debt to purchase a NNN investment, the Cash on Cash ROR may exceed the cap rate of an all-cash purchase. If this scenario of interest rate financing terms and the cap rate of an NNN property, creates this type of leverage, it signals that an impending NNN purchase is a superb risk.

NNN net lease investors definitely also need to factor in the rent bumps, portfolio tax benefits and financing leverage on a NNN purchase. This way, a 5.00% cap calculation in reality will translate into a between 6-9% IRR a.k.a. a compounded annual rate of return.

Call our expert brokers and advisors at the Triple Net Investment Group today for a good idea of what NNN investment property financing programs may look like in the coming months for your portfolio. Interest rates are notoriously difficult to forecast, but our expert knowledge would say that the fed funds rate will ratchet up very slowly, keeping cap rates and an interest rate spike in line for very modest increases, if any.